After Hurricane Maria caused catastrophic damage in Puerto Rico, many new laws and law amendments were made to benefit policyholders. As mentioned on my previous blog,1 one of these laws provided policyholders the option of microinsurance but it was not until recently (almost three years after the laws) that the first microinsurance company, Optima Insurance, is now available for policyholders.

Puerto Rico’s insurance code defines a microinsurance as:

[A]n insurance with a low amount of premium and coverage, where the indemnity benefit is based on a predetermined fixed amount, as established in the terms of the policy.2

It also defines catastrophic microinsurance as a,

Class of parametric microinsurance that offers coverage against financial losses of an individual resident in Puerto Rico caused by risks of earthquake, storm, cyclone, hurricane, flood, fire and /or other natural disaster that occurs in a geographic area or bordering Puerto Rico, as predetermined in the terms of the policy. The right to the benefit provided in the policy will be based on a predetermined fixed amount that arises from the occurrence of the catalyst event (triggering event) of a catastrophic nature recognized by a competent federal agency or body.3

The Insurance Commissioner will establish the norms that will regulate the microinsurance contracts or policies, including the rates, to guarantee they are not excessive, inadequate, unjustly unequal or in any other way contrary to the microinsurance purpose.4 Claims will also be regulated by the insurance code with the following terms:5

- Insurers must acknowledge receipt of microinsurance claims submitted by the insured within twenty-four (24) hours of being notified thereof. Any notification made to a general agent, authorized representative and / or administrator of microinsurance of a claim for microinsurance processed or underwritten in their capacity as distributor of that microinsurance, shall be understood as a notification made to a person authorized by the insurer to receive claims in your name.

- Any error or insufficient information or documentation in the claim must be notified to the insured in writing within the next two (2) days after the claim has been submitted. The notification of error or insufficient information or documents, when the information requested consists of substantially the same information already provided in the claim, will not interrupt the term to resolve the claim.

- The resolution of any microinsurance claim will be made on or before ten (10) calendar days after the claim has been submitted. The Commissioner may order the immediate resolution of any claim if he considers that the resolution of the claim is being unduly and unjustifiably delayed or delayed.

- The microinsurance indemnity will be independent of any other insurance. Any clause of priority or range of responsibility will be inapplicable with respect to microinsurance.

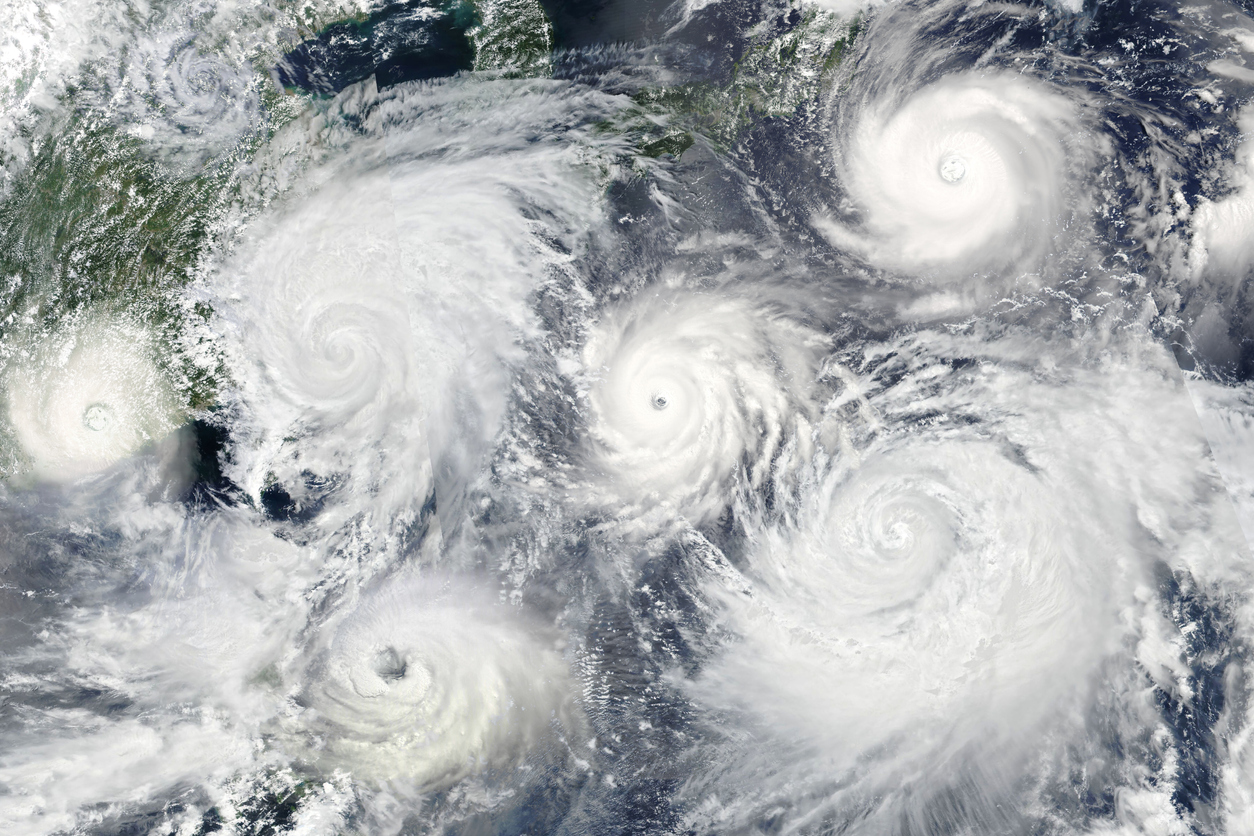

With Hurricane season 2021 just a few weeks away, policyholders should be aware of the different options available to protect their properties.

_______________________________________________________

1 https://www.propertyinsurancecoveragelaw.com/2018/12/articles/consumer-protection/puerto-rico-approves-amendments-to-the-insurance-code-to-protect-policyholders-and-improve-claim-handling-procedures/

2 Microinsurance, definition and authorized types, 26 L.P.R.A. section 1523.

3 Id.

4 Microinsurance rates, 26 L.P.R.A section 1530

5 Claims; terms for resolution and compensation, 26 L.P.R.A. 1536