Recently, I presented at the Professional Public Adjusters Association of New Jersey educational conference on the area of insurance appraisal to roughly 30 public adjusters. During my preparation, I reviewed current and past appraisal provisions contained within standard insurance policies. In my research, I found some very interesting differences contained within insurance policy appraisal provisions concerning three key terms: competent, disinterested and impartial.

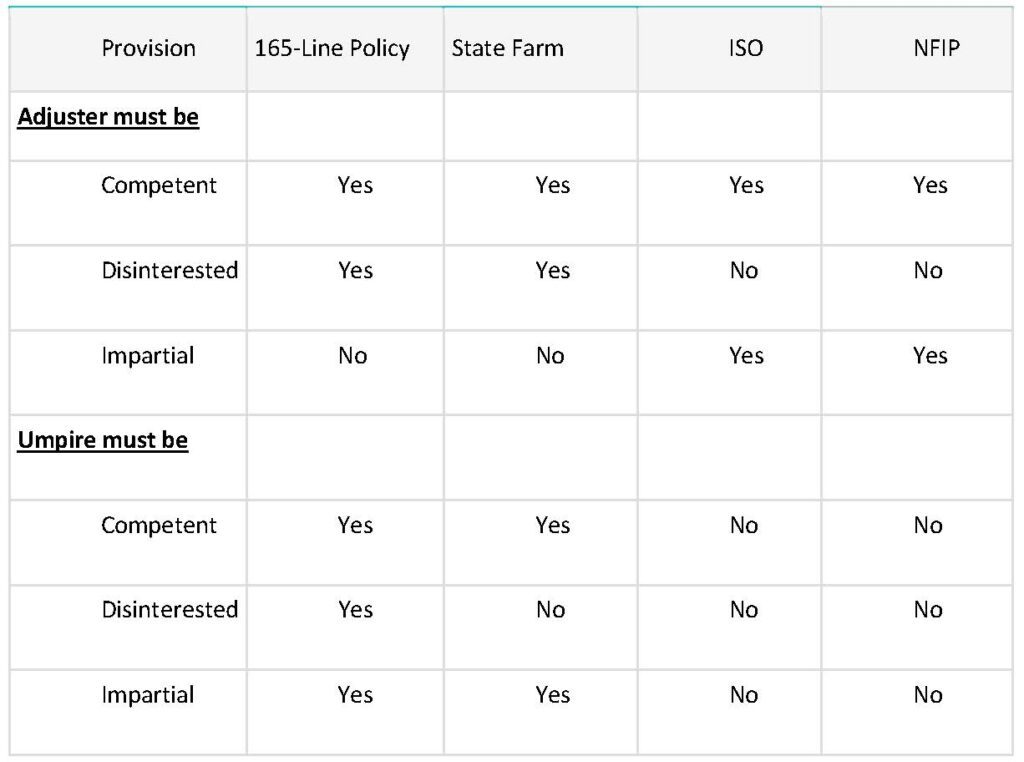

In analyzing four insurance policies: the 165-line, State Farm, ISO with standard HO3, and NFIP, I found that each policy contained very different uses and omissions of competent, disinterested and impartial as it pertains to appraisers and umpires during the appraisal process. Below you will see a chart1 that outlines, for each of the four policies, whether an adjuster or umpire involved must be competent, disinterested, and/or impartial during the process.

It is amazing to see that the insurance companies are writing appraisal provisions where the umpire need not be competent, disinterested or impartial such as the ISO HO3 and NFIP. These glaring omissions within each policy open up a host of issues which eventually make their way to the courts. However, depending upon the jurisdiction, the courts may rule differently.

In New York, an umpire under a standard fire policy is to be both competent and disinterested. However, the courts have ruled that using an appraiser or umpire who has had prior dealings with the insurer is not on its face evidence of being an interested party. In New Jersey, an appraiser must be impartial and disinterested. The courts have held that an appraiser in New Jersey can have previous dealings with the hiring party but must not have a pecuniary interest in the outcome of the appraisal process. In Pennsylvania, however, a contingency fee of an appraiser does not render them more biased than if paid on a flat fee basis.

Altogether, you can see from the above posted chart and changing language of appraisal provisions within insurance policies that you must be careful when invoking appraisal. Always read the policy, define the scope of the appraisal and put everything in writing.

________________________________________

1 Tim Ryles, Appraisal Clause in Homeowners Policies, International Risk Management Institute (IRMI), October 2014.