One topic that has been written about multiple times on our blog involves the implications of selling the home or property during the course of an insurance claim. Notable posts include Things To Consider When Selling Property With An Open Insurance Claim, and Recovering Replacement Cost After Selling Unrepaired Property, by attorneys Kyle Bugden and Ashley Harris, respectively. Due to the real estate landscape in today’s market, it has again become a consistent topic of conversation.

There is no surprise this topic is so well documented; it is very common to sell one’s property despite an ongoing insurance claim. While most articles focus on the implications of doing so prior to repairs being completed, this blog will focus on a less-discussed situation: What if I have already made the repairs? Can I still recover the cost incurred?

The simple answer is yes, you can recover the costs incurred to make repairs to the property (assuming coverage is established). This may come as no surprise due to the relatively straightforward application of most homeowner’s insurance policies.

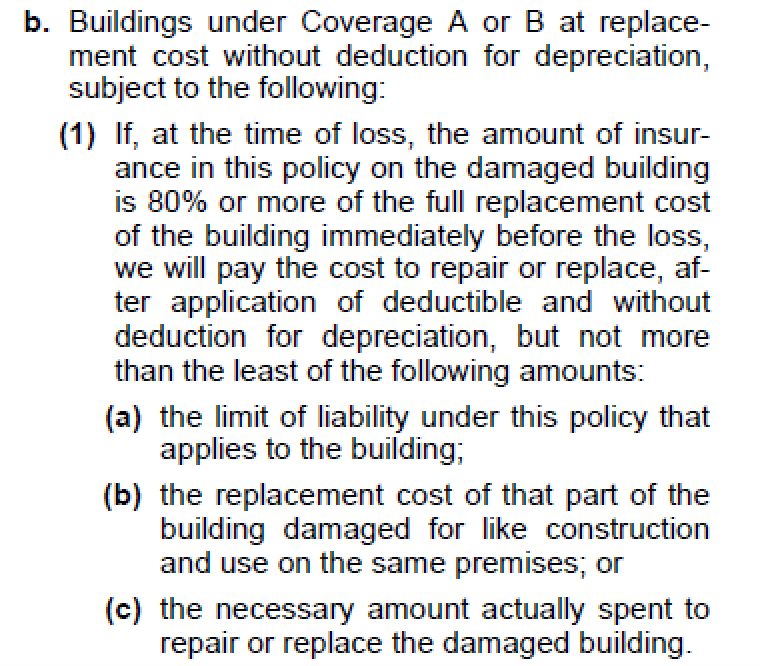

Consider the following policy provision:

In many respects, performing the repairs greatly simplifies the claim when policyholders decide to sell their home, as the damage valuation is much more difficult to dispute. The inability to recover depreciation for unrepaired damages after selling the property may provide a decent incentive to move forward with repairs. More importantly, I have yet to see a homeowner’s policy that includes language limiting a policyholder’s right to recover due exclusively to the decision to sell the property. There are a few considerations to keep in mind, however, if you have an open claim and wish to sell your property:

- While there may not be a policy provision dealing specifically with the decision to sell the property, the conditions section still applies. This means failure to provide the insurance company notice of your intent to sell will almost undoubtedly be met with allegations of prejudice.

- If your insurance company has yet to make a coverage decision, obtaining the proper inspections by appropriate experts may be advantageous prior to performing the repairs. This is not limited to situations involving the sale of the property and applies to all instances of pre-coverage determination repair efforts.

- Keep your receipts. Any invoice, estimate, receipt, or other form of evidence depicting the total amount of incurred costs and the basis for each payment is extremely important after repairs are made. This goes double for policyholders intending to sell the property, as you will no longer have the right to perform the inspection and substantiate what repairs were made/necessary.

While the prompt and answer provided in this blog may not be shocking to most involved in this field, the question remains one of the most frequently asked by policyholders. This trend will undoubtedly continue until the market cools off. So long as you keep in mind the conditions that remain applicable throughout the claim, there is usually no issue with moving forward with the sale. If you have an open insurance claim and have questions regarding the sale of your property, Merlin Law Group attorneys are here to answer them.