Note: This guest post was prepared by Kevin Connor for the American Policyholder Association.

For years, property insurance companies in Florida paid out excessive executive compensation packages and stock dividends, essentially transferring profits into insiders’ pockets instead of preparing for future years of adverse underwriting experiences as most insurers do.

Now these same companies are pointing to the cost of fraud and litigation as reasons for losses and rate increases which seem to be a strategy to divert attention away from the impact of mismanagement and corporate greed. Some continue to pay out generous cash dividends to shareholders even as they file for substantial rate hikes, stop writing policies in parts of the state, or look to withdraw from the Florida markets altogether.

To compound the problem, multiple Florida insurers have failed, and information as to why has not been released to the public. While the Florida Division of Financial Services is required to release findings on why insurers failed, no one seems to be able to get copies of these reports. Florida law requires the department to release initial findings within four months of being appointed as receiver and also a comprehensive report once proceedings have completed. One of the few final reports available on homeowners insurance companies is regarding the failure of Sunshine State Insurance Company in 2014. The company reported that due to an “accounting error,” it did not have the required reserves and was placed into receivership. Sunshine State was later found to have shifted millions of dollars in payments to its parent company and subsidiaries, as well as large executive bonuses while the company was on the verge of insolvency. An interesting component of the required insolvency reports is that the department is required to do an analysis of the effectiveness of the Office of Insurance Regulation’s oversight of insurance companies that have later failed. Some have speculated that this is the reason why these reports appear to be suppressed.

Little attention has been paid to this aspect of Florida’s insurance market: Insurance executives lined their pockets for years instead of operating the companies responsibly and building up adequate reserves and are now pointing the finger at consumers, lawyers, and roofers. We have seen questionable statistics often repeated to support this theory, but no one has produced validation or verification.

Regulatory oversight is supposed to protect against insurance companies being aggressively stripped of cash and reserves, such as through limits on dividends. Florida’s regulators appear to have been insufficient in keeping insurance companies from being run like personal piggy banks or having funds in years when losses were low.

The following are three examples of insurance companies that currently write a significant percentage of homeowners insurance policies in Florida and have paid out excessive compensation packages and dividend payments.

These companies are highlighted in part because they are publicly traded, which means that their compensation packages and dividend payments are disclosed and, in part, because their payouts have been excessive.

The below are not comprehensive analyses of the compensation and other business practices of these companies or those of the industry as a whole. They are meant to offer a window into some of the ways in which top insurance executives in Florida have stripped cash out of their companies with no eye toward long-term viability.

I. Heritage Insurance: Former chairman raked in $27 million in compensation and cashed in on $19 million in stock in one year, averaged nearly $10 million per year in compensation

Heritage Insurance is a relatively new property insurance company that was founded in 2012 and had its initial public offering in 2014. After an initial period of rapid growth, thanks in large part to a sweetheart deal with the state of Florida and years without major storms, the company has been experiencing significant losses over the past two years, recently stopped writing policies in Florida, and is attempting to leave the market. A recent Tampa Bay Business Journal headline says it all: “Heritage Insurance can’t exit Florida’s property market quickly enough as losses mount.”1

Before these losses began mounting, the company paid outlandish sums to its top executive – former chairman, chief investment officer, and co-founder Bruce Lucas.

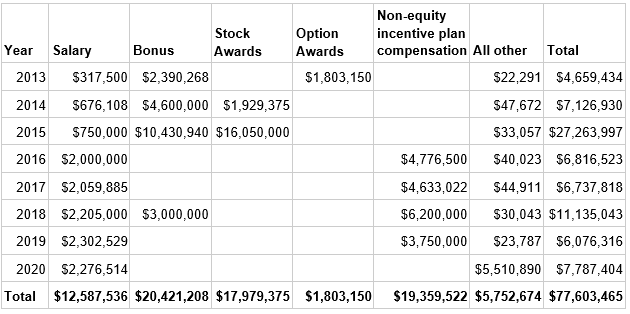

Between 2013 to 2020, the company paid Lucas $78 million in compensation, an average of nearly $10 million per year, including $27.2 million in 2015. This is more than the CEOs of AllState, Progressive, and Travelers made in 2021, all of which are much, much larger than Heritage. The smallest of these companies in terms of market capitalization, Allstate, currently has a market cap 800 times larger than Heritage Insurance ($35 billion compared to $43 million). Even at the height of Heritage’s stock price, in 2015, Allstate’s market cap was 40 times larger than Heritage and paid its CEO half as much.

