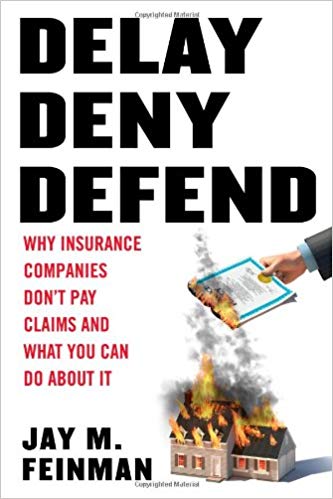

Rutgers insurance law professor Jay Feinman wrote a book, Delay Deny Defend: Why Insurance Companies Don’t Pay Claims and What You Can Do About It, which exposed many insurance company unfair claims practices. In the last chapter of the book, he discussed how we can stop insurance claim wrongful delays and denials.

The problem of insurance companies that delay, deny, and defend is big. No one—except the companies themselves, and they’re not telling—Knows exactly how big. But the problem is big enough that thousands of individual policyholders…are not getting the benefits their insurance companies owe them. Big enough, too, that as awareness of the problem increases it may undermine public confidence in the insurance industry.

Consumers can take some steps to protect themselves against unfair claim practices, but they cannot prevent or cure the practices themselves. Bad practices persist because government regulators have failed to do enough to prevent and punish them. Lawmakers and regulators in every state need to do three things to protect consumers (and consumers need to push them into action). First give consumers the information they need to take a company’s claim practices into account when they shop for insurance. Second, make clear in the law that the rules of the road of claim handling are binding on insurance companies, and give regulators the power to enforce those rules. Third, make sure policyholders and accident victims filing claims have the ability to hold insurance companies accountable when the companies delay, deny, or defend.

Here is a paradox: Insurance is the most highly regulated business in the United States, but the system of regulation has so far failed to implement these reforms and to protect policyholders and accident victims from unfair claim practices. Why isn’t more being done?

J. Robert Hunter, Director of Insurance, Consumer Federation of America, agreed that Feinman’s book “explains how America’s premier insurance companies systematically rip off consumers.” Hunter also had this to say following Hurricane Michael:

Americans always pull together to protect one another whenever there is a disaster like this, but when it comes to rebuilding homes long after the storm has passed, too many people find themselves in lonely battles with insurance companies. We all will have to keep a spotlight on the communities hit by Michael to make sure that survivors don’t face a second disaster in the shape of unfair practices by their insurance companies.

While I recognize that many claims get paid and resolved without problems, lawyers in my firm see the unfair claims practices and abuses. Who would call lawyers if your claim is settled quickly and to your satisfaction? But, the issue is “what to do about the abuses and wrongful actors?”

Both Hunter and Feinman agree that insurance regulators have been largely ineffective stopping unfair claims practices. Feinman noted:

A third form of unfairness is the subject of this book, opportunism through delay, deny, defend by the insurance company at the point when its promise obligates it to pay a claim. As the book demonstrates, here market conduct regulation has been notably ineffective. Claims practice regulation is typically an afterthought for regulators; a textbook coauthored by Therese Vaughan, former insurance commissioner of Iowa and now CEO of the National Association of Insurance Commissioners, perhaps inadvertently illustrates the problem when it notes, in only a single sentence between the three-page discussion of solvency regulation and a three-page discussion of rate regulation: ”States have also adopted laws governing claims settlement and prohibiting unfair claims settlement practices. ” Deborah Senn, former Washington insurance commissioner, put it more bluntly: “Regulators have been nowhere on this. Regulation has really failed this issue.

Hunter’s website says:

Consumers spend hundreds of billions of dollars a year on car, home, and life insurance products whose complexity and individual pricing permit insurer inefficiency and abuse. A large majority of the state insurance departments that regulate these insurers have neither the resources nor the will to do so adequately. . . .

So when the Insurance Journal article, Sometimes I Disagree With Blogs I Love, thought that the idea of an administrative complaint rather than a policyholder’s own right to bring a civil lawsuit would prove effective, I would suggest that those studying the situation, and with a lot more experience with unfair claims practices, strongly disagree. Me included.

Indeed, Professor Feinman’s conclusion was that we need stronger laws from our legislatures to fully allow policyholders and victims of insurance company abuse to protect themselves and seek redress:

Establishing an action for bad faith or other wrongful behavior is important; making the action effective is equally important. Making the action effective requires that the policyholder or victim be fully compensated for the harm suffered, and that the economic incentive for delay, deny, defend be taken away from the company. When a company violates fair claims practices, the harm and the incentive should be reflected in the damages. Many courts and legislatures have responded, and all should provide a comprehensive approach. When a policyholder sues for bad faith, the damages start with payment of the full amount of the loss that she was entitled to receive under the policy. If that’s all the company has to pay, the company has an incentive to delay, deny, defend. More is required.

Which begs the question I wrote in a previous blog:1 Why are some Florida politicians supporting laws that remove protections for policyholders?

It is pretty obvious that unless those representatives are working for an insurance company, nobody would think of this legislation by themselves. I suggest that the insurance lawyers and lobbyists are behind this with their massive lobbying monies. I bet those lobbyists quietly admit that they would be upset if they had their insurance claim delayed or wrongly denied only to find out that there existed no remedy to cure the extra damages caused by those actions.

This topic of insurance company lobbying was also studied by Professor Feinman. It will be ripe for discussion tomorrow.

Thought For The Day

Do I not destroy my enemies when I make them my friends?

― Abraham Lincoln

_______________________________________

1 Delays, Denials and Underpayments Occur When Insurance Companies Are Not Held Accountable—What Are Florida Legislators Thinking? Property Insurance Coverage Law Blog, Feb. 29, 2019.