It is not often that I am able to find a property insurance issue involving my favorite sport—golf! I previously wrote in Hole in One Insurance Coverage, about a dispute involving a hole in one contest at the July 2015 PGA tour event, the Greenbrier Classic, where the charity that was operating the event, Old White Charities, Inc. (“Old White”) sought coverage for two prizes it was obligated to pay in a hole-in-one contest.

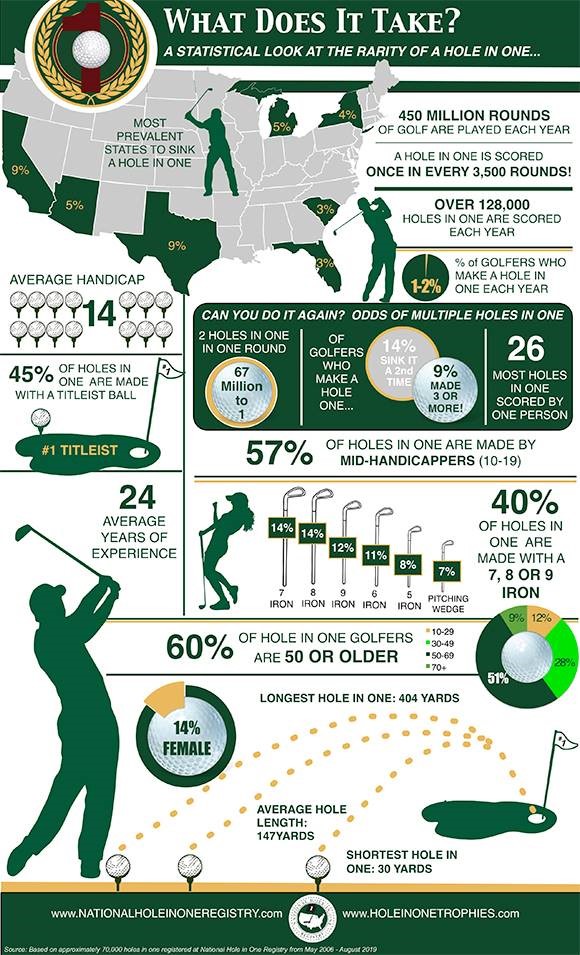

I have been playing golf since I was 12 and I am still waiting for my first hole in one! Here are some interesting statistics from the National Hole in One Registry about the rarity of hole in ones:1

Now, back to the law……The Fourth Circuit Court of Appeal ruled that Old White could not reasonably expect the insurance policy to cover its hole-in-one competition.2

The facts here were that the agent completed the insurance application, which was signed by the insured. The application stated the hole had to be a minimum of 150 yards from the tee. Bankers also included an addendum to the application stating that the 18th hole played an average of 175 yards, but that Old White had no knowledge of or control over the length of the hole on any given day of the tournament because the PGA determined the placement of the tee boxes and the pins. The insurance policies that were issued specified a minimum yardage of 170 yards for the hole. During the PGA tournament, the 18th hole was played at a distance of 137 yards, below the minimum yardage, and two golfers hit a hole-in-one.

Old White asserted state law claims of negligence, reasonable expectations, and fraud against its broker, Bankers Insurance, LLC and challenged on appeal the district court’s grant of summary judgment to Bankers on each of these claims.

The Fourth Circuit Court of Appeals explained the reasonable expectations of an insured:3

With respect to Old White’s claim for damages under the doctrine of reasonable expectation, “the objectively reasonable expectations of applicants and intended beneficiaries regarding the terms of insurance contracts will be honored even though painstaking study of the policy provisions would have negated those expectations.” State ex rel. Universal Underwriters Ins. Co. v. Wilson, 825 S.E.2d 95, 100 (W. Va. 2019) (internal quotation marks omitted). This doctrine applies only when the terms of the insurance contract are ambiguous. Id. “Thus, where the provisions of an insurance policy contract are clear and unambiguous they are not subject to judicial construction or interpretation, but full effect will be given to the plain meaning intended.” Id. (alteration and internal quotation marks omitted).

The Fourth Circuit agreed that the distance requirement of 150 yards stated in the application was clear and unambiguous and that Old White failed as a matter of law to establish an objectively reasonable belief that a hole-in-one would be covered by the policy even if the hole was less than 150 yards in length. Thus, it affirmed the district court’s ruling that Old White could not recover under the doctrine of reasonable expectation.

I’m curious if any of our blog readers who are golfers have had a hole in one? If so, feel free to leave a comment with the course name and distance, and share your accomplishment!

________________________

1 https://nationalholeinoneregistry.com/

2 Old White Charities, Inc. v. Bankers Insurance, LLC, No. 18-1914 (4th Cir. January 21, 2020), unpublished.

3 Id. at 2-3.