Frozen pipes resulting in water loss are nothing new when the first winter freeze comes. When winter storms roll through the normally warm south, they often expose policyholders failing to prepare by maintaining heat or draining water from pipes. A recent Texas federal case involving State Farm highlights this scenario. 1

The case involved Arturo Barona’s commercial building. A pipe froze during the December 2022 freeze. It burst, and water flooded the property. That is the kind of event many may think insurance always covers. But State Farm did not see it that way.

Instead, State Farm correctly pointed to a fairly standard clause most people skip over when buying a policy: The exclusion that removes coverage for freezing unless very specific conditions are met.

Here is the exact policy language that State Farm relied upon:

SECTION I – EXCLUSIONS

2. We do not insure under any coverage for loss whether consisting of, or directly and immediately caused by, one or more of the following:

e. Frozen Plumbing

Water, other liquids, powder or molten material that leaks or flows from plumbing, heating, air conditioning or other equipment (except fire protective systems) caused by freezing, unless:

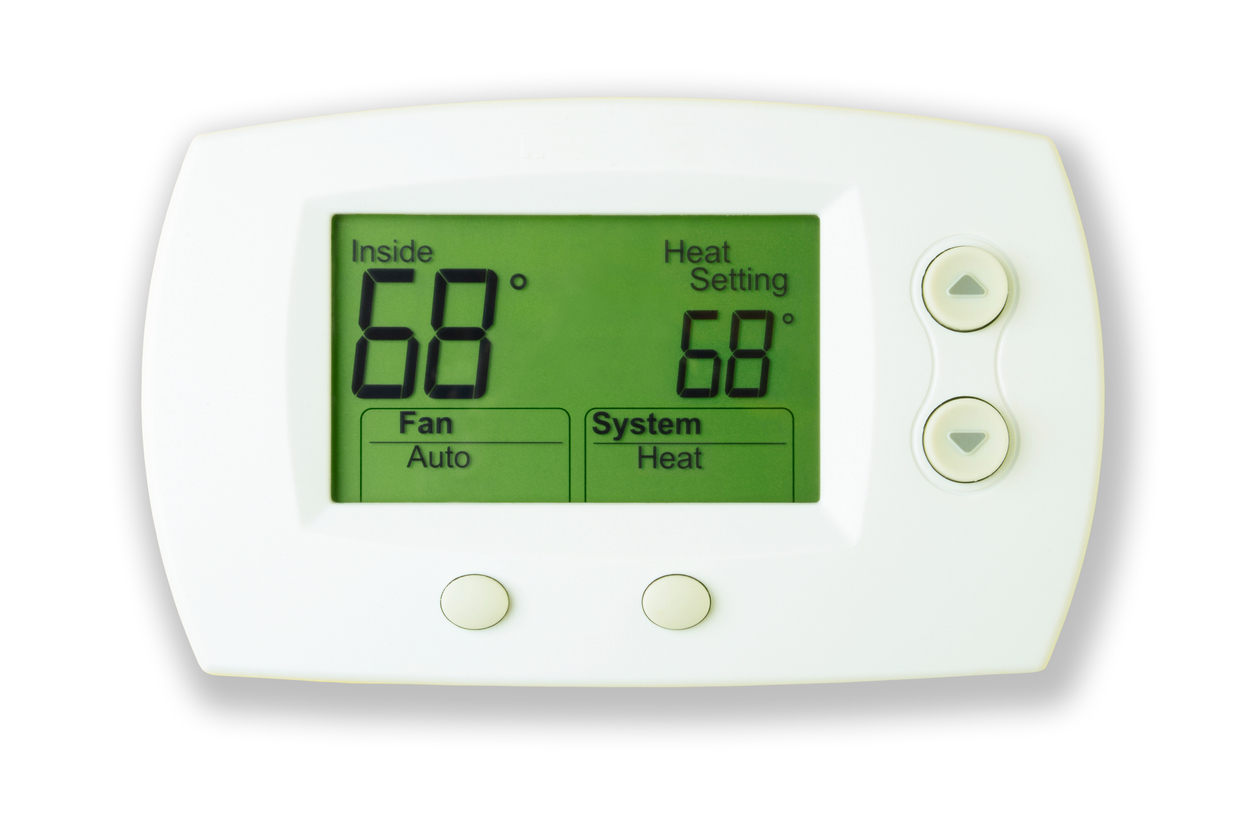

(1) You do your best to maintain heat in the building or structure; or

(2) You drain the equipment and shut off the water supply if the heat is not maintained.

The policyholder admitted he turned the heat off while the building was under renovation and that he did not drain the pipes or shut off the water before leaving for Christmas. When the cold came, the plumbing froze. When the thaw came, the water poured in. State Farm pointed to the exclusion, claimed neither exception was met, and denied the claim. The court agreed.

Coverage cases often turn on ambiguities and competing interpretations. But sometimes they turn on something far more basic: whether the insured did or did not meet the conditions the policy quietly imposes. The phrase “do your best to maintain heat” may look soft and easy to argue around. When the heat is intentionally turned off, the argument is lost before it begins. Courts look for an effort, not perfection. Doing one’s best requires at least doing something. Here, the policyholder admitted they did nothing to maintain the heat.

There is a larger lesson here that extends beyond the courtroom. Frozen pipe cases spike every winter. Insurers can rely on these exclusions. The requirement is to do some winter maintenance to protect the property from freezing pipes resulting in water damage.

Most policyholders assume that if a storm caused the freeze, the loss is covered. But most property insurance policies, like State Farm’s, shift the burden squarely onto the insured to help safeguard the property. When it is written, the duty to maintain heat or drain plumbing is not a suggestion, it is a condition of coverage. When temperatures plunge, the insurance company expects the policyholder to anticipate the risk and take protective measures.

For homeowners and commercial property owners alike, this case is a reminder that avoiding the loss is better than fighting with your insurer afterward. If a building will be vacant even briefly in cold weather, the heat should be kept on and set high enough to protect the plumbing. If the heat cannot be maintained, the water supply must be shut off, and the lines drained. These steps are inconvenient until you consider the alternative: no insurance coverage to restore what was lost.

Cases like this are also a call to read and understand your policy before the worst happens. Exclusions are often written in technical language that seems far removed from everyday life. In moments of loss, they become the rulebook by which insurers and courts determine your financial fate.

A pipe burst is often an avoidable loss in the property insurance world. Insurers will generally ask what was done to prevent the loss and will certainly ask about whether the heat was maintained. Yet every year, thousands of policyholders learn the hard way that avoidable does not mean covered.

This topic often arises in the context of using reasonable care to maintain heat, as discussed in Am I Using Reasonable Care to Maintain Heat In My Home to Provide Coverage for Frozen Pipe Damage, and Is Setting Your Thermostat to Low Enough to Maintain Adequate Heat. I also suggest reading It’s freezing…Coverage for Frozen Water Pipe Losses, to read slightly different policy language and a broader discussion of the issue

Thought For The Day

“An ounce of prevention is worth a pound of cure.”

—Benjamin Franklin

1 Barona v. State Farm Lloyds, No. 4:24-CV-01393 (S.D. Tex. Dec. 12, 2025). (See also, State Farm’s Motion for Summary Judgment, and Barona’s Response).