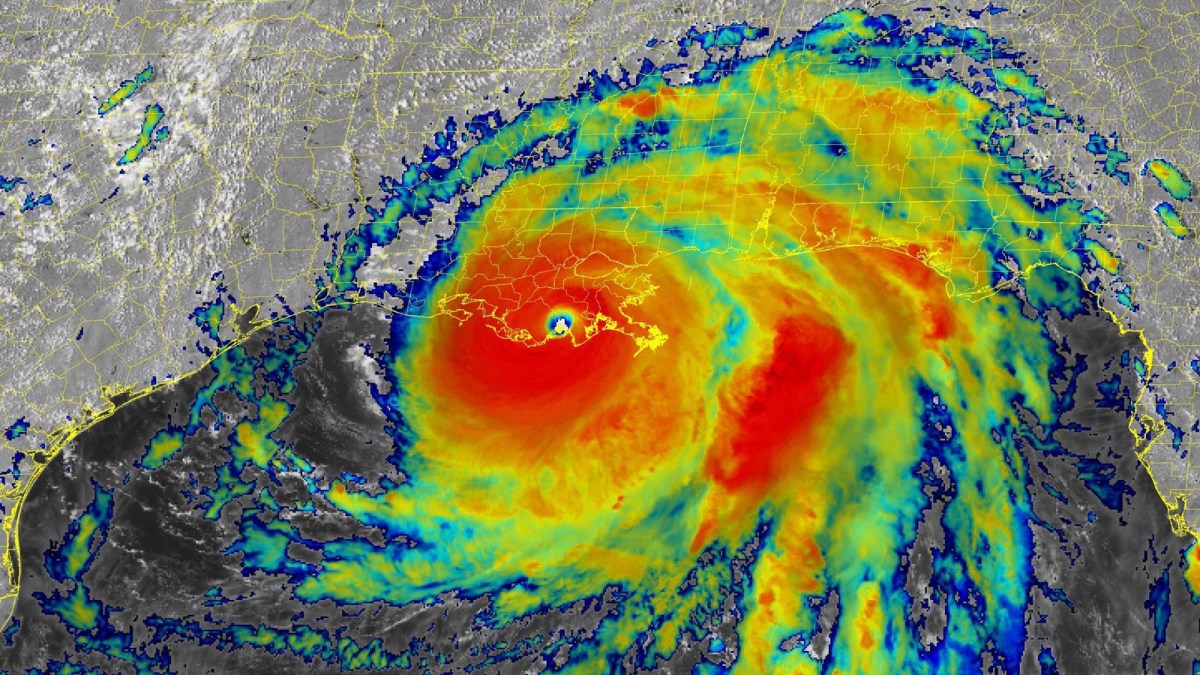

Louisiana Act 345 will have an immediate impact on Louisiana property insurance claims from Hurricane Ida. The law just became effective on August 1, 2021, without much publicity. Hurricane Ida has done significant damage in Louisiana, and everybody involved in the claims process should carefully consider this new law.

The preamble to Act 345 provides:

To enact R.S. 22:1892(B)(6) and (E) through (G), relative to claims settlement practices; to provide for the definitions; to provide for insurance coverage of damaged property; to prohibit insurers from requiring insureds to use a preferred vendor or contractor; to provide for the adjustment and settlement of first-party losses under fire and extended coverage policies; to provide required adjustment dispute resolution language for residential property policies; and to provide for related matters.

The first significant part of the law requires “objective criteria” and “subjective assessment” for taking depreciation and “a written explanation for how the depreciation was calculated.”

(6)(a) For the purposes of this Paragraph the following terms have the meanings ascribed to them:

(i) “Damaged property” means a dwelling, structure, personal property, or any other property, except a vehicle, that requires repairs, replacement, restoration, or remediation to reestablish its former condition.

(ii) “Depreciation” means depreciation including but not limited to the cost of goods, materials, labor, and services necessary to replace, repair, or rebuild damaged property.

(b) An insurance policy covering damaged property may allow for depreciation.

(c) An insurance policy covering damaged property shall provide notice that depreciation may be deducted or withheld, in a form approved by the commissioner.