Much of the compensation paid to Lucas was in the form of cash – about $58 million of the $78 million total, or 75%. This is a relatively large cash percentage for an executive compensation package. It also means that Lucas was able to strip a great deal of wealth out of the company before its stock price declined since he was not paid in the form of stock.

Table I: Bruce Lucas Compensation from Heritage Insurance, 2013-20202

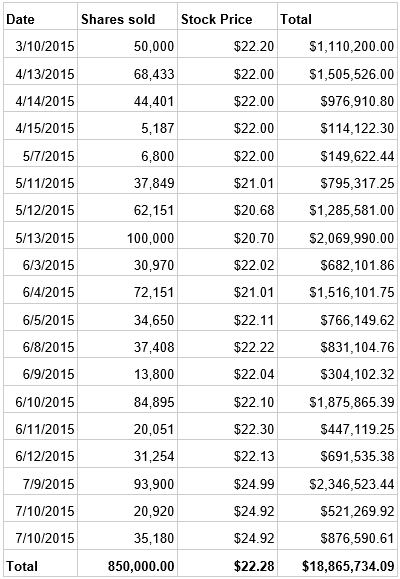

Additionally, Lucas sold substantial initial Heritage shareholdings the year after the company’s IPO. Over the course of 2015, Lucas sold nearly $19 million worth of stock, more than half of his total holdings at the time. The stock price at the time averaged $22 and hit its all-time peak during this period. It is currently trading at $1.65. If Lucas had held onto his stake rather than selling it, it would be worth just $1.4 million, 93% less than what he sold it for in 2015.

Lucas’s $27 million compensation package in 2015 made headlines, partly because the company requested a 15% rate hike in 2016.3 But Lucas was able to sell the $19 million in existing shareholdings quietly (and in accordance with a plan agreed upon with the company in March 2015 to avoid insider trading charges4). The stock he sold was basically paid back to him, again, by the company, as part of the $27 million pay package: he sold 850,000 shares from March through July of 2015 and received 750,000 shares from the company in November 2015.

Table II: Bruce Lucas’ $19 million in Heritage stock sales (2015)5

Lucas stepped down with impeccable timing in November 2020, just as storm-related losses began picking up. Since he stepped down, the company has reported seven straight quarters of losses, including a $48 million loss in the third quarter of 2022.6 The company’s stock price is down about 85% since he left the company.

Support from the state of Florida was key to Heritage’s growth in its early years. In 2013, when Heritage was still a startup and Lucas was still Heritage CEO, Heritage was able to acquire $52 million in policies from Citizens in an unusual deal that did not go through the standard approval process. Florida lawmakers questioned whether the company had received favorable treatment due to its $110,000 in contributions to then-Governor Rick Scott.7

In a recent podcast interview, Lucas described how important this was for the company’s growth and subsequent initial public offering: “We had a lot of things happening that were very positive. We had Citizens Insurance, which is the state-run insurer, had 1.5 million policies and they’d let you come and just cherry pick whatever you wanted, right? Just take it out. So you could instantly get hundreds of millions in revenue…”8

In the same interview, Lucas bragged that “by every metric, when you look at Heritage, it was an absolute home run,” and that it booked a profit every year he was chairman, including $500 million in pre-tax profits.9

Lucas did not address the mounting losses the company has experienced since his departure.

Lucas had been a bankruptcy attorney for Enron and a hedge fund manager prior to founding Heritage. He is now the CEO of Slide, an insurance technology startup. The companies have a formal partnership, which Lucas called “phenomenal” in the same podcast cited above. He cited it as a crucial reason Slide was able to raise $105 million in a Series A fundraising round.10

Florida regulators awarded Slide Insurance $400 million in policies from St. Johns Insurance after that company went insolvent earlier this year. The move came under fire to the point where industry insiders spoke out against it publicly, arguing that the company had received a sweetheart deal.11 Slide and Heritage gave a combined $190,000 to Florida CFO Jimmy Patronis in 2022.

