On April 28, 2021, policyholders in Norman, Oklahoma, and surrounding areas were rocked by a catastrophic hailstorm with baseball size hail and 70 mph winds resulting in more than $1 billion in damages. As many of our blog readers may know, I was one of those policyholders. While I am fortunate to report State Farm has paid my claim in full and all my restoration work has been completed, many policyholders cannot say the same. With supply chain issues and market pricing increases, many Norman policyholders are still waiting on roofs and windows, which keeps their claims open. Others are still fighting over their scope of damages or proper costs for repair/replacement. Regardless of what aspect of their claim remains unresolved, with the one-year anniversary of the catastrophic hailstorm coming up, they now face the possibility of having to timely file a lawsuit by April 28, 2022. Failure to do so may result in a waiver of policy benefits they are otherwise entitled to. How could this happen?

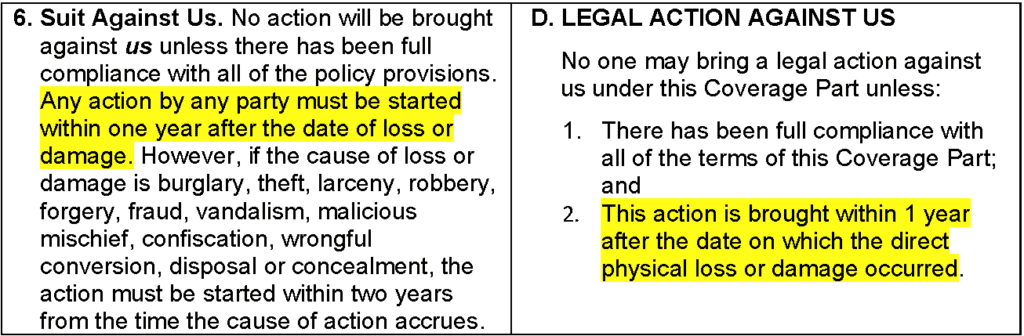

Many Oklahoma policies contain what is referred to as a contractual limitation provision. These policy provisions are valid and enforceable in Oklahoma. For example, here is what a “Suit Against Us” and a “Legal Action Against Us” provision look like from two separate Oklahoma policies:

As you can see, any action such as a breach of the insurance contract for failure to timely and properly pay all benefits owed must be brought within one year after the date of loss. However, not all Oklahoma policies have a one-year limitation; in fact, most contain a two-year limitation.

So, what can policyholders do if their policy has a one-year limitation provision? First, ask your insurance company for a written extension of the deadline. However, be prepared for them to delay getting back to you or decline your request. Second, hire an Oklahoma attorney to file a lawsuit, so all the policyholder rights under the insurance contract are protected.

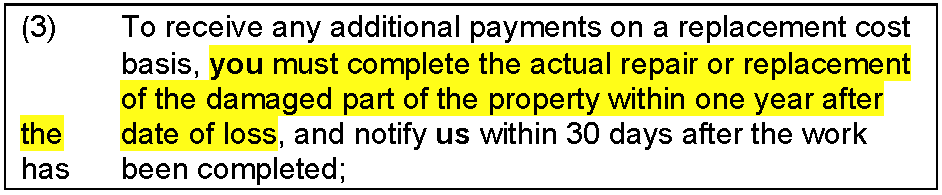

Another policy provision impacted by the upcoming one-year anniversary relates to the amount of time policyholders have to complete the work paid for by their insurance company. For example, here is a common policy provision regarding work completion:

When policy provisions like this exist, a policyholder’s entitlement to payments on a replacement cost is in jeopardy if the repair or replacement has not been completed within one year. Additionally, some policies go even further and state that other policy benefits such as Ordinance & Law or increased cost of construction will not be paid unless the repair or replacement is completed within one year since these additional coverages are typically not paid until they are incurred.

With market conditions, unavailability of labor and materials, and general supply chain issues prevailing, it is likely thousands of policyholders have not been able to repair or replace their storm damage even if their insurance company paid for it. As a result, they too are at risk of waiving benefits they are entitled to under their policy.

So, what can a policyholder do under these circumstances? Again, ask your insurance company for a written extension of the deadline and produce a copy of your construction contract to them so they can verify the work is underway or under contract to be performed. Insurance company internal claims handling guidelines often give the adjuster discretion in providing recoverable depreciation or “holdback” money under certain circumstances when a policyholder provides them with a signed construction contract. If this does not work, the alternative is to hire an Oklahoma attorney to file a lawsuit, so none of the benefits under the policy are waived.

Merlin Law Group is The Policyholder’s Advocate®. If any policyholder or their representative has questions or concerns about how a pending claim may be impacted by the upcoming one-year anniversary, please contact our office for a free consultation or policy review.