If you are a frequent reader of Property Insurance Coverage Law Blog, you know that many of our blog posts make a very important recommendation to all policyholders: read the full policy. If you happened to miss this lesson, otherwise championed by insurance professional Bill Wilson as one of the “10 Commandments of Policy Interpretation,” you can read more in When Words Collide: Policy Interpretation Doctrines and the 10 Commandments. Understand Your Insurance Policy Better—RTFP!

When the difficult time comes in which you suffer a loss to your property and are required to file a claim with your property insurer, the claim process will be much more straightforward if you are familiar with your insurance policy and the coverage provided. While the attorneys at Merlin Law Group are here to assist policyholders who have been denied insurance coverage or otherwise wronged by their insurance company, there are in fact times where the claim process is handled promptly and effectively, and by the time you know it, you are finally on the homestretch of receiving the insurance benefits necessary to restore your property to its pre-loss condition. Even in an ideal scenario such as the above, please remember that sometimes all that glitters is not gold.

What if I were to tell you that the daunting task of reading the fine print of your insurance documentation does not end at this stage? Unfortunately, this is the truth, and it is important to remain vigilant from the beginning to the end of the claim process. Here, however, the reading required of the policyholder is a far less intimidating task than trying to comprehend the carefully crafted provisions within the insurance policy and any of those difficult riders and endorsements that are attached. Instead, the careful analysis required of the policyholder simply deals with prudently reading what is written on the check issued by the insurance company.

The language written on your check for insurance benefits is more significant than what most people would believe. Why is this? Whether the language is written in the smallest font size at the bottom of the check or simply acknowledged by an “X” within a box that categorizes the nature of the settlement check, the implications of this seemingly trivial language cannot be overemphasized.

A scenario that has been seen repeatedly in my practice can be used to better understand what I mean by this. Let’s say that after a policyholder has successfully provided their insurance company with all of the documentation and information necessary for the insurer to adjust the claim and issue payment, the policyholder is notified in writing that they will be receiving a check which represents the settlement of their claim. In this example, the policyholder has suffered a fire loss to their property, which resulted in damage to the interior of their dwelling (which their insurer has deemed to be covered under Coverage A – Dwelling), as well as to some of their personal property (which, was covered under Coverage C – Personal Property).

Within the next few days, the insured receives a letter with a check for the damages caused to the interior of their dwelling. Sometimes, the letter may also indicate that the personal property portion of the claim is yet to be processed and to expect follow-up correspondence detailing additional information and associated payment. Other times, a reference to the unresolved personal property portion of their claim may not be included at all. Regardless of either scenario, if the letter and check state that the payment is being made in accordance with the policy’s coverage for the dwelling, and the check only references the dwelling coverage, it is safe to assume that this settlement check reflects one-half of the total claim.

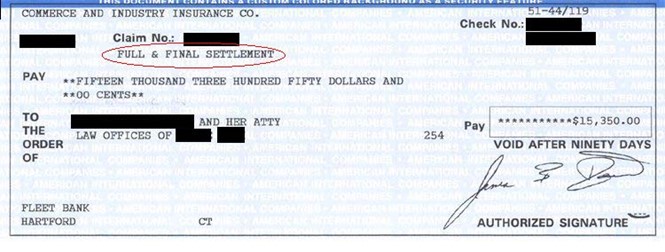

Where an issue may arise is when language is included on the check representing that the settlement check as an “Accord and Satisfaction” or “Final Settlement.” If there exists language similar to the above, then you must be cautious as negotiating or cashing a check like this may come with implications, i.e., an argument by the insurance company that you accepted a check for full and final settlement of the claim (or, that that you were satisfied with the payment and the claim has been resolved). But wait, what about the personal property portion? This clearly does not sound right, and that is because it is not right – which is why many jurisdictions expressly forbid insurers from issuing checks with this type of language when there are still open portions of the claim to be resolved.

In his blog post, Property Insurance Unfair Claims Practices Caused By Releases And Checks Citing “Final Payment,” Merlin Law Group founder, Chip Merlin, provided his thoughts regarding Accord and Satisfaction language being improperly placed on property insurance payments in Puerto Rico.

Georgia’s Unfair Claims Handling statute1 offers an example of how the legislature has attempted to combat this type of wrongful behavior:

Any of the following acts of an insurer when committed as provided in Code Section 33-6-33 shall constitute an unfair claims settlement practice:

(13) Indicating to a first-party claimant on a payment, draft check, or accompanying letter that said payment is final or a release of any claim unless the policy limit has been paid or there has been a compromise settlement agreed to by the first-party claimant and the insurer as to coverage and amount payable under the contract;

(14) Issuing checks or drafts in partial settlement of a loss or claim under a specific coverage which contain language which releases the insurer or its insured from its total liability

Florida’s Unfair Claims Handling statutes also address this type of bad faith practice, albeit not as expressly as Georgia does under § 33-6-34(13) and (14). Some of the statutes which apply to similar unfair claims practices are accounted for in Florida Statute §624.155(1)(b)(3). This statute provides in pertinent part:

(1) Any person may bring a civil action against an insurer when such person is damaged:

* * *

(b) By the commission of any of the following acts by the insurer:

1. Not attempting in good faith to settle claims when, under all the circumstances, it could and should have done so, had it acted fairly and honestly toward its insured and with due regard for her or his interests;

2. Making claims payments to insureds or beneficiaries not accompanied by a statement setting forth the coverage under which payments are being made; or

3. Except as to liability coverages, failing to promptly settle claims, when the obligation to settle a claim has become reasonably clear, under one portion of the insurance policy coverage in order to influence settlements under other portions of the insurance policy coverage.

To get a better grasp as to what the language on such a check reads like, a common example will often look like:

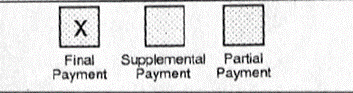

In other instances, the insurer may attempt to procure an Accord and Satisfaction via placing three boxes in one of the corners of the check, categorizing the nature of the settlement payment. This may appear in a way similar to this:

Unfortunately, the many ways in which an insurer can engage in bad faith claims handling may continue all the way until the time in what is perceived to be the conclusion of the claim process. That is why it is not just important to “Read the Full Policy” but to also RTFC: Read the Full Check.

After going through the arduous process that is an insurance claim, I understand that you want to cash the check as soon as possible to get back to the normalcy of your pre-loss life. However, if you carefully examine your insurance payment for any hidden language which may affect your ability to pursue and recover the entirety of your claim, conducting a relatively short review of the check and its language will give you the comfort of knowing that you are not being taken for a ride by your insurer.

____________________________

1 Ga. Code Ann. § 33-6-34.