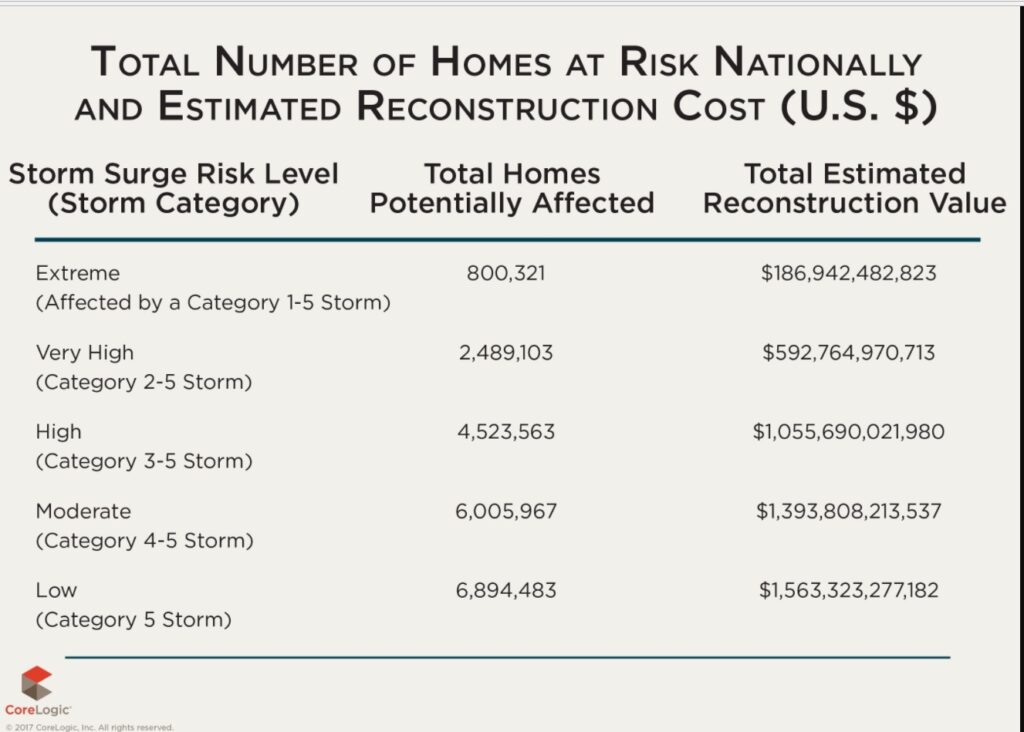

Commemorating the start of the 2017 Hurricane season, CoreLogic, a leading global property information, analytics, and data-enable solutions provider, released its 2017 Storm Surge Report on June 1, 2017. Alarmingly, this report projects that almost 6.9 million homes along the Atlantic and Gulf Coasts are at potential risk of hurricane storm surge damage with a total Reconstruction Cost Value (RCV) of more than $1.5 trillion.

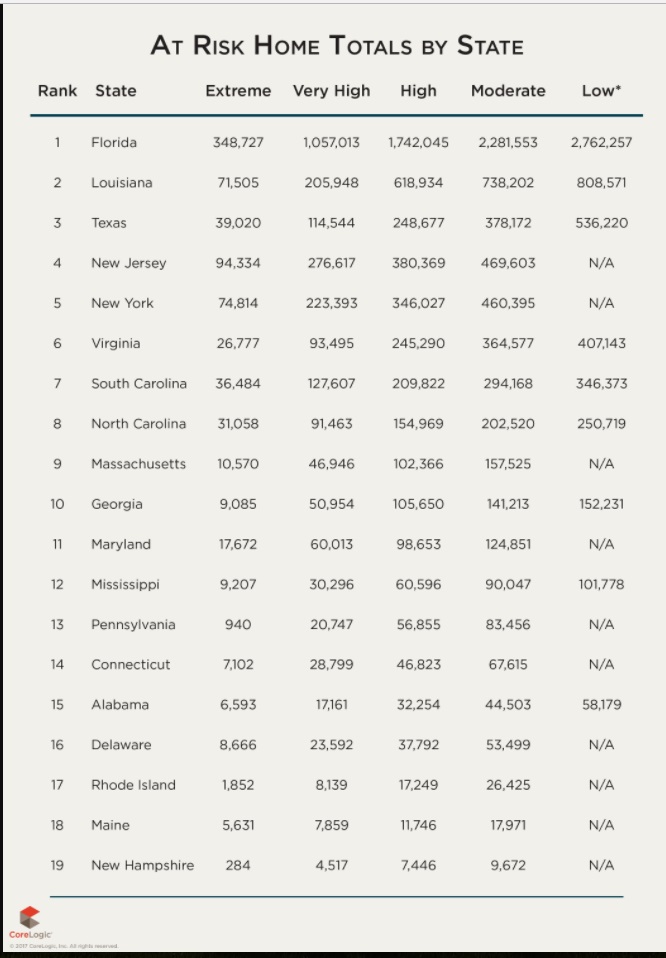

Florida, Louisiana, Texas, New York and New Jersey rank as the top five states with the most homes at risk.

According to the National Hurricane Center, a storm surge, is often the greatest threat to life and property from a hurricane. Storm surge is an abnormal rise of water generated by a storm, over and above the predicted astronomical tide. When it comes to hurricanes, there is a misconception that the winds will cause most of the property damage, when it’s the water that could potentially cause the greatest devastation. This is often overlooked until it is too late. Hurricane Katrina and SuperStorm Sandy are prime examples of the massive damage and devastation that can be caused by storm surge and the large number of people under or uninsured for such a catastrophe.

In the United States, flooding from storm surge is by far the most catastrophic and costliest natural disaster. According to FEMA, every state has experienced some form of flooding due to storm surge or flash flooding in the past five years. Paradoxically, only about five million property owners protect their assets by purchasing flood insurance. Historically, homeowners and business owners have failed to appreciate the cost and extent of damage a water event could cause until it is too late. When disaster strikes, all too often our clients state they believed their property was protected under their homeowner policies or that flood insurances is unnecessary because it’s not mandatory. Both beliefs are false and illustrate the lack of appreciation for the need to protect against a low-frequency, high severity risk.

Hurricane season is here to stay for the next six months, so all homeowners—but especially those residing near the coastline—need to review their policies to verify they have adequate and proper coverage. If there is any uncertainty, they should contact their insurance broker to confirm their needs are being met by their existing policy.