Chip’s Note: This guest post is by Luke Irwin, a public adjuster in the Gulf Coast Region and President of Irwin & Associates.

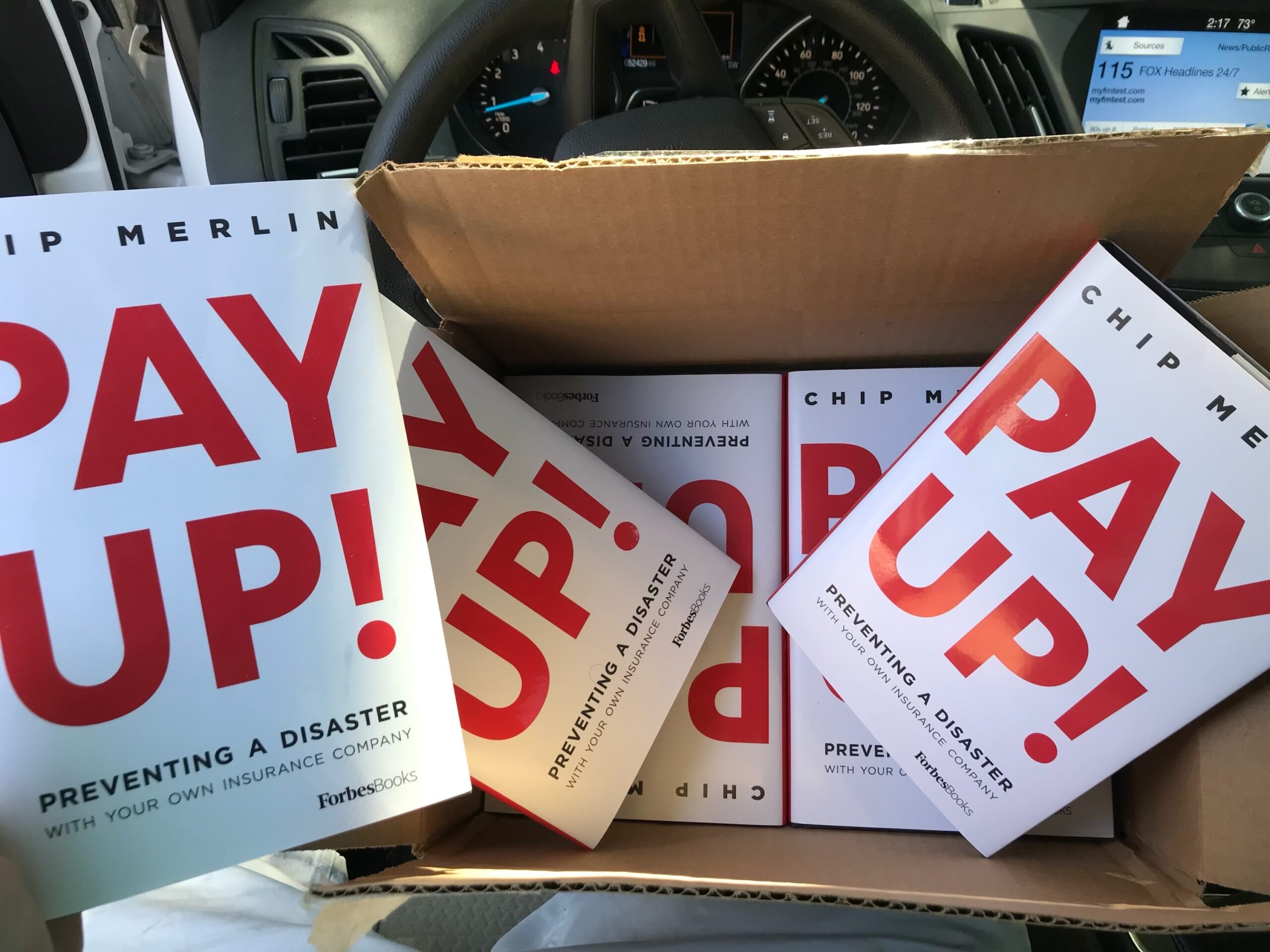

April 14, 2020, I received the shipment. And with the patience of a child looking at a Christmas gift, I ripped open the box to find eight fresh books… Pay Up! by Chip Merlin. It was a book that forged lifelong friendships across the aisle, opened eyes, molded minds, made carriers, and touched the lives of tens of thousands of lives… so far.

