The Louisiana legislature heard a lot of testimony and complaints about property insurance carriers that were not only slow-paying but also far too low-paying on hurricane claims following Hurricane Ida. The stories were similar to the post earlier this week where a federal judge found an insurance company guilty of bad faith for slow payment in Claim Delay Leads to Bad Faith Judgement.

An article in the LaFourche Gazette noted:

Slow responses to damage claims. Constant switch-ups of insurance adjusters assessing the destruction. Low payment offers forcing people unnecessarily into litigation to get a fair deal.

Louisiana lawmakers and others said Wednesday that those are the problems they’re seeing and hearing with the insurance industry as homeowners struggle to rebuild and recover from Hurricane Ida, which struck southeastern parishes Aug. 29 as a Category 4 storm.

Republican Sen. Mike Fesi, who lives in hard-hit Terrebonne Parish, said he’s been waiting 90 days to get a payment offer from his insurance company.

‘Just the not-knowing is worse than anything else. Either you’re going to get paid or you’re not,’ Fesi said during a joint meeting of the House and Senate insurance committees. ‘I can’t say whether the companies are procrastinating on purpose.’

…

‘The number one complaint is delays: slow-pay and no-pay,’ said Doug Quinn, executive director of the nonprofit watchdog group the American Policyholder Association, which is tracking insurance issues after Ida.

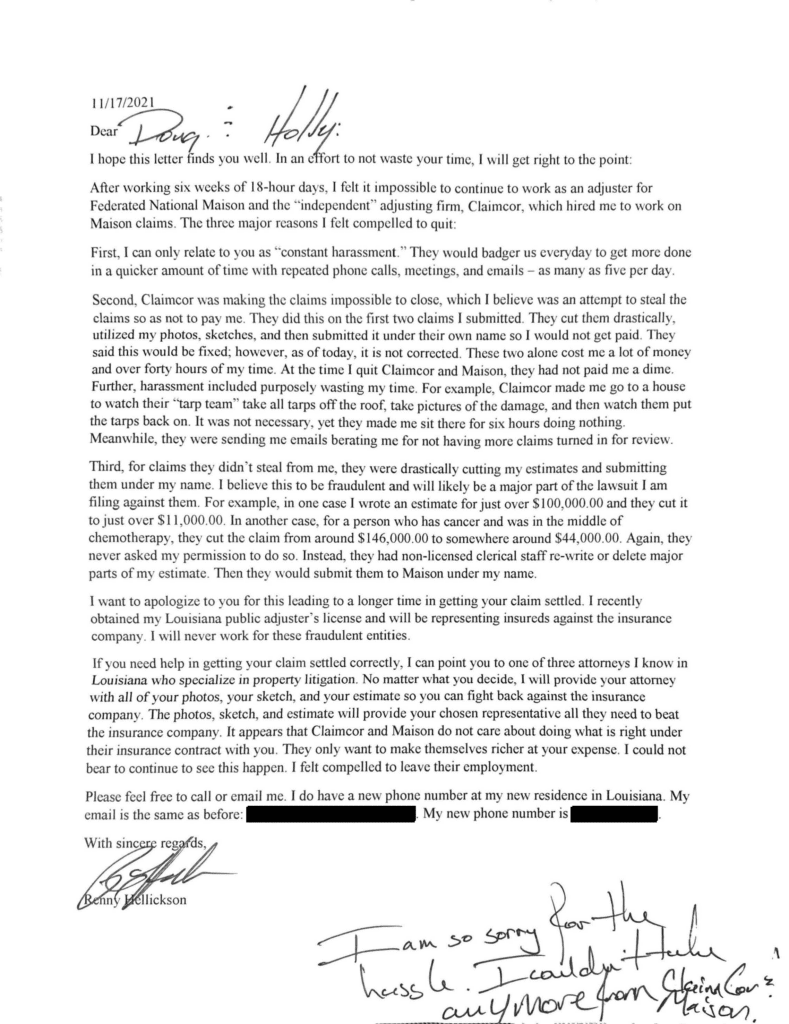

So why is this happening? Is it on purpose? Merlin Law Group clients asked that I publish a letter from their first catastrophe adjuster to show some reasons why this could be happening:

This letter indicates at least two reasons that I have been hearing throughout the country why catastrophe adjusters are having problems with claims departments. The first problem is that many independent catastrophe teams have changed their methods for payment so that the amount of money paid for those leaving home and going to areas with widespread catastrophes has been lowered. The second is that desk adjusters who do not go into the field are being forced to reduce the claims estimates provided by the catastrophe adjusters.

It is not just the one adjuster who wrote the letter. I recently taught a public adjuster course where two experienced former catastrophe adjusters had very similar stories about why they left the independent catastrophe business. They shared their stories about new pay scales and desk adjusters wrongfully changing their estimates with the entire group. Another former catastrophe adjuster in a Colorado wildfire claim broke down and cried, explaining why he felt guilty working for a firm that had the desk adjuster cut his estimate in half for a completely burnt home where it was clear to him that the policy limits should be paid—not half the policy limit.

One thing that insurance commissioners can do is require the original field estimates be provided to the policyholder and then require that desk adjusters provide a written explanation of why any changes were made. Of course, field adjusters can make mistakes, but why not provide both the original estimate and the revised desk adjuster estimate with an honest explanation for the changes made—unless the insurance company has something to hide? This honest transparency should always occur and would help reduce some of the lowball tactics that many insurance company claims departments are using in catastrophe situations.

Thought For The Day

A lack of transparency results in distrust and a deep sense of insecurity.

—Dalai Lama