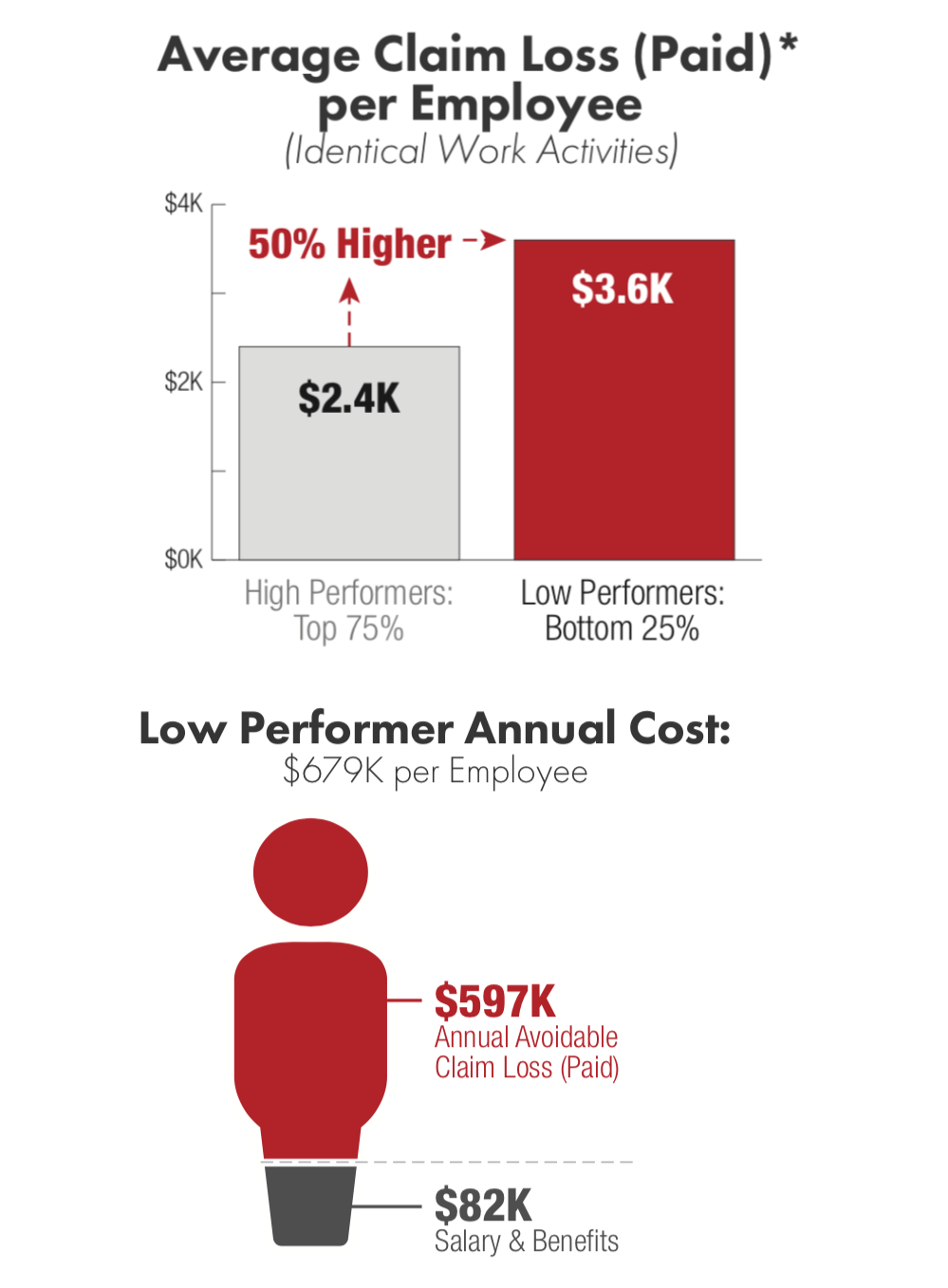

If a picture is worth a thousand words, the above chart is exhibit one about how insurance claims executives feel about claims adjusters that pay more versus paying less to their policyholders. Policyholders often have their claims underpaid because insurance companies reward those claims adjusters who underpay claims. The rewards come from a view and promotion of “high performer” adjusters that pay policyholders less are better adjusters than those who pay policyholders larger and fuller amounts.

This chart and the claims management article referring it, How to Cut P&C Claims Leakage,1 demonstrate that some carriers consider those paying less is what “high performer” property insurance claims adjusters are supposed to do. Can you imagine an insurance company being transparent and advertising that it rewards and views its adjusters as doing a good job if “they pay you less?”

This is exactly what was discussed four years ago in, Incentive Pay to Lower Insurance Claims to Policyholders Still Exists, where I noted “ how financial incentives can promote unethical behavior by employees on the front line of servicing customers.“ Some claims managements, not all, financially reward those claims adjusters who pay less and do not fairly, fully and promptly pay their insurance customers.

I have never seen a financial claims goal rewarding those property claims adjusters who fully and promptly pay their customers. I challenge anybody in claims management to share an actual goal with a financial reward to a property claims unit or property claims adjuster where there are objective measures showing that the goal is to fully pay the insured.

I should not be amazed that articles exist in the public domain which condone unethical claims management incentives. This practice of rewarding adjusters and claims managers for producing results which lower claims payments rather than fully paying policyholders has been going on for a long time. In, How to Create Unethical Claims Practices? Set Wrong Goals and Fail to Monitor Performance Goals for Unethical Conduct, I noted a Harvard Business School working paper2 on the subject. I quoted the paper and similarly noted:

How many insurance companies have goals to ‘fully’ or ‘as quickly as possible pay the full amount of benefits’ as part of the job performance review for adjusters, claims managers and executives running the business? None.

If all adjusters and insurers have an ultimate ethical obligation to promptly pay their customers full covered benefits, everybody would expect these objectives to be reflected as primary goals throughout organization. In reality, most claims insurance claims organizations have goals that promote the exact opposite outcome.

I can appreciate that insurance claim executives are concerned about “being gamed” by the insurance claims process and paying more than what is owed. But, two wrongs never make a right. Establishing a claims culture that does not first reward claims adjusters for fully and promptly paying its customers that full amount owed is doing a disservice to its customers. I am not saying to overpay customers to make this happen. But it does not take a rocket scientist to figure which way the claims payments are going to be made when you reward those adjusters who pay less and look at them as “high performers.”

Chip @ 2 is going to feature a relatively new attorney to the Merlin Law Group, Micah Cartwright, as my guest today. Micah practices out of our Oklahoma City office. We are going to discuss Oklahoma claims standards. We are also going to talk about the significant delayed and underpaid claims by AmGuard Insurance Company. Hope to see you at 2 pm EST for an interesting session.

Thought For The Day

You don’t need a weatherman to know which way the wind blows.

—Bob Dylan

_________________________________________________

1 William Heitman. How to Cut P&C Claims Leakage. Insurance Thought Leadership, Apr. 23, 2020. Available at https://www.insurancethoughtleadership.com/how-to-reduce-pc-claims-leakage/ (last viewed Nov. 2, 2020).

2 Lisa D. Ordóñez, et. al, Goals Gone Wild: The Systematic Side Effects of Over-Prescribing Goal Setting. Harvard Business School NOM Unit Working Paper No. 09-083. Jan. 23, 2009.