Just weeks prior, I met Mario Barrilleaux, a new, pretty aggressive public adjuster on a joint inspection for a wind loss for an elderly lady. I was a cradle-to-grave large loss staff adjuster, moonlighting doing some appraisals for policyholders on the side, and was one of those adjusters who loved working with contractors and public adjusters to get the claim paid correctly within 24-48. After I showed Big Mo he missed a ton of damages, a “bromance” formed. We spoke every day afterward and what we thought about the insurance industry. Talk about two blind ambitious guys who didn’t even know what they didn’t know but were hungry for growth, thirsty for knowledge, and passionate about promoting a collegial network. Mario and I came up with an inventive concept the world had never seen before, and clearly ripped off by well-to-do mothers in Manhattan. We started up a book club.

We reached out to six other great men, some of whom I will intentionally leave anonymous as some are still insurance adjusters, along with public adjusters Adrian Eugene and Al Dodd Jr. (not to be confused with Saints Hall of Famer Al Dodd Sr.), who were all extremely excited to participate. Collectively we came up with several ideas for books we wanted to read, but unanimously agreed with Pay Up! to be the first. We decided to read two chapters a week, highlight passages we thought were noteworthy for discussion, and further research those topics prior to our 7 a.m. Tuesday morning conference call.

It was the early, uncertain days of the COVID pandemic. So having plenty of home time, we read and digested every word in that book. On Tuesdays, most of us would wake up a little early, brew a hot up of coffee, review our notes, and start off every call with Big Mo providing a prayer for us all. We discussed what we read, debated the merits of the hot topics, shared ideas, and even dreamed a little of how we could change the world. It not only helped open our eyes to a world we had no clue we were really a part of, it sparked a fire in all of us to be and do better.

For me, however, Chip Merlin provided two metaphoric pills while reading his book. The insurance version of the “Matrix.” The choice between remaining ignorant to the insurance industry I was a part of by taking the blue pill, or the willingness to continue to learn the unsettling and life-altering truth about the multi-billion insurance industry by taking the red pill. I am a Coast Guard veteran and retired Sgt. Detective. I believe in my heart that I’ve been called by God to be a servant and advocate. I have always run to fight. Even if it was to my detriment, I fight the good and noble fight. My father would often quote from the Aaron Tippen song, “you have to stand for something, or you’ll fall for anything.” So, for me, I took the “red pill.”

Discussions of a promotion were made to me by the new Vice President of Claims. I had a choice to make. It was not whether to stay in and be part of the system, but my exit strategy.

On Independence Day, July 4, 2020, after speaking with my amazing wife, and being encouraged by several other industry professionals such as Galen Hair and Rajan Pandit, I left the comforts of a great salary and benefits to start off on my new chapter.

Hurricane Laura hit Louisiana, then Hurricane Delta, then Hurricane Zeta, and then Hurricane Ida. While we didn’t drift apart, the eight of us in our book club got busy and never got to start on that second book.

I have had the honor of meeting Chip Merlin three times in person and a few more times when he spoke on Zoom. Each time I have met him, I’ve thanked him for his leadership. I even asked him to sign the book I read at the New Orleans Win the Storm Convention. He finally asked the other day at the American Policyholder Association conference in Denver – with a kind of confused expression on his face – why I keep thanking him. So, I told him about this true story.

Whether it’s the few minutes before taking the kids to school, sitting at my desk, or my team and I driving to a meeting, I grab a cup of coffee and read Chip’s daily blog every morning. It’s ALWAYS a bit nostalgic as I learn and think about a new concept from the blog. But I wonder what Big Mo would say or get out of it. Big Mo passed this last spring from cancer. This past Christmas, when he thought he was in remission, we pledged to grow the book club when he was fully out of the weeds.

I think it’s time. Time to get the book club back together, bring on a few new members, and see if they want the red pill or blue pill.