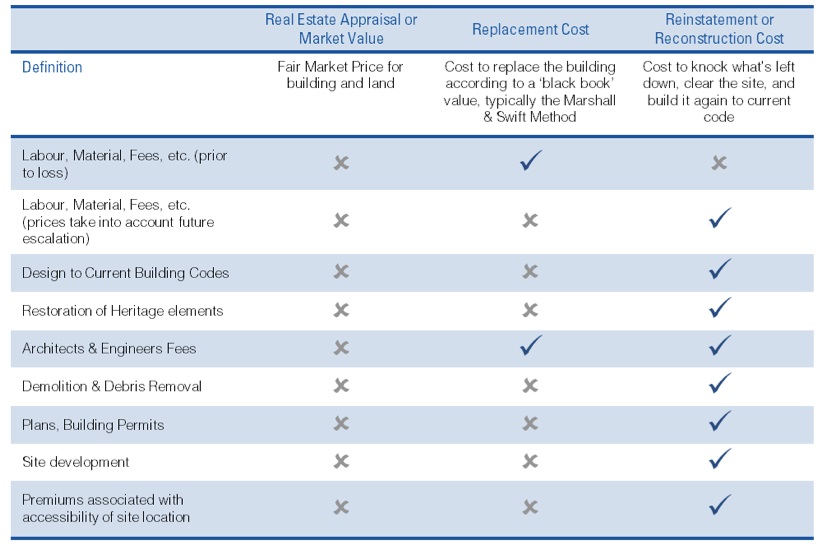

A recent post, Insurance Agents and Determining Coverage Limits for Buildings, generated a number of very interesting comments about the differences between Replacement Cost Value of a building and the Reconstruction Value of a building. There is a difference between the two values and it is a big issue.

A.W. Hooker posted an article soliciting it services, Replacement or Reconstruction Cost Estimate, which discusses the difference and explains the significance of insuring to value and obtaining coverages which reflect reconstruction costs rather than replacement cost values when deciding on policy limits and coverages for structures:

How do insurance companies calculate the replacement cost?

There is no standard method used by insurance companies but most often a construction cost manual such as Marshall & Swift will be referenced for the unit cost per square foot of a similar type of building and multiplied by the area of the subject building.

Why is this a flawed way of calculating the replacement cost?

Because it is theoretical replacement with a similar type of building and not an actual reconstruction cost evaluation, which includes for all costs associated with reconstructing a building at today’s standards and codes. Other costs are not considered with replacement cost, such as demolition of the existing destroyed building. While replacement cost is merely the cost to replace the building using the same as or far as possible the same material and design as what exists.

When is a replacement cost appropriate, when is a reconstruction cost appropriate?

For many simple or standard types of buildings the replacement cost taken from a cost manual may be appropriate. However if there is any non-typical or unique characteristics to the property it will likely not be appropriate. For any special purpose property or special use property only a detailed reconstruction cost estimate prepared by a Quantity Surveyor will properly account for all the unique characteristics present.

In many cases, the replacement cost calculated from the ‘black book’ value will not be enough to cover the costs to rebuild the property. Should a loss occur, the owner would be out of pocket for rebuilding expenses over and above the ‘black book’ value. It is recommended that in all cases, a reconstruction cost estimate be used, particularly when the property is used for commercial purposes.

What sort of rebuilding expenses are not taken into consideration from the ‘black book’ value?

Demolition and clearance of the site, shoring up of neighbouring buildings, reinstatement of any non-structure components of the site (such as a parking lot, landscaping or below grade services) allowance for the escalation of the cost of labour and materials in the future, permit fees, and any premiums associated with construction for the property’s geographic area.

The ‘black book’ value also does not take into consideration that should your property need to be rebuilt, it would have to be built to be compliant with the current building code, which could have a serious impact on the design and materials you must use to rebuild. A Replacement Cost Estimate will only cover the cost to replace the building with one of comparable size, utility and materials. For example, it would not take into account that your new building will require an elevator (where a narrow staircase previously sufficed).

What are the other considerations that will be taken into account for a Reconstruction Estimate?

Heritage components, current building codes, construction standards, accessibility, building material availability, etc,

The Massachusetts Association of Insurance Agents held a seminar on the topic. The PowerPoint presentation, Replacement Cost v Reconstruction Cost v. Total Component Valuations: Is the Client Covered Effectively? provides an excellent discussion of policy coverage terms causing gaps in coverage. The author noted that the primary problem for the agent is found in the rules to determine valuations, policy limits, and policy language. The presentation warns through numerous examples that replacement cost values may leave the policyholder with significant out of pocket expenses.

The problems of properly insuring a structure with values that do not leave the policyholder with gaps of coverage and for limits sufficient to reconstruct are complex. I find it amusing that judges, not trained in the nuisances of insurance, write so many opinions that the policyholder is in the best position to make this analysis. Really? If agents cannot even figure out which values to use and have to be taught to understand the potential gaps of coverage, how can a uneducated consumer be in a better position?

Positive Thought For The Day

“The function of education is to teach one to think intensively and to think critically. Intelligence plus character – that is the goal of true education.”

—Malcom X