Despite its current woes, Heritage had until recently continued to pay a substantial dividend of $0.06 per share per quarter, or $0.24 per year. This amounts to nearly $7 million a year and a dividend yield of roughly 15% (meaning that 15% of its market capitalization was paid out as dividends on a yearly basis). The company elected not to make a dividend payment in August 2022.

Lucas made much more money than other top executives at Heritage during his time there, though they still received substantial pay packages. Richard Widdicombe, President and CEO during Lucas’s time as chairman and chief investment officer, made $7.6 million in 2015, and routinely made $3 million per year, much of it paid in cash.

II. United Property & Casualty / United Insurance Holdings Corp: $10 million in dividends each year, including $4 million in dividends to CEO

United Property and Casualty, the main operating subsidiary of United Insurance Holdings, is currently in the process of withdrawing from and winding down its business in Florida, Louisiana, and Texas. Its stock is now trading at just $0.33 per share, down from $22 in 2018 and a high of $27 in 2015. Recent press reports suggest that Hurricane Ian has pushed it to the brink of failure.12

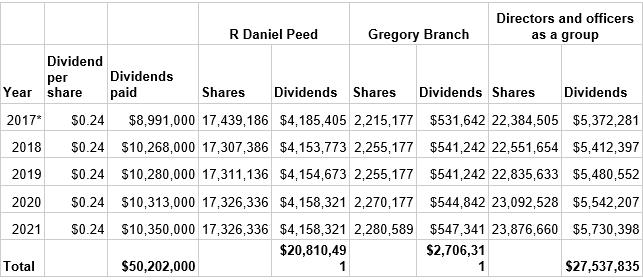

UPC’s parent United Insurance Holdings Corp., continued to pay a $0.06/share quarterly dividend, more than $10 million a year, even as its stock price slid dramatically. It finally stopped declaring dividend payments in the second quarter of 2022.13 Its current market capitalization, $13.85 million, is not much more than its dividend payments in 2021, $10.3 million.

United Insurance CEO Daniel Peed is paid a relatively low salary (he made $180,600 in 2021),14 but he owns 40% of the company’s common stock. This means that the company has been paying him $4.2 million per year in cash since 2017, when the company was formed out of a merger. He does not appear to be reinvesting that in the company by purchasing more stock.

Greg Branch, a longtime director and former chairman, also has a sizable stake in the company and is making about $550k a year in dividend payments. Branch used to be non-executive chairman and CEO of a predecessor company and had a very generous compensation package when he served in that role.

The below table shows estimated United Insurance Holdings dividend payments to Peed, Branch, and all directors and officers as a group. Notably, the company is majority-owned by directors and officers. Payments to executives and directors are estimated based on the number of shares they own according to the proxy statement for that year.

Table III: United Insurance Holdings Dividend Payments, 2017-202115

Peed only became CEO in 2020 but had joined the company as vice chairman in 2017 when United and the company he had been running/owned in large part, American Coastal, went through a merger. Peed had remained CEO of another company, AmRisc, which is partially a subsidiary of Truist (formerly BB&T), and provides underwriting services to American Coastal. Peed also owned nearly 8% of AmRisc. Until recently, United paid AmRisc commissions of about $100 million a year.16 Peed stepped down as AmRisc CEO in December 2018 and divested his stake. UIHC continues to depend on AmRisc (particularly for commercial residential) for underwriting/agent services. Peed’s insider relationship with AmRisc raises questions of profit-shifting, though further analysis is needed.

