Peg Brown is the Chief Deputy Commissioner for the Colorado Division of Insurance. When she made an announcement this week at the Rocky Mountain Association of Public Insurance Adjusters (RMAPIA) that she would be retiring, I was sad. It is my impression that Peg is in her prime with passion and experience that genuinely helps Coloradans and Colorado’s insurance market. I would not have felt this way a decade ago. But over the years, I have come to appreciate Peg’s views and proactive endeavors to improve insurance for everybody. She will be missed.

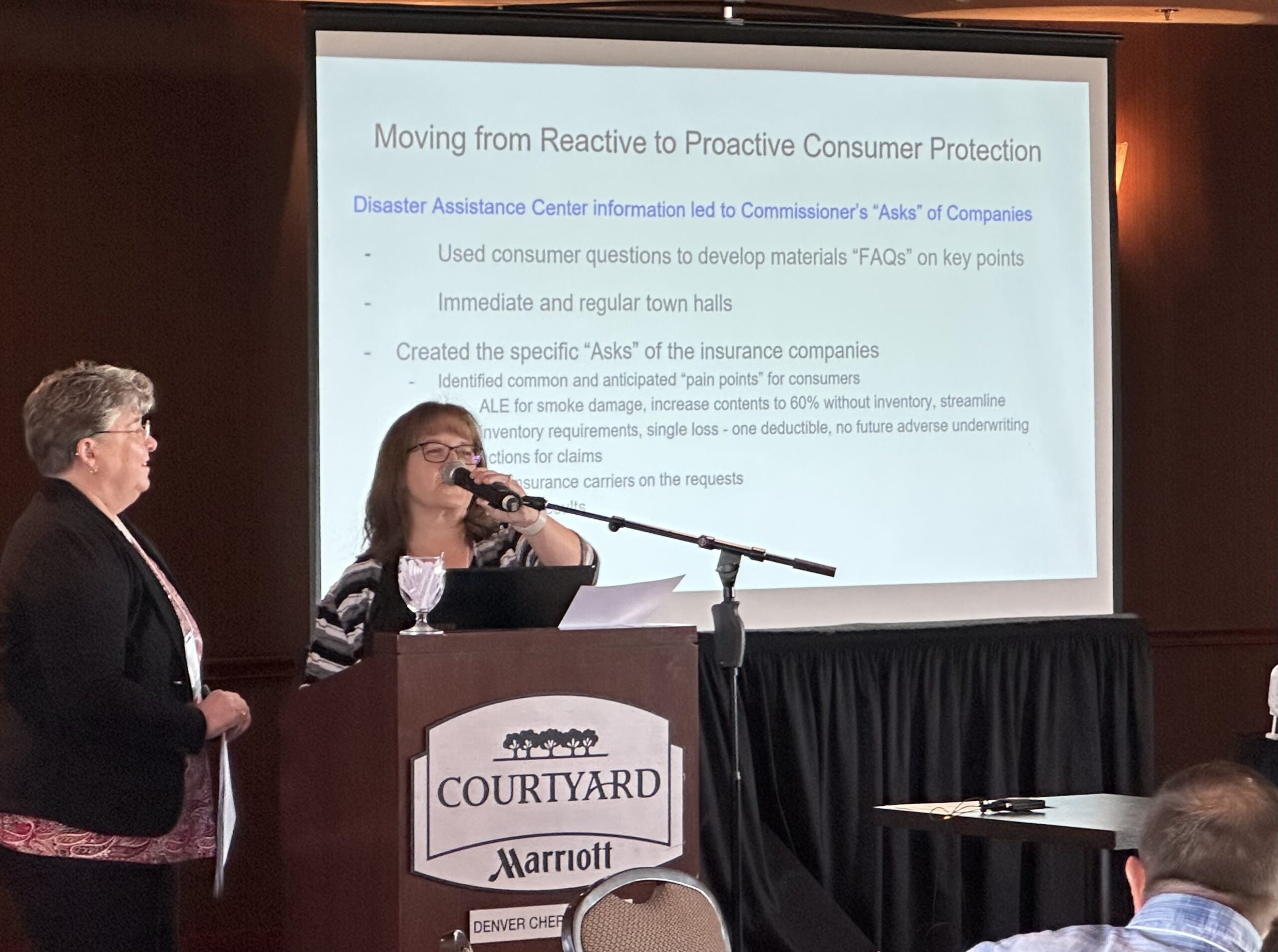

The above photo is of Peg Brown and Bobbie Baca, Director of Consumer Services. They spoke about the Department’s current agendas and issues confronting them. They also asked for participation and input from various stakeholders in Colorado’s insurance marketplace. They specifically addressed the various initiatives surrounding wildfire issues and how they were collaborating with other state regulators facing similar problems. The presentation and discussion was refreshing and thought provoking.

The insurance industry is complex. It is challenging to navigate, especially for policyholders who have limited knowledge of the various regulations and processes involved. State insurance regulators play a critical role in protecting those policyholders. My experience is that if we actively engage with these departments, educate, and work together, we can promote better pro-policyholder regulations and enforcement that protect the interests of policyholders across the nation.

