Overhead and Profit can generate a lot of debate when insurance company adjusters are looking to meet their adjustment severity goals and lower claims payments. But have you ever wondered how those same insurers instruct their sales people to calculate overhead and profit when they are calculating the premiums that they charge their customers for the same coverage?

It would be reasonable to think that insurance companies would calculate the same overhead and profit, if not less, at the time of underwriting costs of construction. After all, insurance to value provides for new construction replacement costs, which are lower than repair construction values. But veteran readers of this blog know where this is going……

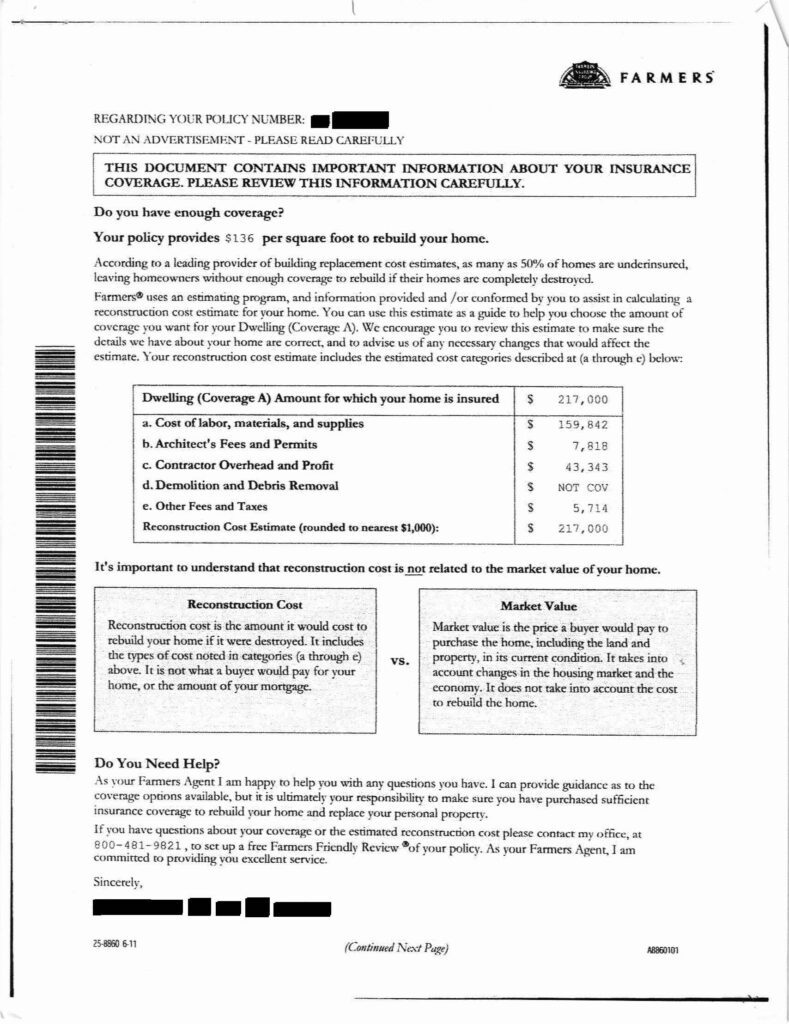

Analyze the above scan taken from a document instructing Farmers policyholders how to determine the cost to insure their homes. Can you divide ……by …… ? What does that equal? Bingo!! Twenty-Five Percent Overhead and Profit!!

Insurance company appraiser Jonathon Held, who promotes a much lower profit and overhead figure when he presents his knowledge of pricing to umpires, must be falling off his chair as he reads this. He is not alone. I expect that Farmers Insurance claims managers are wondering how many regulators will ask this question and how many bad faith lawsuits might arise from their customers’ reliance on this document. How will Farmers respond to customers who ask why its sales agents calculated twenty-five percent for overhead and profit when calculating their premiums when its adjusters calculate a substantially lower percentage when adjusting their claims. Farmers’ home office counsel are probably wondering if some smart class action attorneys may sue them for an extra five percent of all the claims payments that provided only twenty percent—at best—for overhead and profit.

The truth is that everybody in the insurance and restoration industry knows that general contractors generally need at least a thirty-eight to forty-two percent profit margin to break even. Restoration contractor associations teach this at their seminars. Even Belfor and ServoPro, dominant insurance industry stalwarts, estimate margins much higher than twenty percent when bidding jobs, even though their Xactimate estimates show something completely different.

Which begs the question…

Is Xactimate really exact? I can hear your laughter whether you want to admit it or not.

Thought For The Day

“Above all, don’t lie to yourself. The man who lies to himself and listens to his own lie comes to a point that he cannot distinguish the truth within him, or around him, and so loses all respect for himself and for others. And having no respect he ceases to love.”

― Fyodor Dostoyevsky, The Brothers Karamazov

Song From My Hogtown Heroes: