Our law firm library is brimming with insurance company chronicles from books published long ago by the insurance industry. In these, company executives of yesteryears boasted about the swiftness with which they compensated their claimants. They painted pictures of drained company treasuries and the extraordinary efforts of their claims staff, working overtime to ensure prompt payments. These tales often shined a light on a business ethic that put the policyholder first.

Fast forward to today, and the narrative has shifted dramatically. Contemporary insurance company cultures lean heavily on cost containment. Their prime focus? Limiting indemnity dollars disbursed to policyholders, managing allocated expenses tied to a particular claim, and overseeing unallocated expenses essential for operating their claims departments. This is a stark contrast to the customer-focused ethos of the past.

Regrettably, the primary fear these claims executives seem to harbor is the potential negative publicity that could arise from their practices and could attract regulatory scrutiny aimed at curtailing unjust claims processes. It’s worth noting, and perhaps a thorn in their side, that platforms like this blog and entities like the Merlin Law Group consistently shine a spotlight on these trends, challenging and advocating against them.

What inspired this particular post was a message I received from the sitting President of the National Association of Public Insurance Adjusters, Chris Aldrich. He shared a snippet from a social media discussion involving a group of insurance adjusters:

Nic Sacca

$60 for a tarp?! Roofers charge a minimum of $250 and they always get approved. Plus a ladder assist makes more just to show up to an inspection.

This makes a lot of sense as new adjusters would unknowingly jump on this and then the turnover cycle begins.

Once they have been worked to the bone and then wise up it’s already too late. These insurance companies need to stop being greedy.

Plus it’s a shame to be the one working the hardest just to be the one underpaid on every claim touched.

EVERY entity touching these claims is making more that the actual adjuster.

Adjusters are overworked and underpaid.

This post was in a long stream of posts from adjusters complaining that they could no longer afford to be a property insurance adjuster.

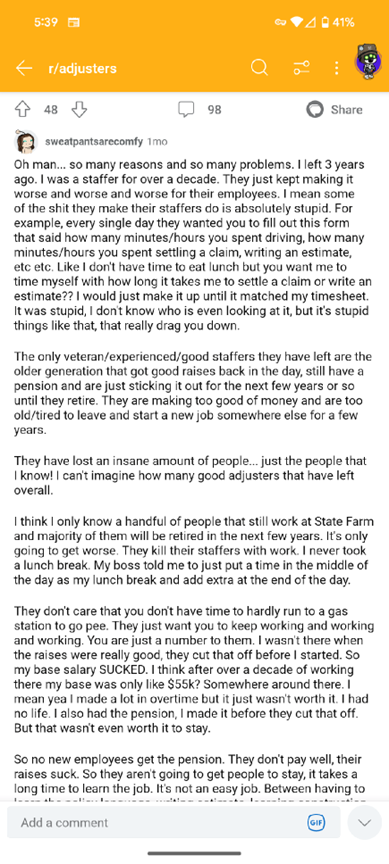

A client of mine who works for Google sent me a long stream of State Farm adjusters discussing their work conditions. Here is one such post which is very similar to the hundreds I read:

I genuinely believe that a majority of property insurance adjusters are driven by a desire to assist people during their times of distress. This sentiment becomes palpable when I engage with property adjusters from companies like Chubb and AMICA. Furthermore, seasoned independent adjusters from various organizations have confided in me about their innovative strategies to navigate around bureaucratic red tape to expedite claims adjustments and ensure timely payments.

Ideally, these insurance claim professionals wish for a work environment where they possess the autonomy and authority to decide on claims based on their on-ground observations. Here’s raising a toast to all the dedicated adjusters who uphold integrity and actively resist unjust practices. Cheers!

However, if you’re among the victims of Hurricane Ian or any other claimant for that matter, hoping for field-based property insurance adjusters to swiftly decide and address your needs, I regret to say that this dream has been relegated to the annals of history. Today, the narrative is dominated by undue delays, lack of urgency, and an almost nonchalant attitude towards immediate claims settlement. The underlying hope? That claimants would eventually lose patience and not pursue what’s rightfully theirs.

So, what’s the remedy? Legislation must be stringent, penalizing insurers that resort to deliberate delays and underpayments. Regulatory bodies need to shed their complacency, recalibrating their stance from being insurance company allies to staunch consumer advocates. It’s imperative to shed light on these corrupt practices – whether it’s by lodging formal complaints with insurance regulators, bringing these issues to the forefront through media, or taking legal action against erring insurers.

Too often, insurance companies bank on the complacency or fear of the general populace, believing they won’t challenge this flawed system. It’s high time we usher in a culture shift – one where such laxity and exploitation are no longer the norm.

Thought For The Day

Cautious, careful people, always casting about to preserve their reputation and social standing, never can bring about a reform.

—Susan B. Anthony