The Illinois Department of Insurance’s mission is “[t]o protect consumers by providing assistance and information, by efficiently regulating the insurance industry’s market behavior and financial solvency, and by fostering a competitive insurance marketplace.”

The Illinois Department of Insurance’s vision is to “[e]mbrace efficiency and innovation to educate and protect Illinois insurance consumers and to encourage a vital and robust Illinois insurance market.”

The Department carries out this mission and vision through effective administration and enforcement of the Illinois Insurance Code,1 the Illinois Pension Code,2 and related laws and regulations, including Title 50 of the Illinois Administrative Code.3 The Director is also responsible for the operations of the Office of the Special Deputy Receiver, which handles the affairs of insurance companies placed in rehabilitation, conservation, or liquidation.

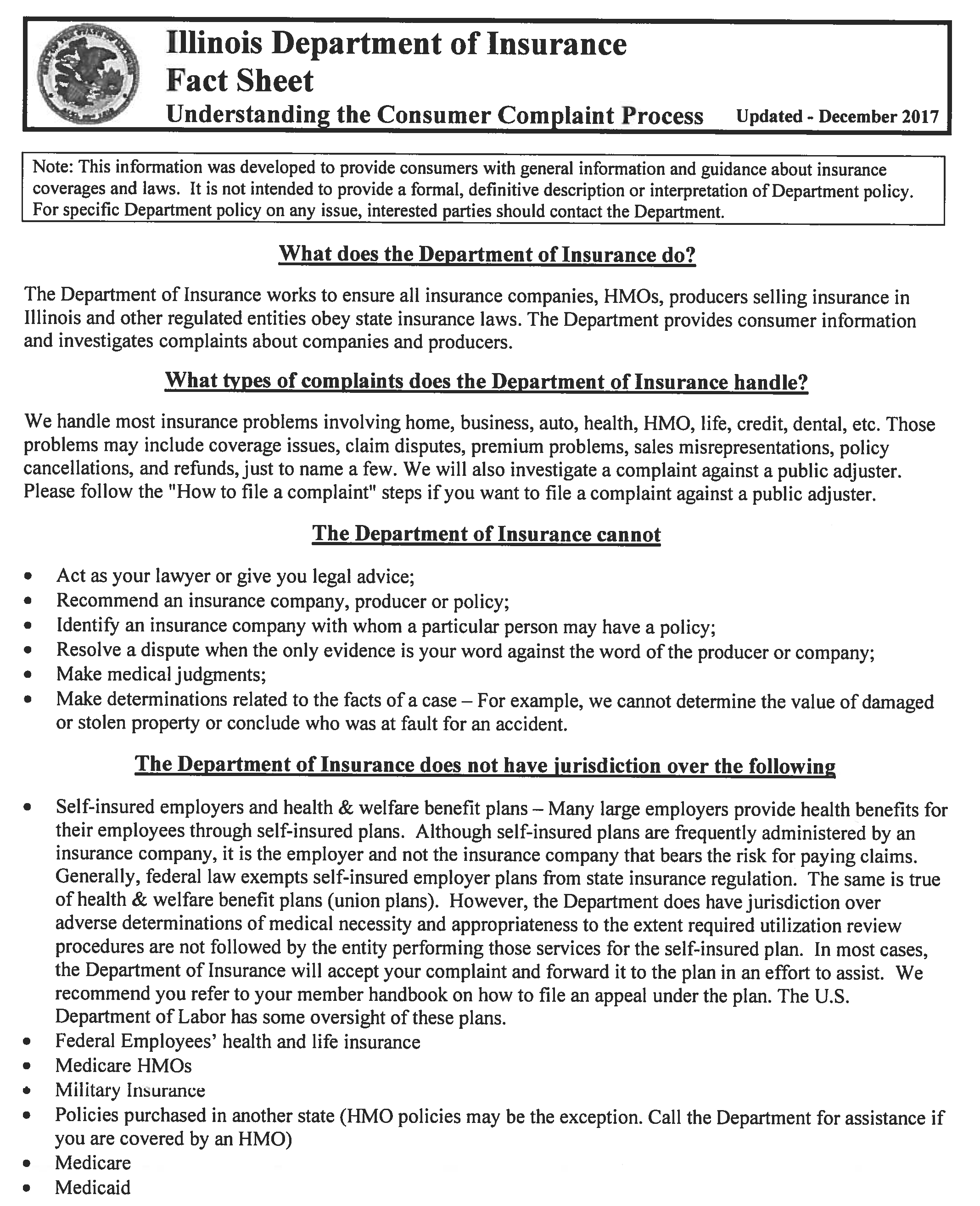

Below is a link to the Department’s Fact Sheet, which explains what the Department does, what types of complaints it handles, what it cannot do, what it does not have jurisdiction over, what to do before filing a complaint, and how to file a complaint.

Below is the link to the Consumer Complaint Form:

When your complaint is filed, a file number will be assigned, and you will be sent written notification of that number. A copy of the complaint will then be sent to your insurance company. Illinois allows 21 days for an insurance company to respond to the complaint. When a response to the complaint is received from your insurance company, an analyst will review the complaint and response, and take appropriate action. You should expect the Department’s investigation to take four to six weeks. You will receive a written response from the Department explaining the results of its investigation once it is completed.

If you have questions about your rights or the process of filing a complaint, you can contact the Illinois Department of Insurance toll free at (877) 527-9431, or https://insurance.illinois.gov, or reach out to a qualified insurance professional.

_________________________

1 215 ILCS 5/1 et seq.

2 40 ILCS 5/1-101 et seq.

3 50 Ill. Adm. Code Part 101 et. seq.