If you are a Vermont property owner, have suffered a property loss, and believe that you have been wronged by a delaying, denying and bad treating insurance company, you have the right to file a complaint with the insurance commissioner.

In Vermont, the entity that regulates the conduct of insurance companies is the State of Vermont Department of Financial Regulation, a state agency that touches the lives of every Vermonter through the regulation and monitoring of a broad spectrum of financial industry activities.1 The department’s job is to protect consumers against unfair and unlawful business practices in the areas of banking, securities (investments), insurance, and captive insurance, while ensuring that licensed entities are financially healthy.2

Michael S. Pieciak is Commissioner of the Vermont Department of Financial Regulation.3

If you have been wronged by your insurance carrier that has not fully paid all that you are entitled to under your policy, there are two ways to file a complaint with the Vermont Department of Financial Regulation: 1) Online or 2) By Mail or Fax:

1. File a Complaint Online

This is a quicker method that allows a consumer to more easily and quickly communicate with the Department of Insurance staff and electronically upload documents to support the complaint.

Here is a link to start the process: https://dfr.vermont.gov/consumers/file-complaint/insurance

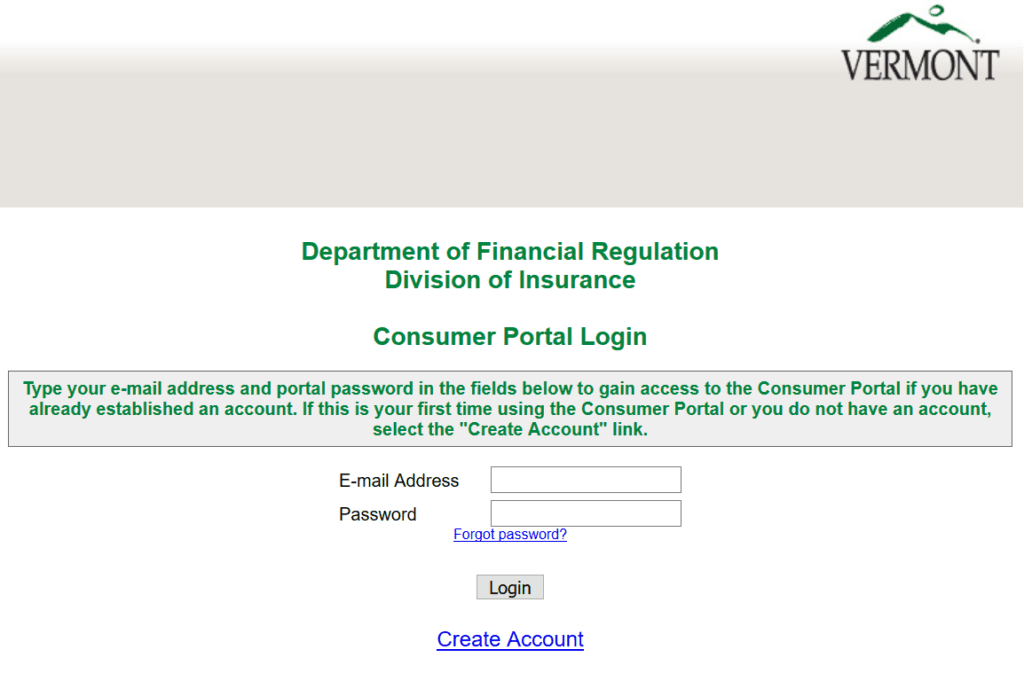

Under the heading “File Complaint” click on the box “Online” and it will bring you to this screen:4

You will need to set up an account using a computer. The consumer portal is not compatible with mobile devices or tablets.

2. File a Complaint by Mail or Fax

Here is a link to the Insurance Complaint Form that you can print, fill out and submit by mail or fax.

Fax number: is 802-828-1446.

Mailing Address: Department of Financial Regulation, Insurance Consumer Services, 89 Main Street, Montpelier, VT 05620-3101

On page 4 of the Complaint Form, the consumer must describe the problem in detail and also answer this question: “WHAT WOULD YOU CONSIDER TO BE A FAIR RESOLUTION OF YOUR PROBLEM?”

After filing a complaint, consumers want to know what timeline they can expect from that point forward. The Department provides the following information in response to Frequently Asked Questions:5

Q11. How soon should I expect a response from the Consumer Services staff?

A11. Within two business days after we receive your written complaint, we will e-mail you acknowledging receipt of your complaint. You will be notified of any correspondence added to the Portal via e-mail.

Q12. Will you contact the insurance agent or company?

A12. In most cases, a letter requesting an explanation and a copy of your complaint will be sent to the company or agent. After the company or agent responds, we will determine what further action, if any, we will take

Q13. How long will the investigation take?

A13. The company or agent has 21 days to send us a written response. After reviewing the information, you should hear from us within 30 days.

Q14. Should I call to check status of my insurance complaint?

A14. Of course you can always call us, however, we suggest that you allow us the opportunity to receive and review the response from the insurer or agent.

If you have any questions, need help with filing your insurance complaint or wish to discuss the insurance complaint, you can call the Vermont Department of Financial Services at 800-964-1784 or email dfr.insuranceinfo@vermont.gov.

_____________________________

1 https://dfr.vermont.gov/about-us

2 https://dfr.vermont.gov/about-us

3 https://dfr.vermont.gov/about-us/commissioner

4 https://gov.sircon.com/consumerPortalLogin.do?method=initProcess&request.authorization.token=BlACk1dVPvaqy6IHnhSgZ6yLo2xHZ7AY

5 https://dfr.vermont.gov/sites/finreg/files/doc_library/dfr-insurance-consumer-complaint-portal-faq.pdf