Insurance company property claims manuals are often sanitized to prevent criticism. They contain general and often give vague instructions to claims adjusters. The actual instructions are often provided in verbal meetings with claims managers, which may have PowerPoint presentations, email claims bulletins, and other non-specific documents which are not placed in claims manuals. Why don’t market conduct examiners and departments of insurance investigators ask for these types of documents when investigating insurance company claims practices and conduct?

The Heritage Insurance Company has been a slow-paying and underpaying entity following Hurricane Ian. Policyholders, contractors, public adjusters, and even some of the people trying to adjust the Hurricane Ian claims are upset with Heritage property insurance claims performance. One reason is that the person in the field has no authority to make decisions. The six-page document attached at the top of this post clearly states:

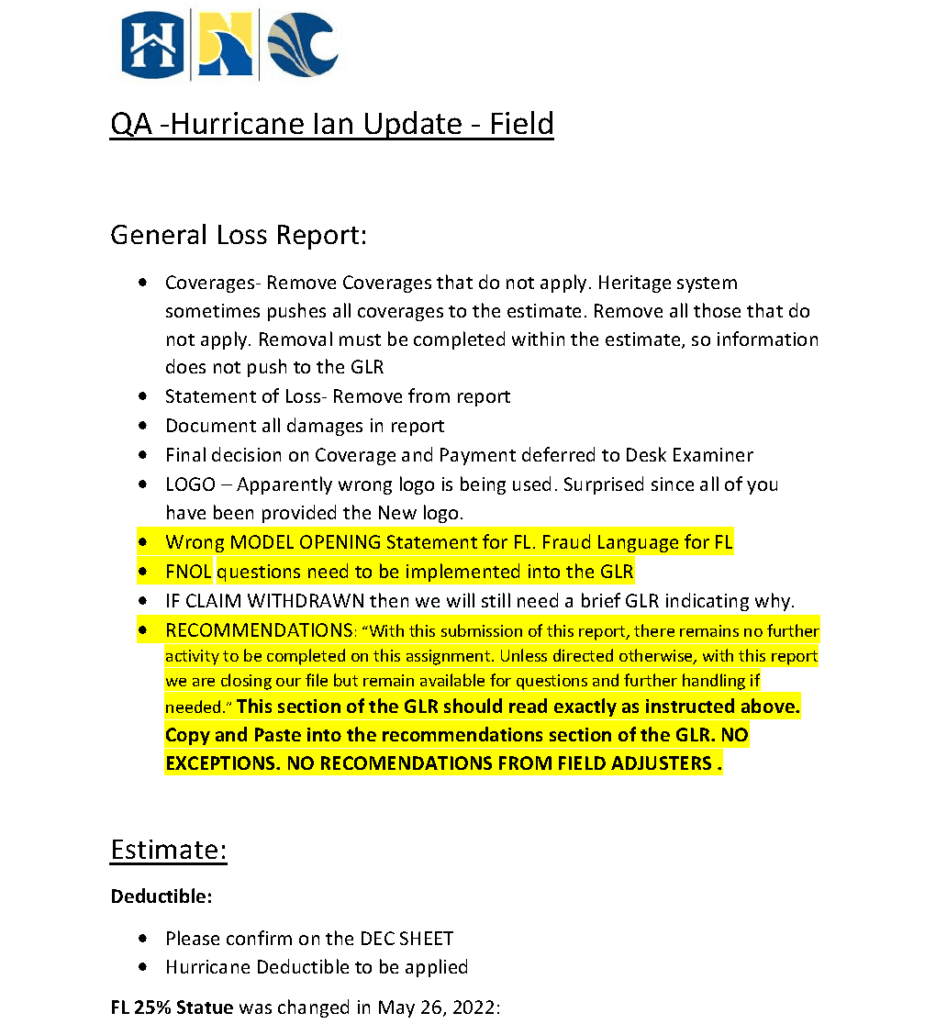

Final decision on Coverage and Payment deferred to Desk Examiner

…

NO RECOMENDATIONS FROM FIELD ADJUSTERS

How are Heritage claims estimates determined? There is a guide:

Follow Heritage Insurance estimating guidelines that were previously provided.

If you need an additional copy, then our QA Team will be happy to provide

The important part of this is that the Heritage claims personnel and the Desk Examiner can change whatever the field adjuster places in the estimate. Insurance companies do this through a process known in the insurance industry as “collaboration.” Policyholders, contractors, and public adjusters should start asking for “collaboration” notes and data for any estimates provided.

Why don’t we require property insurance companies like Heritage to share this claims methodology and information with customers? All Heritage policyholders with Hurricane Ian claims should know that their insurance company gives their field adjuster who meets with the policyholders no authority. That is honest, although hardly an ethical good faith method of property claims adjustment.

The market conduct examiners investigating insurance property claims conduct need to keep up with these methods. These internal and non-specified claims instructions should be demanded and then audited for full disclosure. The claims files are often sanitized so that the honest adjuster’s thoughts are never found in a closed claim file review. All of these methods and standards of how property insurance claims are handled should be made transparent to stop internal claims severity goals and claims initiatives to drive down the amount of a claims payment to an insurer’s own customer. First-party customers deserve an honest explanation about how their claims are handled—does anybody disagree?

Any reasonable person in charge of making certain that insurance regulation was working would set up a whistleblowing desk where any company or independent insurance adjuster could safely report unethical claims conduct. I do not understand why insurance commissioners do not do so if they are really trying to protect the public and keep insurers honestly, rather than dishonestly, competing with each other.

This point was previously made in Are Market Conduct Examiners Listening to Common Property Insurance Claims Complaints?:

Market conduct examinations of insurance company claims practices are important. Do you think that examiners are listening to the same repetitive complaints I hear from policyholders, contractors, roofers, public adjusters and other lawyers at the various seminars and trade shows I attend?

Many market conduct studies never analyze internal operation analysis insurance companies own claims departments. Instead, most examinations are claim file examination which look for technical deficiencies.

The North Dakota Department of Insurance paid attention to the internal claims documents of Farmers claims management and fined Farmers $750,000. The Insurance commissioner noted that it was not his job to investigate why other states did not address Farmers “Bring Back a Billion Program” and incentive pay claims culture, but he had this to say about it:

We felt that Farmers’ programs created a natural, inherent bias against policyholders. When a person is either punished or incentivized by shortchanging the policyholder in how they pay a claim, that, in my opinion, is a violation of (state law).

I am certain that Amy Bach and United Policyholders will raise these issues with Insurance Commissioners and at the next NAIC meetings.

Those that are aware of fraudulent conduct by insurance companies intentionally underpaying claims should report the conduct to the American Policyholder Association at this link: https://apassociation.org/tools/

Thought For The Day

There is no persuasiveness more effectual than the transparency of a single heart, of a sincere life.

—Joseph Barber Lightfoot