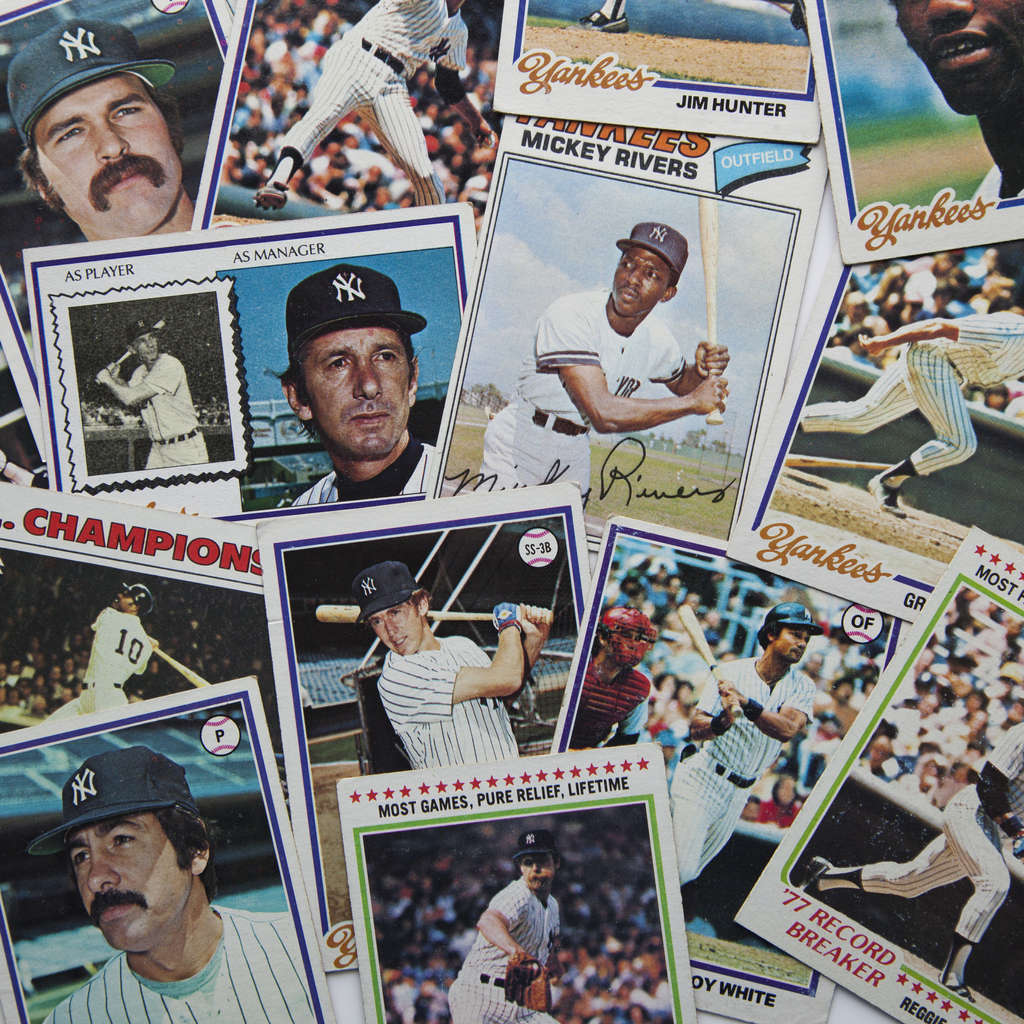

Unfortunately, there are times in all of our lives when we need to call on our insurance company to help out. This is often the worst times in our lives. It is a time in need where we expect the people who say they are going to help, to help. In reality, this doesn’t always happen. With the MLB all star game, Olympics, NBA finals, and much more going on in the past weeks, it got me thinking about all of those valuables that we loved as kids. We’ve all had friends growing up who “just got this cool new rookie card.” I remember spending time with my friends gawking over each other’s sports card collections and making trades to get that perfect card, or that perfect set of cards that you’ve been working towards. As those children grow older, the collections sometimes gets larger, more expensive, and more cherished. So, naturally I started thinking about how these collections get taken care of in a catastrophe.

Many collectors spend years curating extensive collections of fine art, rare stamps or coins, comic books, toys, sports memorabilia, and more. The result of this effort can be extremely rewarding, but there is certainly some risk involved. A major theft, a fire, or a flood can quickly destroy items that cannot be replaced. In that case, the collector may lose their prized possessions completely, as well as the monetary investment they made. When it comes to insuring a sports memorabilia collection against unforeseen tragedy or natural disasters, basic existing homeowners or renters policy, likely, aren’t enough. It probably won’t properly compensate you.1 Collectibles insurance can protect you financially if your collection is damaged or destroyed by a natural disaster, fire, or a home invasion.2

There are several key differences between collectibles insurance and standard homeowners insurance. In most cases a homeowners or renters policy may:

- Limit contents coverage to a percentage of the total value of your home (usually 50 – 70%).

- Limit the amount they’ll pay for theft of valuable items.

- Not cover losses due to natural disasters like floods, hurricanes and earthquakes.

- Be based on actual cash value (the documented purchase price) and not the item’s current collectible value.

‘So typically, any game-worn equipment, tickets, programs, seat out of Fenway Park, whatever, they just don’t cover that stuff, not for its collectible value. They insure it for the replacement cost, and the problem with that—to an insurance company, replacement cost means the cost to replace the lost or damaged item with a similar item of like kind and quality new. So, what that means is if you have a PSA 4 graded ’52 Topps Mantle card, they owe you one brand new baseball card. They don’t owe you a Mantle. They owe you a baseball card. That replacement cost works fine for your television. If you’ve got a 36-inch tube TV, you don’t want that TV, you want a new flatscreen. Replacement cost is great for your household possessions. But when it comes to collectible or antiquity value, it falls short.’

Said Bob Brodwater, assistant vice president at Insurance Collectibles Services in Hunt Valley, Md.: ‘Some collectibles you can sometimes schedule on a homeowner’s policy with an appraisal. A homeowner’s company will require an appraisal in those cases, and they’ll do limited. Certainly, if you’re talking about high-value collectors, adding everything to a homeowner’s policy isn’t even an option.’3

The whole purpose for having your collection insured is to provide adequate compensation in the event of loss. Claims are paid based on replacement value at the time of the loss. This accounts for appreciation in value from the time in which specific items were first purchased or acquired and is the fundamental difference between a homeowners policy and collectibles insurance.4

For a personal collector with a small collection valued at $20,000, a policy can be purchased for as low as $75 annually, said Thomas Finkelmeier Jr., president of Finkelmeier Insurance Agency, LLC in Wapakoneta, Ohio. For a $75,000 collection, the price per year for insurance is just $150. Bump that up to a $500,000 collection and the premium goes up to $1,850.

Regrettably, collectors often don’t find out that their collections were underinsured, or not insured at all, until after the damage has occurred.5 Having a conversation with your agent is definitely advisable to determine if your family’s collections are properly insured.6

______________________________________________________

1 https://www.cardboardconnection.com/how-to-insure-your-sports-card-and-memorabilia-collection

2 https://www.thesprucecrafts.com/best-collectibles-insurance-5116346

3 Greg Bates. Are your sports collectibles insured? Sports Collectors Digest. Jan. 20, 2021. (Available online at: https://sportscollectorsdigest.com/news/are-your-sports-collectibles-insured)

4 Id.

5 https://americancollectors.com/articles/are-your-collectibles-insured/

6 Id.