The term “surface water” generally refers to water that accumulates on the ground’s surface in a diffuse manner, typically resulting from precipitation (rain or snow) that does not flow within a defined channel or watercourse. This definition is crucial in understanding coverage limitations and exclusions within property insurance policies, especially concerning flood damage. Standard form property insurance policies often exclude damage caused by surface water, categorizing it alongside other naturally occurring water-related events like floods, tidal water, and overflow of bodies of water, whether or not driven by wind.

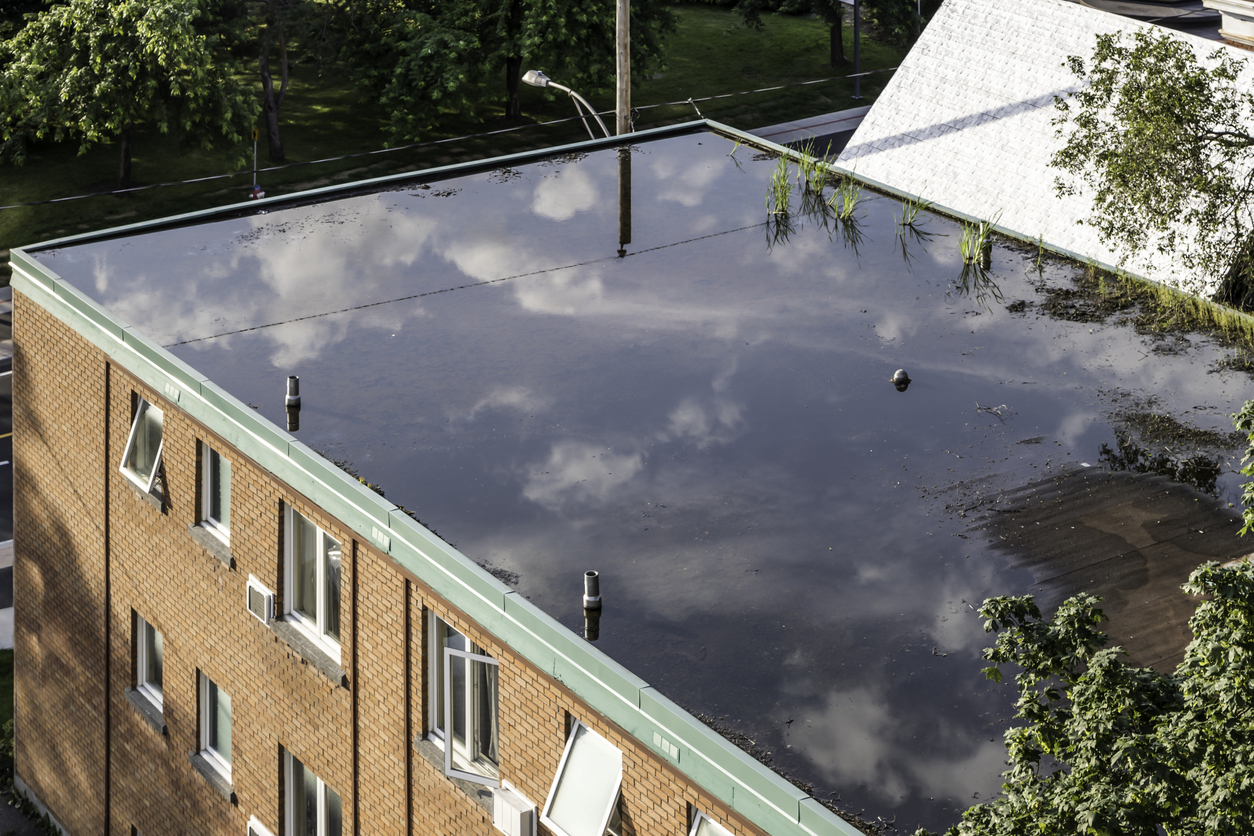

The interpretation of what constitutes “surface water” can vary and has been subject to legal debate, particularly when water accumulates or causes damage in areas not directly in contact with the ground, such as on a building’s roof or an elevated surface like a balcony. Courts have generally found that surface water refers to water on the surface of the ground, not on elevated surfaces, and is usually created by natural phenomena like rain or snow. However, the specific definitions and applications can differ based on jurisdiction and the precise language of an insurance policy.

I noted how insurance industry coverage experts can have a different view of the term in Surface Water Revisited by Bill Wilson. I agree with the following view:

The argument is that the deck is a ‘surface’ and that the exclusion does not say ‘water on the surface of the earth/ground.’ I think it has to be placed in context with the rest of the exclusion which lists sources of water that all originate from the surface of the earth. There are a couple of legal principles described in several VU articles that say that an undefined term takes the general meaning of the other words in the phrase/exclusion. To learn more, go to the VU and search for ‘ejusdem generis’ and you’ll find several articles to support the premise that ‘surface’ water refers to water accumulating on the surface of the earth.

United Policyholders recently filed a brief, as noted in Defining Surface Waters: United Policyholders Argues That a Flood Does Not Happen on a Roof. That brief noted the modern trend of creative insurance company attorneys trying to argue out of coverage in water damage cases:

United Policyholders claimed that the case is an example of ‘creative denials’ on water claims based on strained constructions of policy language and that this is occurring across the country. I agree that insurers are more frequently battling their policyholders trying to reduce payments on water losses.

The National Association of Public Insurance Adjusters (NAPIA) has also taken a position on this matter with an amicus brief. Its argument noted the following:

Consistent with this Court’s recognition that the term ‘surface water’ is not boundless, water which falls from the sky and first and only touches a rooftop or other elevated manmade surface does not become ‘surface water’ such that any damage subsequently caused by that water is per se excluded from coverage. Instead, when precipitation falls or leaks into an insured’s building through holes or other compromised areas of a roof damaged by hail, wind or some other covered peril — rather than running off the roof and behaving as one would expect water intercepted by a roof to behave — it does not fall within the plain meaning of the term ‘surface water’ because it was never water lying or flowing on the surface of the earth and naturally spreading over the ground (even if the roof is considered an extension of the ‘earth’s surface’). Morley v. United Services Automobile Association, 465 P.3d 71, 77 (Colo. Ct. App. 2019).

If this Court now concludes that rainwater which falls and collects on a roof surface and subsequently infiltrates into a building is excluded from coverage as ‘surface water’, insurance companies will seize that opportunity to apply this new and overly expansive definition of ‘surface water’ in such a way as to deny covered claims for reasons extending far beyond the unambiguous language and purpose of this exclusion. Rainwater, even if it never touched, fell upon or entered from the ground, would be a regularly (and impermissibly) excluded cause of loss. This conclusion sweeps far too broadly.

…

While their policies may exclude coverage for loss caused by flood and ‘surface water,’ no reasonable insured would expect the term ‘surface water’ to include rain falling from the sky, pooling on a roof or other artificial surface far above the ground and infiltrating from that elevated surface downward into their building. Water which does not reach, have any contact with or emanate from the ground ought not be treated or characterized as ‘surface water’ and thus should not be excluded from coverage. Only certain causes of water damage are excluded as ‘surface water’, and falling rain collecting on a rooftop surface is not one of them.

Thought For The Day

No matter how much water a sink takes on, it never lives up to its name. The Titanic would never have sunk if it were made out of a sink.

—Jarod Kintz