Brothers, sisters, elders, and pastors better think twice before getting insurance with Church Mutual Insurance Company. Church Mutual claims managers will read the insurance policy looking for the most ingenious way not to pay a church following a disaster. Proof of this is found in a recent Hurricane Michael case where Church Mutual successfully argued that it had no obligation to pay any monies unless the policyholder church made a formal election to get paid on an actual cash value basis.

Warning! If you are an experienced claims adjuster, you are already wondering how Church Mutual pulled off this legal maneuver and are in disbelief. Even the judge noted that there were no cases supporting the argument. Maybe that should have been a sign (not from God, but others doing this line of work) that after hundreds of millions of claims, the argument should fail. Maybe because no insurance company would ever act in such “bad faith” and make this argument, the result came out the way it did.

Our law firm is dedicated to being the best we can be, and that means studying insurance cases every day. We spend hundreds of thousands of dollars on research materials and up-to-the-minute computerized reports. In addition, we have a lawyer in our firm that is a full-time professional law librarian who helps our lawyers win cases based on all kinds of research. Some may think that I am this outgoing guy giving speeches or sailing in my free time, but hours of every day are spent in study on insurance law. To do this at a high level is not cheap, but if you want to win and beat insurance companies who litigate for a living, you do what it takes.

So, in those hours of study, I recently came across a newsletter mentioning a case with a recent judgment against a church in favor of Church Mutual Insurance Company involving Hurricane Michael. I am involved in a couple of very high-valued cases left from Hurricane Michael, and our firm represents a number of Churches throughout the United States. This random note from a newsletter that is supposed to help me find relevant cases piqued my interest. Church Mutual filed a judgment against its own policyholder church, which was a victim of Hurricane Michael. I was curious.

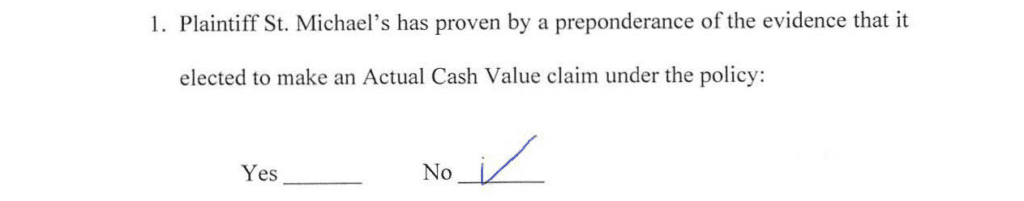

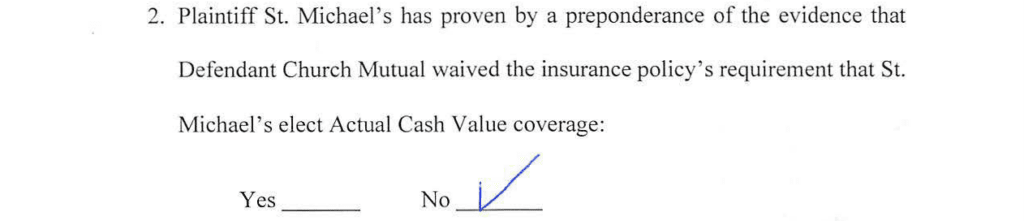

The case docket indicated that there was a sealed jury verdict. I have never seen a docket with a sealed jury verdict in federal court. I have been doing this line of work for 40 years. I was even more curious. The unsealed verdict available for us to see (but only if you subscribed to another computer service) contained the following:

I have been doing this for my entire adult life. I have never seen a verdict question posed to a jury like this. It is unheard of. So, I dug deeper.

A prior Order on Summary Judgment by the judge explained the argument made by Church Mutual Insurance Company:

St. Michael’s Anglican Catholic Church owns property that Church Mutual Insurance Company (“CMIC”) insured. After Hurricane Michael damaged the property, CMIC made four payments—totaling nearly $100,000—based on its determination of the actual cash value (“ACV”) of the loss, St. Michael’s, believing the damages were higher, sued for the difference.

