Business owners and owners of commercial property should not buy Farmers Insurance. Virtually every insurance company in the United States considers the entire cost of restoration right away when making payments, including at actual cash value—except Farmers Insurance. Farmers Insurance has declared war on its own customers and independent restoration contractors.

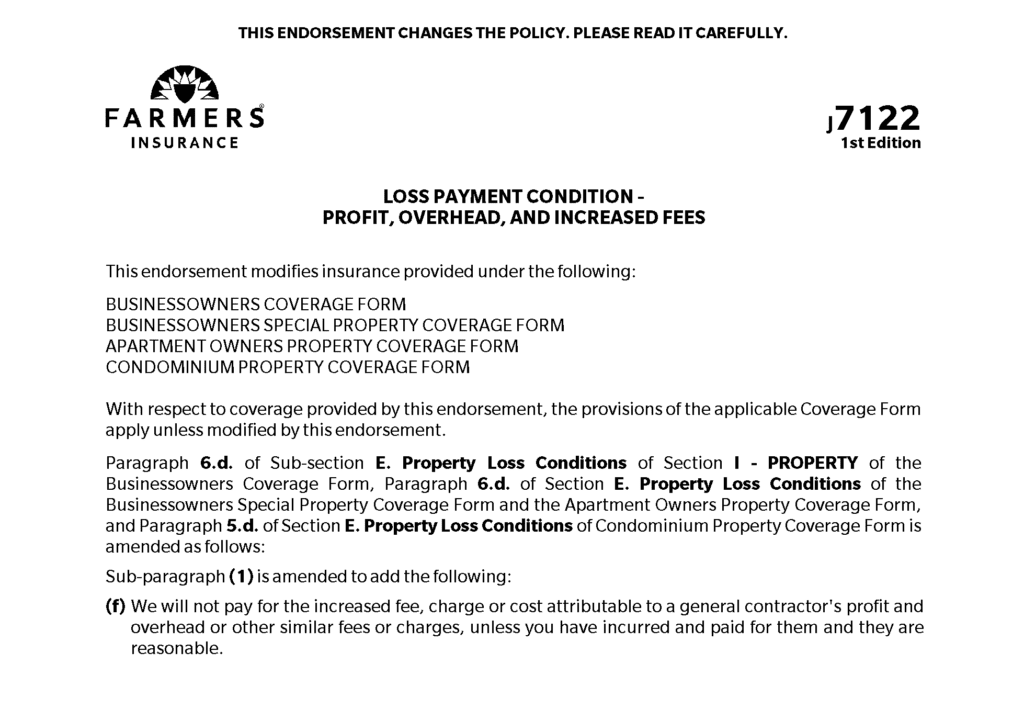

In Crazy New Policy Language? Report It To United Policyholders!, I posted about rogue insurance company tactics used to get a competitive advantage; the following endorsement to the Farmers Insurance business policy is a classic example:

When it comes to reconstruction, replacement costs always include the contractors profit and overhead. This policy effectively removes payment of these significant costs when even determining actual cash value. State insurance regulators should never be approving this rogue insurance policy form.

Farmers Insurance is a cheap insurance company that advertises how good it is yet is selling a horrible product through this business policy. Farmers Insurance agents should warn their own commercial customers against buying this policy because this policy is clearly not providing the best coverage at the best price for the commercial customer.

Thought For The Day

There is no advertisement as powerful as a positive reputation traveling fast.

—Brian Koslow