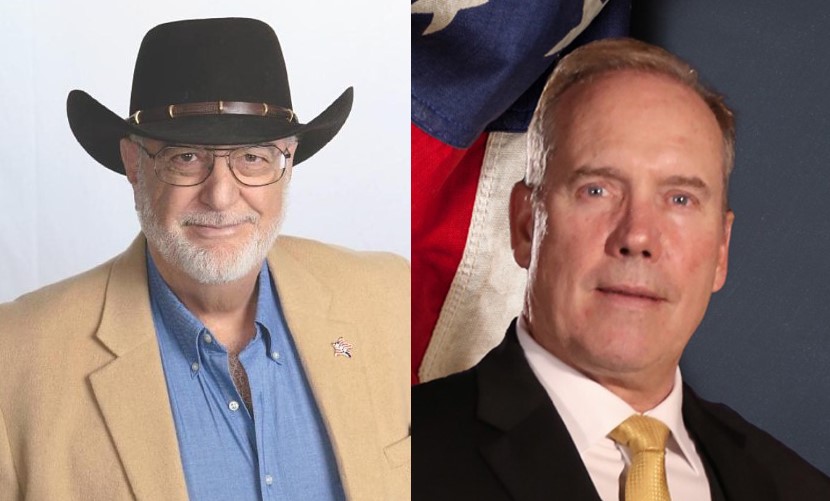

Do insurance companies support training for their claims adjusters and managers to promote good faith and ethical claims handling? Barry Zalma recently stated in his September 1st insurance industry newsletter, Zalma’s Insurance Fraud Letter, the following:

The insurance industry has been less than effective in training its personnel. Their employees, whether in claims, underwriting or sales, are hungry for education and training to improve their work in the industry.

…

If funds are not available for training, vendors can be willing to assist. Although vendors are usually prohibited from making gifts to the insurer’s employees, they may agree to donations to the insurer of educational materials that will help the employees improve their abilities for acknowledgement of the presentation.

I understand that many insurance claims personnel are committed to performing their duties ethically and seek proper training to do so. However, they require their employers to invest adequately in their professional development. Unfortunately, as Zalma points out, many companies are reluctant to make such investments.

For instance, during a recent Windstorm Insurance Network board meeting, there was a discussion about how insurance companies have significantly reduced training and education budgets for their property claims staff and managers. As a result, many insurance industry property claims adjusters have to bear the entire cost of attending conferences from their own pockets. Another case in point is a deposition I recently took from a State Farm property claims manager. She shared the invaluable insights she gained from a three-month national catastrophe training program in Jacksonville, Florida, offered by State Farm. Regrettably, State Farm discontinued this program a few years ago as a cost-cutting measure.

It is not just Zalma and me who are saying this. In Alice Young—Public Adjuster Spotlight, I asked Alice Young what her “deepest worries and fears” were about the future of the adjusting industry, and she said:

I have a genuine fear and concern for homeowners because of the lack of experience in company adjusters. The future of being able to adjust, negotiate, and settle claims with insurance company adjusters who are not trained, not experienced, and not invested in their job is not one I look forward to. The turnover is very high with insurance company adjusters. I fear that many insurance company adjusters no longer believe that they are in ‘the honorable profession’ like it used to be. It makes it much more difficult to help policyholders as a public adjuster when the person from the insurance company is not highly trained and motivated to properly adjust a claim.

What happens in an insurance industry where the culture of honest and ethical adjustment is not trained and expected in every interaction? Barry Zalma also wrote the following under a sub-title, Insurance Fraud By Insurers:1

Insurance fraud is not limited to fraud by insureds against their insurers or claimants defrauding people who are insured. Much to the shame of the insurance industry, the reverse also happens.

The poster child of fraud by an insurer was Martin Frankel who created a scheme he masterminded to ‘loot’ more than $200 million from seven insurance companies that he controlled….

Between June 29, 1999 and January 14, 2000, the insurance companies were ordered into liquidation by the courts in the four states in which they were domiciled. Martin Frankel, the man who allegedly controlled a financial empire that included the insurance companies, a securities trading firm, a non-profit foundation, and the Thunor Trust, was indicted in both state and federal courts for fraud, criminal conversion, and for allegedly looting at least $215 million from the assets of the insurance companies.

Frankel’s scheme to defraud the insurance companies, those it insured, and its investors began in 1991, lasted nearly ten years, involved the participation of dozens of co-conspirators, and ultimately resulted in the insolvency of the Insurance Companies. Frankel was convicted of multiple crimes. Because Frankel’s enterprise was not limited and also included market research, running insurance companies, gathering data concerning financial markets, and conducting ‘special projects’ activities, all of which provided ample links between the members of the enterprise which extended beyond the commission of the crime, caused the defendant to be convicted and the conviction to be affirmed.

Doug Quinn from the American Policyholders Association (APA) has consistently voiced concerns about insurer fraud against policyholders. He emphasizes the urgent need to address and halt such practices. Given that many insurance regulators appear to be inactive on this issue, Quinn has turned to the media, sharing whistleblower accounts of unethical or fraudulent behavior by insurance companies in their claims processes:

The American Policyholder Association uses a four-step strategy to protect consumers from Insurer Fraud. A key part of that strategy is publicizing tactics used to illegally underpay or deny legitimate claims.

APA has received multiple complaints from Florida Policyholders in the wake of Hurricane Ian. In addition, multiple insurance industry insiders with evidence of potential fraud have reached out to the APA Whistleblower program.

The American Policyholder Association has been working closely with the State of Florida fraud investigators & also with multiple media outlets to address these issues. These media outlets include NBC, CBS, ABC, The Insurance Journal, Tampa Bay Times, and the world-renowned Washington Post. While many of these stories have been published and aired, the story is ongoing and there are several national media outlets working closely with the APA on News stories that will run in the coming months.

If you know of insurance company fraud and wrongful practices, the American Policyholder Association urges that you expose these and confidentially contact the APA at this link and report engineering fraud at this link.

I encourage others to subscribe to Barry Zalma’s newsletter at his website: https://zalma.com/zalmas-insurance-fraud-letter-2/.

Thought For The Day

Integrity is choosing courage over comfort; choosing what is right over what is fun, fast, or easy; and choosing to practice our values rather than simply professing them.

—Brené Brown

1 Barry Zalma. Insurance Fraud by Insurers. Zalma’s Insurance Fraud Letter, Sept.1, 2023. Available online at https://zalma.com/blog/wp-content/uploads/2023/08/ZIFL-09-01-2023.pdf.