It is important for everybody to understand some of the critical missions of state departments of insurance:

- Licensing and Regulation: State insurance departments are tasked with making sure that insurance companies, agents, and brokers possess the necessary licenses and meet regulatory standards. They monitor the financial solvency of insurers, ensuring that claims can be paid when required.

- Consumer Education and Outreach: These departments offer valuable resources to help consumers make informed decisions about their insurance coverage. They provide information on various types of insurance, policy terms, and guidelines for comparing rates and coverage options.

- Consumer Assistance and Complaint Resolution: State insurance departments serve as a support system for consumers, answering questions and providing guidance on insurance-related concerns. They investigate and resolve complaints against insurance companies, agents, or brokers, taking appropriate enforcement actions as needed.

- Enforcement of Insurance Laws and Regulations: These departments are responsible for upholding state insurance laws and regulations. They protect consumers from unfair or deceptive claims, underwriting, and solicitation practices by monitoring company activities, conducting audits, market conduct examinations, and initiating legal actions against violators.

- Monitoring and Approving Insurance Rates and Forms: State insurance departments review and approve insurance rates and policy forms to ensure fairness, reasonableness, and compliance with state regulations. This oversight protects consumers from excessive or discriminatory rates and guarantees that insurance policies provide suitable coverage.

- Advocating for Consumer Interests: State insurance departments often champion consumer interests in insurance-related matters. They may propose or support legislative and regulatory changes that protect consumer rights and encourage fair competition within the insurance market.

- Disaster Response and Recovery: In the aftermath of natural disasters or other emergencies, state insurance departments play a vital role in coordinating the insurance industry’s response and recovery efforts. They assist policyholders with claims, offer information about disaster-related insurance issues, and monitor the industry’s ability to handle increased claims demands.

- Promoting Transparency and Competition: State insurance departments work to enhance transparency and competition in the insurance market by collecting and distributing data on insurance rates, policy offerings, and company performance. This information empowers consumers to make informed decisions and stimulates competition among insurers.

This is a big job. Most state insurance departments are far underfunded and do not have enough regulators to fully complete all these missions. Without input from policyholders and others advocating for policyholders, my experience is that many departments simply do not take a proactive approach to initiating pro-consumer agendas. So, here are a few ways to get involved and make a difference:

- Stay informed: Keep up-to-date with the latest regulations, guidelines, and insurance news within your state. Knowledge is power, and being well-informed enables you to provide valuable input and advocate for positive change.

- Communicate with state officials: Establish open lines of communication with your state insurance department. Share your experiences, concerns, and suggestions with officials to help them better understand the challenges policyholders face and identify potential areas for improvement.

- Attend public hearings and meetings: Participate in public hearings, meetings, and other events organized by state insurance departments. These events offer opportunities to voice your opinions, learn from others, and gain insights into the decision-making processes that shape insurance regulations.

- Join or form policyholder advocacy groups: Connect with insurance consumers to form or join policyholder advocacy groups. Public adjusters and restoration contractors should make certain that their associations are actively having respectful dialogue with regulators about issues in the field that are adversely impacting policyholders. By respectfully collaborating and pooling resources, you can amplify your voice and influence in promoting pro-policyholder regulations and enforcement. I use the word “respectfully” because after speaking with numerous regulators, many have told me that they feel like a “punching bag” by those who do not listen but only want to harshly attack them.

- Spread awareness: Educate your clients, friends, and the media about the importance of consumer protection missions and the roles I listed above of state insurance departments. Encourage them to get involved and build a community of informed policyholders working together for positive change.

- By working hand-in-hand with state insurance departments, we can create a more transparent, fair, and accountable insurance landscape. Let’s embrace the inspiring message that change is possible when public adjusters, insurance consumers, and state officials unite for a common goal: To protect and empower policyholders across the nation.

It’s important to remember that state insurance departments are not just regulatory bodies but partners in protecting policyholders. Those reading this blog are usually informed insurance consumers and people involved with insurance claims. You can play a significant role in creating a more policyholder-friendly environment by actively participating and working with the people running state insurance departments. Most want to hear from you if you simply take the time to respectfully reach out.

If you are a public adjuster or restoration contractor, please contact your association leaders about your association’s regulatory outreach plans. Does anybody from your associations attend the National Association of Insurance Commissioners quarterly and ad hoc meetings? Simply forward this post to them and ask while you also indicate you want to help.

One reason I publicly support, with time and money, the efforts of United Policyholders is because United Policyholders actively engages with insurance regulators state-by-state and at national meetings. Most of us are too busy in our daily and professional lives to be able to do this at the level that United Policyholders can. So, rather than just read this post and let it go, I encourage you to click on the United Policyholders linked website right now. Sign up to become more informed and provide financial support. You will have taken steps to help make for a better insurance marketplace.

Thought For The Day

Retirement is not in my vocabulary. They aren’t going to get rid of me that way.

—Betty White