III. Universal Property & Casualty / Universal Insurance Holdings: Massive pay packages of $14-$25 million for its former CEO, $25 million in dividends each year

Universal Insurance Holdings’ main operating subsidiary, Universal Property & Casualty, is Florida’s largest property insurance carrier. The company’s financial condition has declined significantly over the past year: it posted a loss of $48 million in the fourth quarter of 2021, year-over-year decreases in net income in the first two quarters of 2022, and a net loss of $72 million for the third quarter of 2022.17 Its third-quarter loss was driven by an estimated loss of $1 billion resulting from damage caused by Hurricane Ian.

Universal’s stock is now trading at $10.99 per share, down 40% from its January 2022 stock price and down 77% from its 2018 peak of $48.55.

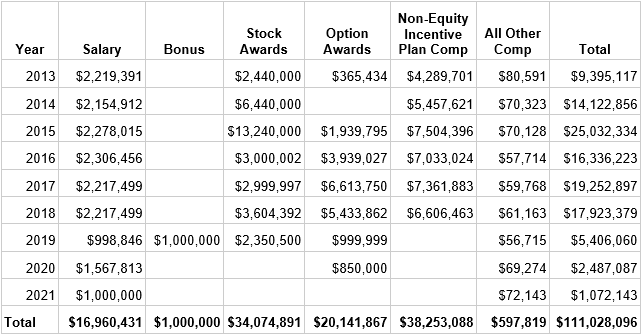

Executive compensation packages at Universal were extremely inflated for many years. Its former CEO, Sean Downes, received annual compensation packages that reached as high as $25 million (in 2015), totaled $107 million, and averaged $13.7 million during his time as CEO. Downes has continued to receive compensation in 2020 and 2021 in his role as executive chairman. Much of this compensation was paid in cash, including $17 million in salary and $38 million in non-equity compensation.

As discussed above in the section on Heritage and Bruce Lucas, these compensation amounts are higher than CEOs at large insurance companies that are many times the size of Universal.

The table below shows Downes’ compensation packages for his years as CEO (2013-2019) and executive chairman (2020 and 2021).

Table IV: Sean Downes’ Compensation as Chairman and CEO and Executive Chairman, 2013-202118

Notably, Downes took over as CEO in 2013 after its prior CEO, Bradley Meier, stepped down. That year, the company had been fined for a number of significant violations, including improper delays and denials.19 Meier’s compensation packages also ran into the millions.

The current CEO of Universal is Stephen Donaghy. Donaghy’s compensation packages as CEO have been substantially lower than Downes, but are still significant, including $3.3 million in 2020 and $3.5 million in 2021.

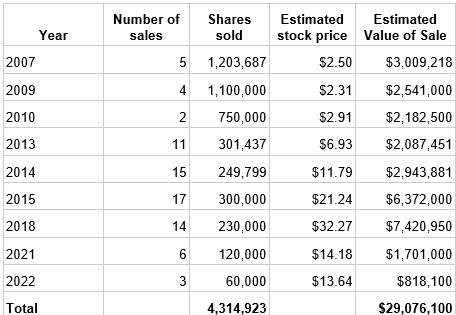

Much like Lucas, Downes sold a substantial amount of Universal stock over the years, including over one million shares from 2013-2018, during a period when few major storms hit Florida, and Universal stock was surging. Downes cashed in on an estimated $19 million worth of stock during that period and has sold an estimated $29 million worth of stock since 2007.

The below table shows these estimated figures. The value of stock sold is calculated by using an estimated stock price for each given year, which is the average of the high and low stock price for that year. Determining the actual value of Downes’ stock sales at the time of the sale is possible but would require finding the price for each of the 77 transactions.

Additionally, the table below only captures sales of stock – some other kinds of disposals of stock, including gifts, were excluded for the purpose of simplicity. A more comprehensive analysis would likely produce a higher total.