(d) If depreciation is applied to a loss for damaged property, the insurer shall provide a written explanation as to how the depreciation was calculated.

(e) Depreciation shall be reasonable and based on a combination of objective criteria and subjective assessment, including the actual condition of the property prior to loss.

This follows the California rule, which requires an objective criteria for depreciation. It is interesting the term “subjective assessment” is included. “Subjective” usually means “based personal opinions and feelings rather than on facts.”

For insurance companies and independent adjusters in the field determining depreciation, they must “provide a written explanation as to how the depreciation was calculated” if the insurance company intends to deduct depreciation. While this should be the method of adjustment in every case, many property insurance companies do not require the field adjusters to state in writing how the amount of depreciation was determined. In each situation, however, the condition of the property before the loss must be part of the criteria. This requires some investigation by adjusters because they will not have seen the property before the loss. Therefore, all adjusters should ask for risk inspection reports and pre-loss photos from the underwriting department as part of conducting a full investigation. Absent this type of investigation and analysis, which is made in writing at the time depreciation is taken, Louisiana policyholders should receive payment with no depreciation being deducted.

The second major aspect of the law prohibits preferred vendors and requires adjusters to warn that the policyholder is under no obligation to use a preferred vendor.

E.(1) An insurer shall not require that repairs, replacement, restoration, or remediation be made to an insured’s property by a particular preferred vendor or recommended contractor when making a payment on a residential or commercial property damage claim.

(2) An insurer shall not recommend the use of a particular preferred vendor or recommended contractor without informing the insured or claimant that the insured or claimant is under no obligation to use the preferred vendor or recommended contractor to complete repairs, replacement, restoration, or remediation of the insured’s property.

General contractor overhead and profit must be part of the calculation of loss, including determination of actual cash value payments.

F.(1) In the adjustment or settlement of first-party losses under fire and extended coverage policies, an insurer is required to include general contractor’s overhead and profit in payments for losses when the services of a general contractor are reasonably foreseeable. This requirement applies to policies that provide for the adjustment and settlement of losses on a replacement cost basis and to policies that provide for the adjustment and settlement of losses on an actual cash value basis.

(2) The deduction of prospective contractor overhead, prospective contractor profit, and sales tax in determining the actual cash value of an adjustment or settlement is not allowed on replacement cost policies or on actual cash value policies.

Another part of the bill has appraisal language mandated in residential policies starting next year.

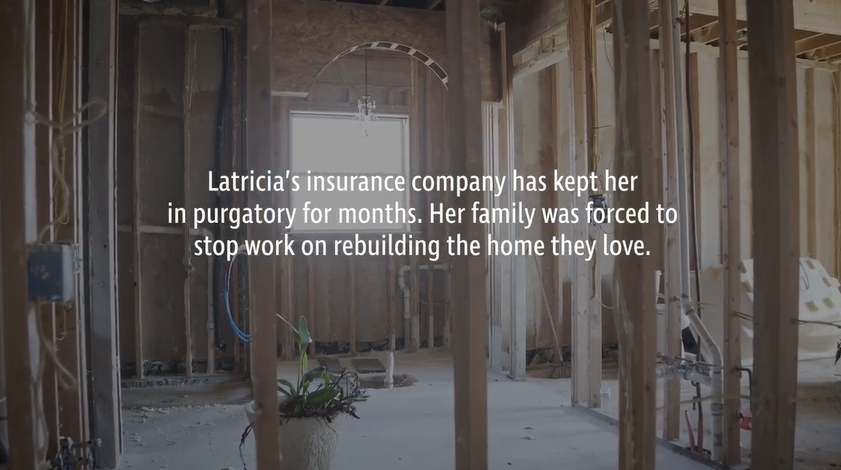

This Act came about to correct insurance property claims industry abuses against Louisiana policyholders in the aftermath of Hurricane Laura. The Video For The Day is just one example.

Thought For The Day

Most anyplace one lives is essentially dangerous. There are floods in the Midwest, and tornadoes. There are hurricanes along the Gulf. In New York, you get mugged.

—John Gregory Dunne

Video For The Day