In a matter of days, the Florida legislature is poised to consider another sweeping round of legal changes to Florida’s property insurance market. In large part at the behest of CFO Jimmy Partronis, whose campaigns are largely funded by the insurance companies he is supposed to regulate, the legislature will consider a slate of “reforms” taken directly from the insurance industry’s Christmas list.

The alleged need for further abolishing more consumer protections, many of which have been ingrained in Florida law for decades, is runaway litigation driven by attorneys, public adjusters, and restoration contractors trying to game the system. But is that true, or is this simply propaganda used by the insurance lobby to insulate themselves from accountability in Tallahassee’s current politically friendly environment?

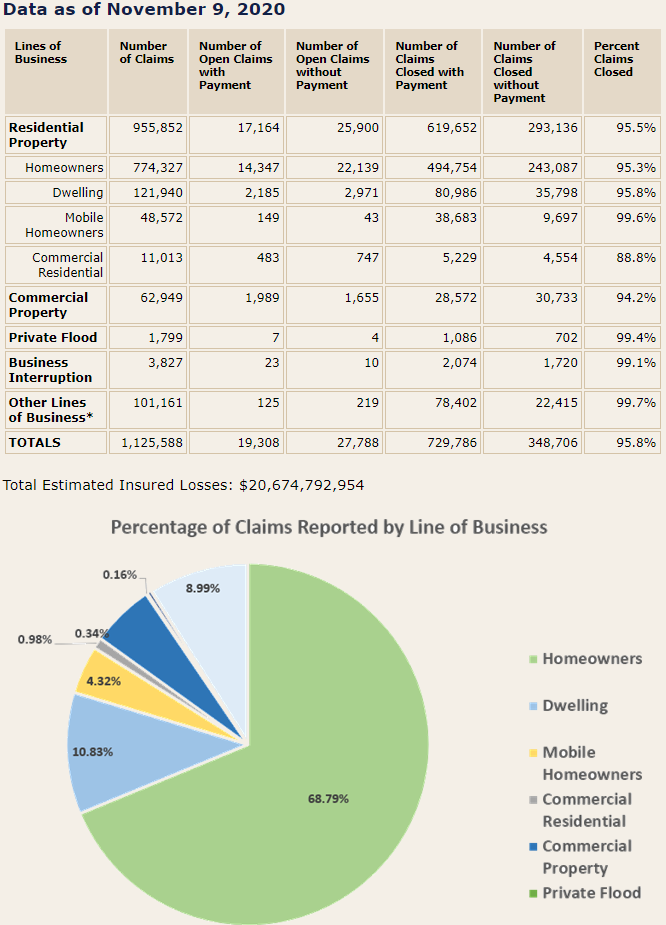

Based on the statistics published by the Office of Insurance Regulation, the latter seems more probable. Specifically, as of November 2020 (more than three years after Hurricane Irma), 1,125,588 insurance claims were filed statewide due to Hurricane Irma. Of those claims, 955,852 were for residential property, and 62,949 were filed for damage to commercial structures. Given the huge wind field of this storm, the lack of widespread flooding, and the statewide destruction, this storm was the most costly in Florida history until Hurricane Ian.

While significant amounts were paid, the statistics show that 348,706 of the claims submitted after the storm were closed without payment, i.e., denied. That’s a whopping 31% of the total number of claims submitted by policyholders. For residential claims, more than 25% were denied, while commercial claims came in at an astounding 49%. In Lee County, one of the hardest hit areas of Florida, 29,336 of the 102,319 claims submitted (29%) were refused.

The litigation that came from Hurricane Irma has been used as a springboard for the insurance lobby and its legislative agenda. But what do you expect to happen when, as an industry, you deny 31% of the claims submitted to you after a historically devastating storm? Are attorneys, public adjusters, and contractors really the driving force behind the subsequent Irma litigation, or is it angry policyholders who didn’t receive dollar one after paying hefty premiums for supposed coverage?

At the end of the day, there are a number of causes for the influx of litigation in recent years. But to ignore the systemic problems in Florida’s insurance market (underfunded companies completely dependent on the reinsurance market, inadequately staffed and inexperienced claims departments, and outright fraudulent conduct like pressuring field adjusters to change reports and estimates to minimize or deny payment) is a huge mistake. This is especially true when making decisions that may permanently take away the rights of vulnerable policyholders after their lives are turned upside down following a catastrophe.