Many policyholders are not aware of how a coinsurance clause applies, or that it even exists, until after a loss occurs. This is an unwelcome lesson for those who those who unknowingly risked a portion of their expected insurance proceeds. Whether you have a homeowners policy,1 a commercial package policy,2 or a business owners policy,3 this is a reminder to pull it out of your drawer or ask your agent or broker about the coinsurance clause in your policy and how it applies to property damage.4

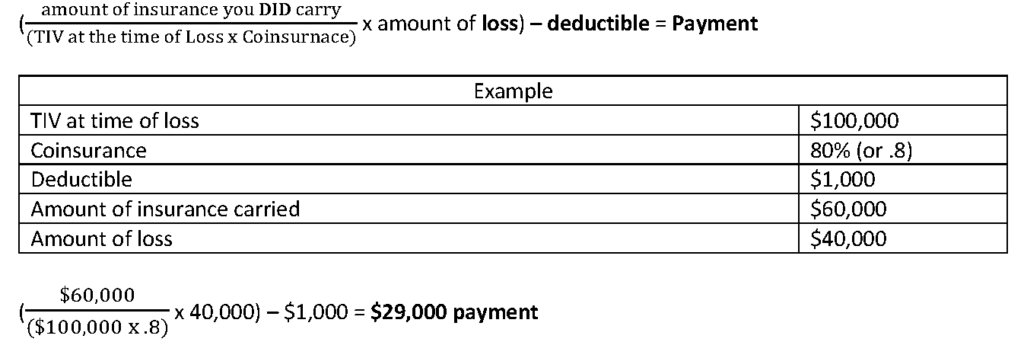

Generally, a coinsurance clause requires the policyholder to insure the property to a percentage of its full value.5 The failure to do so results in having to bear the proportionate amount of the loss for which the property should have been insured. The purpose of the clause is to avoid widespread underinsurance and to ensure adequate premiums are collected based on the risk insured. A common and simplified formula reflecting the application of this clause is:

While the amount of insurance you did carry is straight forward, figuring out what you should have carried is not as simple. To figure out what you should have carried you must know (1) the total insurable value (“TIV”) at the time of loss and multiply that by (2) the coinsurance percentage listed in your policy.6 The basis to calculate the TIV will be based on how the loss is to be settled – actual cash value or replacement cost. Here is a more reflective formula, and an example of how a policyholder may be penalized after suffering a $40,000 loss even though he/she was carrying $60,000 in coverage:

Coinsurance options differ based on the type of property policy. Business owners policies are written with 80% coinsurance clauses like homeowners and commercial policies, however, homeowners coinsurance clauses can be endorsed down (for an increased premium) and commercial policies can be increased on application (for a decreased premium).7 While commercial policyholders may be tempted to save a few bucks in exchange for simply insuring their property to value, we caution against insuring a property with a 100% coinsurance clause since the TIV is calculated at the time of the loss, not at the time the policy was purchased. With a 100% coinsurance clause, there is no margin for error in predicting what the value of the property will be in the future. While an inflation guard exists, in part, to address this problem, we have often seen it fail to adequately keep pace with the proper valuation of a property.

Although these general concepts are broadly applicable, it does not replace reading the language in your policy. Many polices are not written on ISO forms and will differ. Even if it is written on an ISO form, differences will exist depending on the type of property. For example, commercial and business owners policies will often apply the coinsurance clause to both real and personal property, while homeowners policies limit coinsurance to real property. Further, commercial policies will often pay the lesser of the limit of insurance or the coinsurance calculation, whereas business owners policies and homeowners polices will usually pay the greater of actual cash value or the coinsurance calculation.8

We recomm

end policyholders, agents, brokers, adjusters, and attorneys alike add the coinsurance clause to their shortlist of provisions to re-read when procuring a policy, renewing a policy, adjusting, or settling a loss. If you have any questions regarding how a coinsurance clause in your policy applies to a loss, do not hesitate to reach out.

__________________________________

1 For homeowners policies, this provision is often found in “Section I – Conditions; D. Loss Settlement; 2. B.”

2 For commercial property, this provision is often found in “Additional Conditions: 1. Coinsurance”

3 For Business Owners Policies, this provision is often found in “E. Property Conditions: 5. Loss Payment: d.(1)(b)”

4 General references are to ISO forms unless otherwise stated.

5> For example, 80% of the cost to replace a structure.

6 Christopher J. Boggs. (April 12, 2012) Session 2: Valuation/Coinsurance Training Triple Pack. Academy of Insurance. (This may be listed on your declarations page or within the body of your policy)

7 id.

8 id.