Unfair claims practices in Puerto Rico was the point of the New York Times article noted in, Puerto Rico Hurricane Maria Claims Still Not Paid—New York Times Reports on the Insurance Claims Crisis in Puerto Rico. Merlin Law Group attorney Chris Mammel and I were talking about the deceptive releases in Puerto Rico and he reminded me that Florida put an end to this wrongful claim practice by issuing a Bulletin following Hurricane Andrew.

Insurance Commissioner

DATE: March 24, 1993

RE: RELEASE OF HURRICANE ANDREW CLAIMS

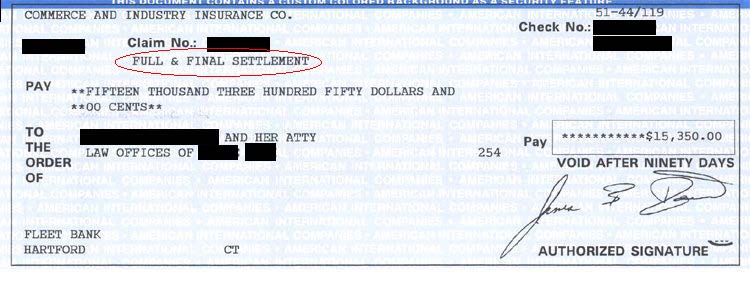

It has been brought to the attention of the Florida Department of Insurance that some insureds are being re- quired to sign full releases in order to receive claims disbursement in settlement of claims relating to Hurricane Andrew.

The Department interprets Florida Statutes 626.9541(1)(i), 626.9641(1)(b), 626.9702, 627.4265, 627.702 and Emergency Rule Subsections 4ER92-26(4)(g), 4ER92-27(4) and other emergency rule subsections on similar topics, to mean:

1. No check or draft issued in settlement of an insurance claim shall contain a provision which makes negotiation of the instrument an acceptance of the amount payable thereon as full and final settlement of the underlying insurance claim, except those that are for full policy limits.

2. To eliminate misunderstanding or confusion and possible violation of Florida Statute 626.9541 and Rule 4-166.023, Florida Administrative Code, the Department is requesting that insurers limit the use of general re- leases to those settlements for which they are appropriate, and insert in said releases language to the effect that the release shall not constitute a final waiver of claims which are reasonably unforeseen on the date of the release.

As a result, we rarely encounter the “accord and satisfaction” defense in Florida because such contact will cause insurance regulators to punish this wrongful conduct under the regulations and statutes cited within the bulletin.

I am certain there are many policyholders in Puerto Rico wondering why their regulators are not punishing and fining insurance carriers for the same conduct under the very similar regulations which exist in Puerto Rico. Of course, the most recent Puerto Rico insurance commissioner recently resigned on January 22 when many were complaining of the insurance claims mess. Perhaps, other insurance regulators there will start to do what they are paid to do and stop the unfair claims practices noted in the Times article1 including the escape of claims payments through “accord and satisfaction.”

Thought For The Day

The bottom line is the best consumer protections are competitive, innovative markets that are transparent. Now, they need to be vigorously policed for force and fraud, but the agencies that do that need to be accountable.

—Jeb Hensarling

________________________________

1 Frances Robles and Patricia Mazzei, After Disasters, Puerto Ricans Are Left With $1.6 Billion in Unpaid Insurance Claims, New York Times, Feb. 6, 2020. Available at https://www.nytimes.com/2020/02/06/us/puerto-rico-insurance-tsunami.html