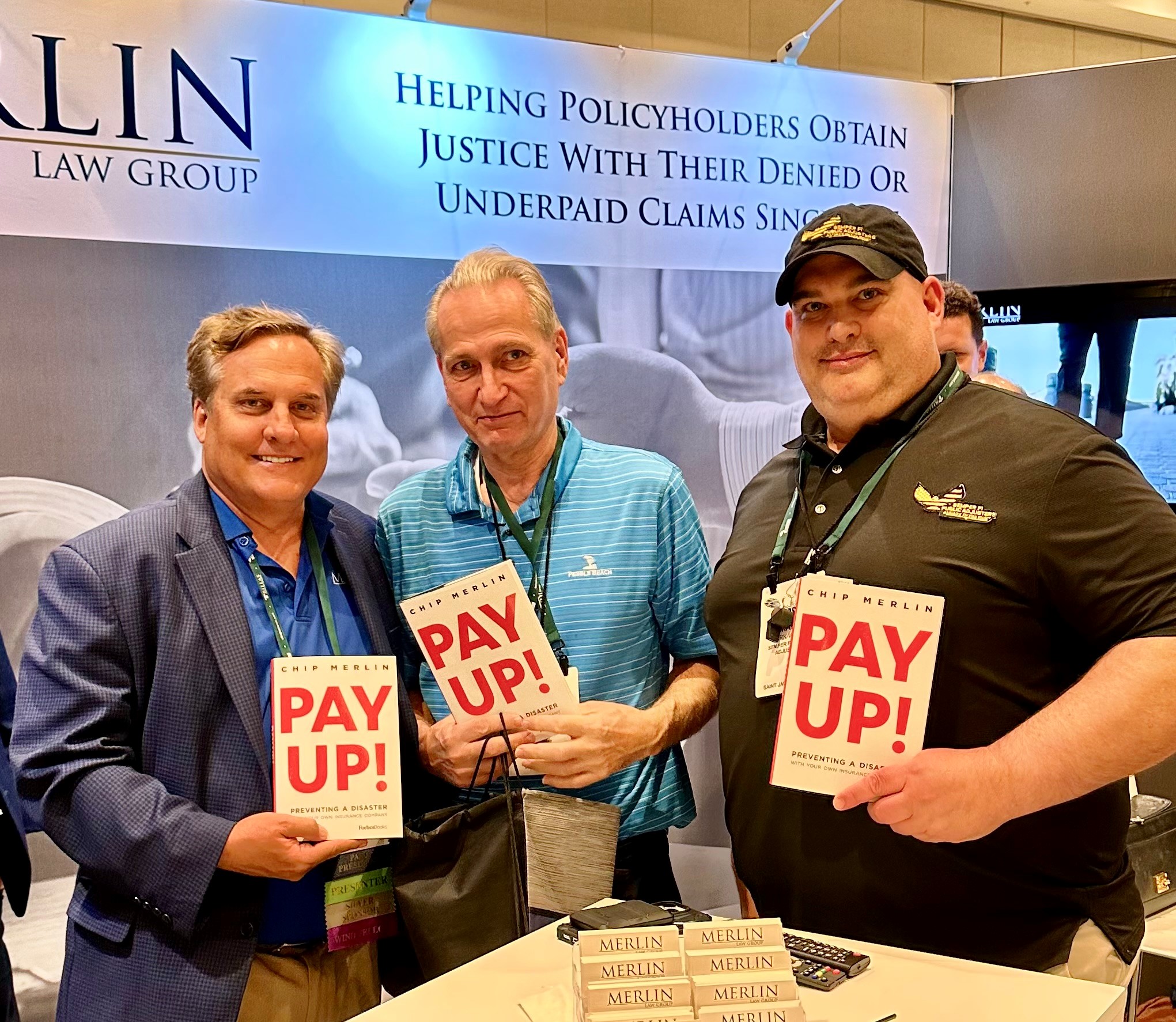

The 2023 Windstorm Insurance Conference has been great. The two gentlemen in the above photo taken on Monday night are whistleblower independent adjusters who testified during Florida’s Special insurance Session in December. Florida’s Department of Financial Services (DFS) investigators claim they could not track them down and speak with them following their testimony. It does not appear that these whistleblowers are “hiding out.”

An Insurance Journal Story, Florida Adjusters Say No Action on Charges of Insurers Doctoring Their Reports, stated:

Mandell and Vinson said they have not heard from the attorney general, the Florida Department of Financial Services or other agencies that may be in a position to investigate. The communications director for Florida Attorney General Ashley Moody said Thursday that the office had received no correspondence about the matter.

A DFS spokesman said Thursday that the department had, in fact, investigated the adjusters’ assertions, but the investigation was closed ‘due to a lack of participation by witnesses.’

‘I was never contacted by anyone from DFS,’ Mandell said in an email. ‘I have phone logs.’

The DFS has now referred the case to the Florida Office of Insurance Regulation as a possible market conduct violation by the insurance companies, said Devin Galetta, the DFS communications director.

Let me help out:

Ben Mandell: 850.392.7499

Mark Vinson: 318.542.0427

There is also a third whistleblower, Shaun Markwardt, 865.469.4561, who explained to me that independent company desk adjusters often change the field adjuster estimates without their permission before sending that report to the insurance company for approval. He told me that it was rare for him to ever directly communicate with the insurance company desk adjuster with authority to pay the claim.

Mandell and Vinson were very open about their views when speaking with me. Mandell told me that when he worked for Crawford, the Crawford managers would never have put up with the type of unethical conduct others agreed to do. They also blamed a lot of the pre-Hurricane Ian insurance mess on the following:

1. Roofers saying anything to make roof work a covered cause of a loss.

2. Roofers overcharging for roof work.

3. Attorneys helping those roofers.

4. Crazy high estimates from public adjusters.

The point is that Mandell and Vinson have views very similar to many mainstream independent adjusters. However, they have the courage to publicly call out insurance claims management for unethical and potentially criminal behavior.

So, what is the problem with the Department of Financial Services investigators? Are they just poor at doing their job? Some may suggest that they might be so in bed with the insurance industry that they will never honestly investigate wrongful insurance company behavior.

One thing is certain, none of the three witnesses want to hide what they think is the truth. They want to speak with Florida regulators and criminal investigators whose job it is to protect the public from such alleged corruption. The DFS owes a very public explanation about what it is doing on this matter. The Attorney General’s office is supposed to investigate the alleged theft of consumers’ money.

Thought For The Day

It seems to me that at this time we need education in the obvious more than investigation of the obscure.

—Oliver Wendell Holmes, Jr.