Table V: Sean Downes Stock Sales and Estimated Value, 2007-2022***20

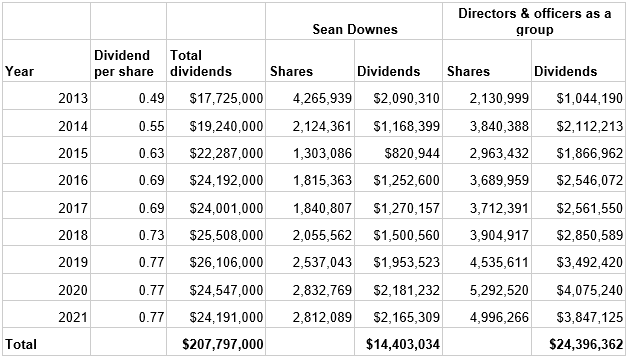

Notably, Universal also pays a substantial dividend each year, about $25 million each year. These payments have totaled nearly $208 million since 2013, the year Downes became CEO. Downes himself has been paid an estimated $14.4 million in dividends since 2013 – between $1 and $2 million per year. Directors and officers as a group have been paid an estimated $24.4 million.

Despite its current financial woes, Universal continues to pay its dividend and has shown no signs of suspending its dividend payment.

Table VI: Universal Insurance Holdings Dividend Payments, 2013-202121

______________________________________________________________

1 https://www.bizjournals.com/tampabay/news/2022/11/10/clearwater-property-insurer.html

2 Sources: Proxy statements for Heritage Insurance available on EDGAR: https://www.sec.gov/edgar/browse/?CIK=1598665&owner=exclude

3 https://www.palmbeachpost.com/story/news/state/2016/06/27/rate-hike-greedy-insurance-ceo/6881037007/

4 See footnote 1 for an explanation of the plan: https://www.sec.gov/Archives/edgar/data/1552968/000089924315001146/xslF345X03/doc4.xml

5 Sources: Form 4s filed by Bruce Lucas in 2015, available on EDGAR: https://www.sec.gov/edgar/browse/?CIK=1552968

6 https://www.bizjournals.com/tampabay/news/2022/11/10/clearwater-property-insurer.html

7 https://www.insurancejournal.com/news/southeast/2013/09/27/306476.htm

8 https://alejandrocremades.com/bruce-lucas/

9 https://alejandrocremades.com/bruce-lucas/

10 https://alejandrocremades.com/bruce-lucas/

11 https://www.insurancejournal.com/news/southeast/2022/03/07/657010.htm

12 https://www.bizjournals.com/tampabay/news/2022/11/18/uihc-property-insurance-florida.html

13 https://www.sec.gov/ix?doc=/Archives/edgar/data/1401521/000140152122000112/uihc-20220630.htm

14 https://www.sec.gov/Archives/edgar/data/1401521/000140152122000020/uihcproxy2022.htm

15 Source: Proxy statements for United Insurance Holdings Corp filed with the SEC and available here: https://www.sec.gov/edgar/browse/?CIK=1401521&owner=exclude

Note: Dividend payments to Peed, Branch, and executives and directors as a group are estimated based on the number of shares they own according to the proxy statement.

* It is difficult to estimate dividend payments to Peed in 2017, since it was the year of the merger.

16 https://www.sec.gov/ix?doc=/Archives/edgar/data/0001401521/000140152122000010/uihc-20211231.htm

17 https://www.insurancejournal.com/news/southeast/2022/04/29/665320.htm https://news.ambest.com/newscontent.aspx?refnum=245432&altsrc=23

18 Source: Proxy statements for Universal Insurance Holdings Corp filed with the SEC and available here: https://www.sec.gov/edgar/browse/?CIK=891166&owner=exclude

19 https://www.insurancejournal.com/news/southeast/2013/10/09/307620.htm

20 Source: Insider transactions for Sean Downes, available here: https://www.sec.gov/cgi-bin/own-disp?action=getowner&CIK=0001287040

*** Note that value is estimated by using an estimated stock price for each given year, which is the average of the high and low stock price for that year. Determining the actual value of the stock sales would require going through the 77 Form 4s that these sales are reported on to find the sale price for each transaction. Downes’ Form 4s are available here: https://www.sec.gov/edgar/browse/?CIK=1287040

21 Source: Proxy statements and 10-k’s for Universal Insurance Holdings Corp filed with the SEC and available here: https://www.sec.gov/edgar/browse/?CIK=891166&owner=exclude

Note: Dividend payments to Downes and executives and directors as a group are estimated based on the number of shares they own as reported in that year’s proxy statement.