Can you imagine the scene in the Florida legislature where insurance industry lobbyists were presenting drafts of new laws to Republican lawmakers? It must have gone something like this:

‘These laws will allow us to not pay claims, or if we have to, we will have a lot more leverage to pay less because nobody will be able to afford a lawyer. And, if they do hire a lawyer and sue, it will cost them a lot more, and we will make them go through more hoops that exist nowhere else in the country. We will take away almost any chance of bad faith lawsuits so we can deny a lot more claims. We will not have to offer as much coverage. And the best, we will get these laws passed and not promise to lower any premiums. Indeed, the rates may go up!’

It does not take a financial genius to figure out that taking people’s money and never paying what is owed on insurance claims can be very profitable. The geniuses who passed these laws understand that basic concept so much that they are now touting Florida as a great place for insurance companies to do business, as noted in the above video and in an article by Lawrence Mower, Amid Florida Insurance Crisis, Investors And a Senator See Opportunity:

Lured by the nation’s highest premiums and new laws making it harder to sue insurance companies, investors see an opportunity in Florida’s beleaguered insurance market. Current and former state officials and other observers said they are receiving regular inquiries from potential investors looking to make a profit.

‘As soon as we were done with the last vote in session, I had a couple of people … including legislators, asking if I wanted to invest in an insurance company,’ Sen. Jason Pizzo, D-Hollywood, told the state’s insurance commissioner last month.

That includes state Sen. Joe Gruters, R-Sarasota, who has pitched fellow lawmakers on investing in a homeowners insurance company that projects a 165% return on investment over five years.

… But Florida-based insurance companies employ unusual financial structures that can allow executives to extract considerable profits from homeowners’ premiums.

A guest blog, Major Florida Property Insurers Paid Out Excessive Executive Compensation Packages Dividends For Years, written by Kevin Connor for the American Policyholder Association, noted that:

For years, property insurance companies in Florida paid out excessive executive compensation packages and stock dividends, essentially transferring profits into insiders’ pockets instead of preparing for future years of adverse underwriting experiences as most insurers do.

… One of the few final reports available on homeowners insurance companies is regarding the failure of Sunshine State Insurance Company in 2014. The company reported that due to an ‘accounting error,’ it did not have the required reserves and was placed into receivership. Sunshine State was later found to have shifted millions of dollars in payments to its parent company and subsidiaries, as well as large executive bonuses while the company was on the verge of insolvency. An interesting component of the required insolvency reports is that the department is required to do an analysis of the effectiveness of the Office of Insurance Regulation’s oversight of insurance companies that have later failed. Some have speculated that this is the reason why these reports appear to be suppressed.

Little attention has been paid to this aspect of Florida’s insurance market: Insurance executives lined their pockets for years instead of operating the companies responsibly and building up adequate reserves and are now pointing the finger at consumers, lawyers, and roofers. We have seen questionable statistics often repeated to support this theory, but no one has produced validation or verification.

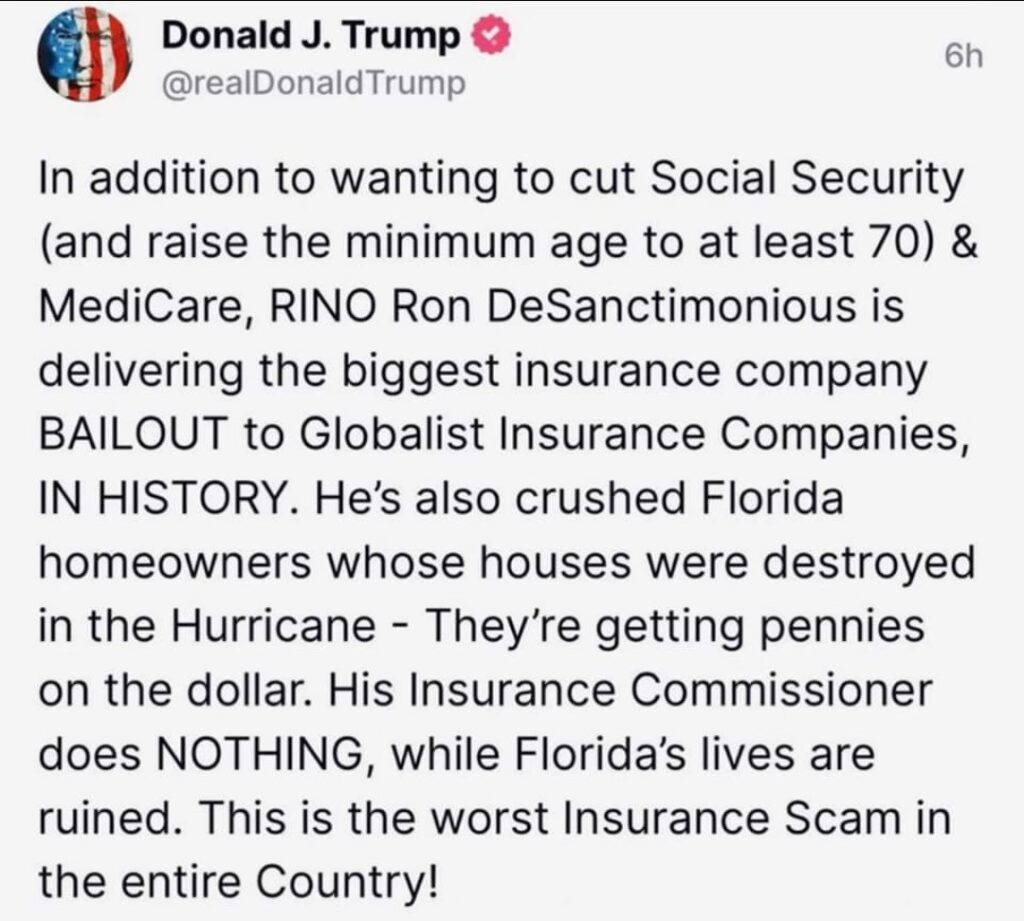

Florida has an insurance crisis because Florida’s insurance regulators and most of its Republican lawmakers are in bed with insurance lobbyists, as noted in How the History of Insurance Repeats Itself and Is Full of Modern Lessons Which Need to Be Acted Upon. The Republican legislature, government officials, and insurance regulators being in bed with the insurance lobby is not a secret. Donald Trump has called them out on this:1

What can we do? Follow former President Trump’s advice—clean the swamp. Insurance lobbyists and the insurance industry run Florida’s insurance marketplace. Until we get them out of the regulation and lawmaking business, this will continue to be a mess.

Thought For The Day

Don’t spend major time on minor things. If you find that you’re spending too much time on the insignificant, you have to clean house.

—Jim Rohn