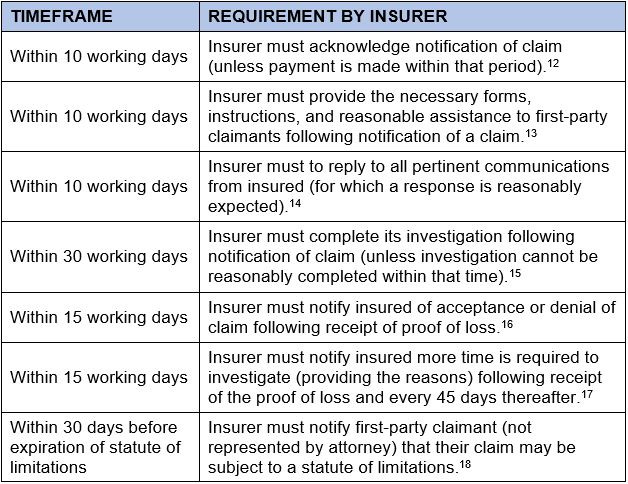

Similar to other states, Arizona has adopted unfair claims settlement practices statutes and regulations. While one cannot a bring a private cause of action under the Unfair Claim Settlement Practices Act1 and its companion regulations, they lay out specific standards for insurers to promptly investigate and process claims.

Under the Act, insurance carriers are expected implement reasonable standards for the prompt investigation of all claims brought under a policy.2 This includes acting reasonably and promptly upon communications relating to insurance claims.3

An insurer may not refuse to pay claims without conducting a reasonable investigation, and must affirm or deny coverage within a reasonable time following submission of the proof of loss.4 Insurer’s may not misrepresent facts or insurance policy provisions and must attempt in good faith to effectuate prompt and fair settlements of claims once liability becomes reasonably clear.5

Property insurers may not restrict the assignment of a loss or claim after the loss has occurred.6

The investigation or payment of claims may not be delayed for the purpose of requesting preliminary claim reports followed by subsequent formal proofs of loss.7 Insurers may not force their insureds to initiate litigation to recover amounts owed under the policy by offering substantially less.8

Once liability has become reasonably clear, an insurer must promptly settle claims under that section of the insurance policy.9

When paying claims, the payment must be accompanied by a statement describing the coverage under which the payment is being made.10 If an insurer is denying a claim or offering a compromise settlement, they must promptly provide a reasonable explanation of the basis relative to the facts or applicable law.11

___________________________

___________________________

1 Ariz. Rev. Stat. Ann. § 20-461 (D)

2 Ariz. Rev. Stat. Ann. § 20-461 (A)(3)

3 Ariz. Rev. Stat. Ann. § 20-461 (A)(2)

4 Ariz. Rev. Stat. Ann. § 20-461 (A)(4); Ariz. Rev. Stat. Ann. § 20-461 (A)(5)

5 Ariz. Rev. Stat. Ann. § 20-461 (A)(1); Ariz. Rev. Stat. Ann. § 20-461 (A)(6)

6 Ariz. Rev. Stat. Ann. § 20-461 (A)(7)

7 Ariz. Rev. Stat. Ann. § 20-461 (A)(13)

8 Ariz. Rev. Stat. Ann. § 20-461 (A)(8)

9 Ariz. Rev. Stat. Ann. § 20-461 (A)(14)

10 Ariz. Rev. Stat. Ann. § 20-461 (A)(11)

11 Ariz. Rev. Stat. Ann. § 20-461 (A)(15)