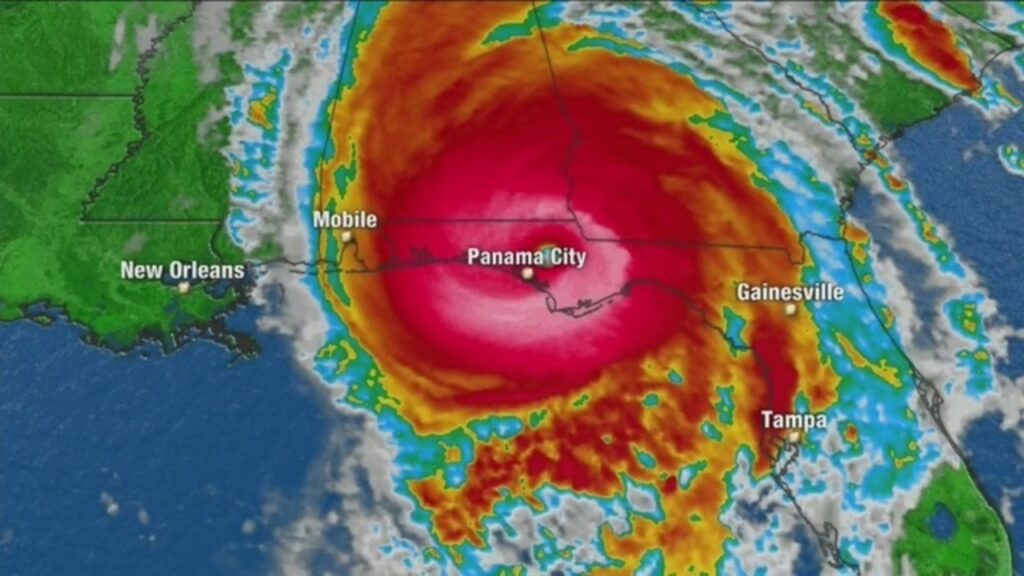

Hurricane Michael has left a familiar mark on the Florida Panhandle. Much like Hurricanes Katrina and Ike, Hurricane Michael brought devasting winds followed by wind and flooding and more wind. Battered homes and businesses are assessed in the aftermath in an attempt to determine the extent and cause of damage resulting from the multiple perils associated with a hurricane. This has proven to be no easy task after a major hurricane.

Typically, the first insurance adjusters on the ground in the aftermath of a hurricane are National Flood Insurance Program (NFIP) authorized adjusters. When there is potential of “substantial damage” to the insured building due directly from flood, including non-covered flood damage, the adjuster completes an Adjuster Preliminary Damage Assessment (APDA) form.1 The National Flood Insurance Claim Manual (Claim Manual) cites 44 C.F.R. § 59.1 (2018) in defining “substantial damage”:2

Substantial damage is damage from any origin where the cost to repair generally equals or exceeds 50 percent of the market value of the building at the time of the flood. The adjuster should know that some communities have adopted a percentage threshold less than 50 percent. For the purpose of claim handling, the adjuster should complete and submit an APDA when the estimated cost to repair flood damage approaches or exceeds 50 percent of the RCV of building.

As noted in the Claim Manual, communities may adopt a lesser threshold. Bay County Builder Services has prepared a Substantial Structural Damage Information Packet (Packet) for builders and residents seeking additional information, as well as a damage assessment. Just a quick look through the Packet demonstrates the difficulty and the need for an expert to determine the extent and cause of damage and more so, if repair is an option, the proper approach or repair method.

The Packet includes a Job Aid3 published by FEMA to assist in understanding “substantial structural damage” as it differs from “substantial damage” and how it relates to repairs:

How SSD Relates to Repairs

The IEBC, at minimum, requires any damage to be repaired by restoring it to the pre-damage condition (Sections 404.1 or 601.1). In some cases, the code requires not only repair of the damage, but also improvement of the building beyond its pre-damage condition. With respect to natural hazards, the IEBC “triggers” such improvements when damage is classified as either Substantial Damage or Substantial Structural Damage.

● Substantial Damage (SD), defined in terms of repair cost, requires the entire structure to be retrofitted to meet the requirements for new flood-resistant construction (Section 404.5 or 606.2.4). The IEBC’s SD provisions apply only in flood hazard areas.

● Substantial Structural Damage (SSD), defined in terms of capacity loss, requires evaluation and/or retrofit of certain structural elements other than the damaged elements, as explained further below.

It is possible for a building to sustain both SD and SSD in the same event, in which case both sets of requirements will apply. Even so, SSD is different from SD, despite the similar names.

Making the SSD Determination

Because SSD is defined in terms of capacity loss to structural elements, making the SSD determination requires an understanding of the building’s structural system, as well as the extent and meaning of the damage.

Policyholders whose homes or businesses have been substantially impacted by both wind and flood will benefit from a qualified expert who can determine both the extent and cause of damage to their structures. Not only will an expert aid in determining whether repair to a substantially damaged structure is reasonable and by which method, the expert will also aid in determining which insurance company is liable for damages, i.e., wind v. flood.

The Claim Manual4 provides the following guidance to the flood adjuster:

When adjusting wind/water losses, the adjuster should use established and proven investigative methods to document flood and wind damage to buildings and contents occurring during hurricane or storm events. “Wind/Water Investigative Tips” below can also be helpful.

For “substantial damage” and “slab” claims after Hurricanes Katrina and Ike, we found it necessary to engage the assistance of engineers and meteorologists to aid our clients in proving the extent and cause of their covered damage. A policyholder impacted by both wind and flood, which is usually synonymous with substantial damage, quickly finds that after the adjustment by both the wind and flood adjusters, there is still a huge gap in getting back to pre-loss condition. There is only one way that happens …. Damage anyway!

________________________________

1 National Flood Insurance Claim Manual, Section 2: Claims Processes and Guidance, 1 Adjuster Preliminary Damage Assessment, June 2019.

2 Id.

3 FEMA, Job Aid, Public Assistance, Understanding Substantial Structural Damage in the International Existing Building Code, April 2017.

4 National Flood Insurance Claim Manual, Section 2: Claims Processes and Guidance, 52 Wind/Flood Loss, June 2019.