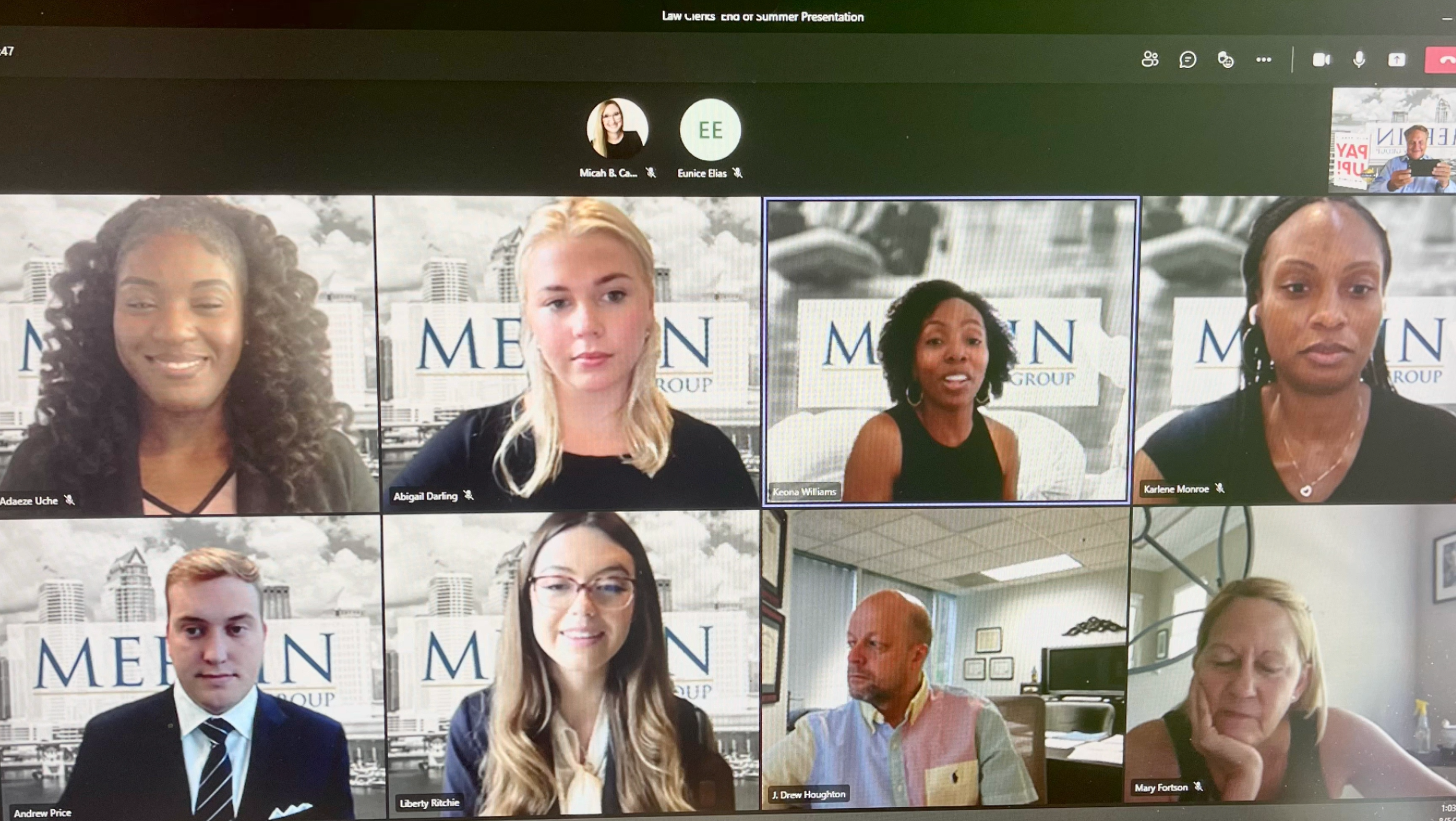

Some of Merlin Law Group’s best attorneys have come through our summer associate program. The photo above is from a presentation this summer’s legal interns made about Pay Up!

It was interesting to listen to views of law students about a book I wrote. They creatively added questions posed to the public about various topics in Pay Up!

A takeaway from their presentation that surprised me was the amount of insurance fraud “people in the street” think occurs. The follow-up question not asked would be “why do you think that?”

All insurance fraud is wrong, but I have often thought that insurance companies make up the amount which occurs. In, Are Insurance Fraud Statistics Fraudulent?, I wrote:

A more skeptical person may assume these statistics are made up by the insurance industry and broadcast by their paid spokespeople to assuage anger over their exorbitantly high premiums. A highly respected claims expert, Gary Fye, has suggested to me that the insurance industry propagandists are engaged in a wrongful attempt to create a culture where society suspects all claims are fraudulently created or inflated. It does not take a genius to figure out why insurance companies would love to encourage this myth among the general populace.

Just because one questions the truthfulness of insurance fraud statistics does not mean one supports insurance fraud. Insurance fraud is wrong, and it should be punished. As a society we must be ever vigilant against those who abuse the system. Indeed, that a few may attempt to destroy property or participate in other schemes to fraudulently make money from insurance companies is expected. We all suffer from these wrongdoings, and we should applaud audits and fair investigations that uncover fraudulent activity.

I quoted and noted insurance fraud and insurance claim expert Barry Zalma in, Insurance Fraud Expert Admits Insurance Industry Makes Up Statistics:

Although insurance fraud exists and is recognized by insurers and police agencies, no one really knows how extensive it is because most frauds succeed and are never recognized; others are recognized and paid by the insurer who is unwilling to get into a long and drawn-out fight with the fraud perpetrator; and a very few are caught and prosecuted.

Zalma makes a great point because successful fraud should not be counted as fraud—it is undetected.

Insurance fraud statistics make liars out of anybody trying to state what degree it occurs. It would be an interesting exercise to follow up those questions with claims adjusters and those in the field.

Trying to determine where most fraud occurs during the property insurance claims process is important to everybody. Doug Quinn and those with the American Policyholders Association also suggest that insurance fraud against policyholders is just as prevalent a problem to stop.

My hat is off to our legal interns. This summer is passing far too quickly, but it is refreshing to see passionate and bright legal minds coming into the profession.

Thought For The Day

The excitement of learning separates youth from old age. As long as you’re learning you’re not old.

—Rosalyn Sussman Yalow