CMIC argues it owes nothing more because St. Michael’s never formally elected an ACV recovery. The insurance contract provided “replacement cost” coverage, but only if St. Michael’s repaired or replaced the damaged property, which it admits it has not. CMIC “will not pay on a Replacement Cost basis” until and unless insured “actually repair[s] or replace[s] . . . as soon as reasonably possible”). The policy also provides that St. Michael’s can get actual cash value, even if it did not repair or replace. That provision is at the heart of the parties’ dispute.

CMIC’s motion presents two difficult questions: whether St. Michael’s needed to formally elect ACV coverage and whether St. Michael’s, in fact, did that.

The court then turned to the policy language:

The Valuation section, in turn, provides that

[i]f Replacement Cost is shown in the Declarations Page . . . we will determine the value of Covered Property . . . as follows:

(1) At Replacement Cost (without deduction for depreciation) as of the time of loss or damage . . . .

(2) You may make a claim . . . on an [ACV] basis instead of on a Replacement Cost basis. In the event you elect to have loss or damage settled on an [ACV] basis:

(a) We will then determine the value of Covered Property on an [ACV] basis . . . ;

(b) You may still make a claim on a Replacement Cost basis if you notify us of your intent to do so within 180 days after the date of the loss or damage.

The judge then noted what Church Mutual was arguing:

Based on this language, CMIC says claims under the policy are replacement cost value (‘RCV’) ‘by default,’ such that an insured must take action to seek payment on an ACV basis….(‘Making a claim without an election is making the choice to proceed with RCV benefits. Otherwise, the word ‘elect’ in the policy is superfluous.’).

Analyzing this argument, the judge wrote:

This is not clear to me, for several reasons. First, CMIC could not articulate what affirmatively electing ACV looks like. See Hearing at 56:8-57:19. And CMIC cites no case law supporting its construction. Further, the Valuation subsections are not obviously hierarchical: the RCV subsection isn’t facially prioritized, and the ACV subsection isn’t expressly subordinate. Finally, as St. Michael’s points out, the policy’s Duties in the Event of Loss section is silent on the need for an insured to formally make an ACV as opposed to an RCV claim.

On the other hand, ‘instead’ suggests substitution—of something new (ACV valuation) for something already in place (RCV valuation). And persuasive authority suggests the Eleventh Circuit might agree that the policy required an affirmative ACV claim. See Buckley Towers Condo., Inc. v. QBE Ins., 395 F. App’x 659, 664 (11th Cir. 2010) (‘[T]he insurance contract provides for [a] means of seeking reimbursement . . . without any need to repair or replace anything—the requirement of the insurer to honor a properly made ACV claim.’)

I could write a law review article about why the judge should have never allowed this aspect of the dispute to go to the jury. Members of my firm are in disbelief, saying things like, “nobody adjusts claims this way.” This is true. The insurance industry teaches its insurance adjusters to pay for actual cash value until replacement costs are incurred or whatever the policy requires for the extra replacement cost benefits.

So, until this case is corrected, my suggestion is to ask in writing that payment be made for actual cash value amounts until replacement is incurred and then pay replacement cost benefits.

There is another lesson, and that involves Church Mutual Insurance Company. Maybe their leaders do not know about this case, but maybe they do. If Church Mutual is an honest and transparent insurance company looking out for its policyholders who are church leaders, Church Mutual should publish this case as a warning about what a church can expect if a church makes a property insurance claim with it. Otherwise, it should publicly take the bold move to abandon its position.

This is what Church Mutual says about its values:

“We recognize our customers are the company.”

“We are powered by purpose.”

“We act with honor.”

“We are courageous and bold.”

“We share your commitment to serving and inspiring others and work alongside you not only to protect your people and property, but just as importantly, your faith-based mission.”

Many preachers talk a good talk. However, all of us know that actions speak louder than words. Let’s see what Church Mutual does in this instance.

Thought For The Day

Give me one hundred preachers who fear nothing but sin and desire nothing but God, and I care not whether they be clergymen or laymen, they alone will shake the gates of Hell and set up the kingdom of Heaven upon Earth.

—John Wesley