Most people in the internet age will copy portions of what I am about to write about. Beware of what you read, rely on, and what is said by “people in the know.” I have learned from the hurricane school of hard knocks experience since Hurricane Hugo in 1989 and “the song remains the same” for many hurricane loss scammers.

Hurricane Hugo? 31 years ago, and you learn lessons from that? How?

Read our article from 2009, long before most people who are currently in Louisiana saying they are “hurricane experienced,” I wrote about this:

We represented an apartment complex in South Carolina for an apparent Hurricane Hugo loss involving broken brick walls. In litigation, our expert engineer pointed out that some of the damage probably was the result of an earthquake which occurred just after Hurricane Hugo. Who ever knew that South Carolina has earthquakes? We reported the claim late to the Difference In Conditions (a special insurance policy covering flood and earthquake) insurance company, proved a small earthquake did occur, and eventually recovered for earthquake loss.

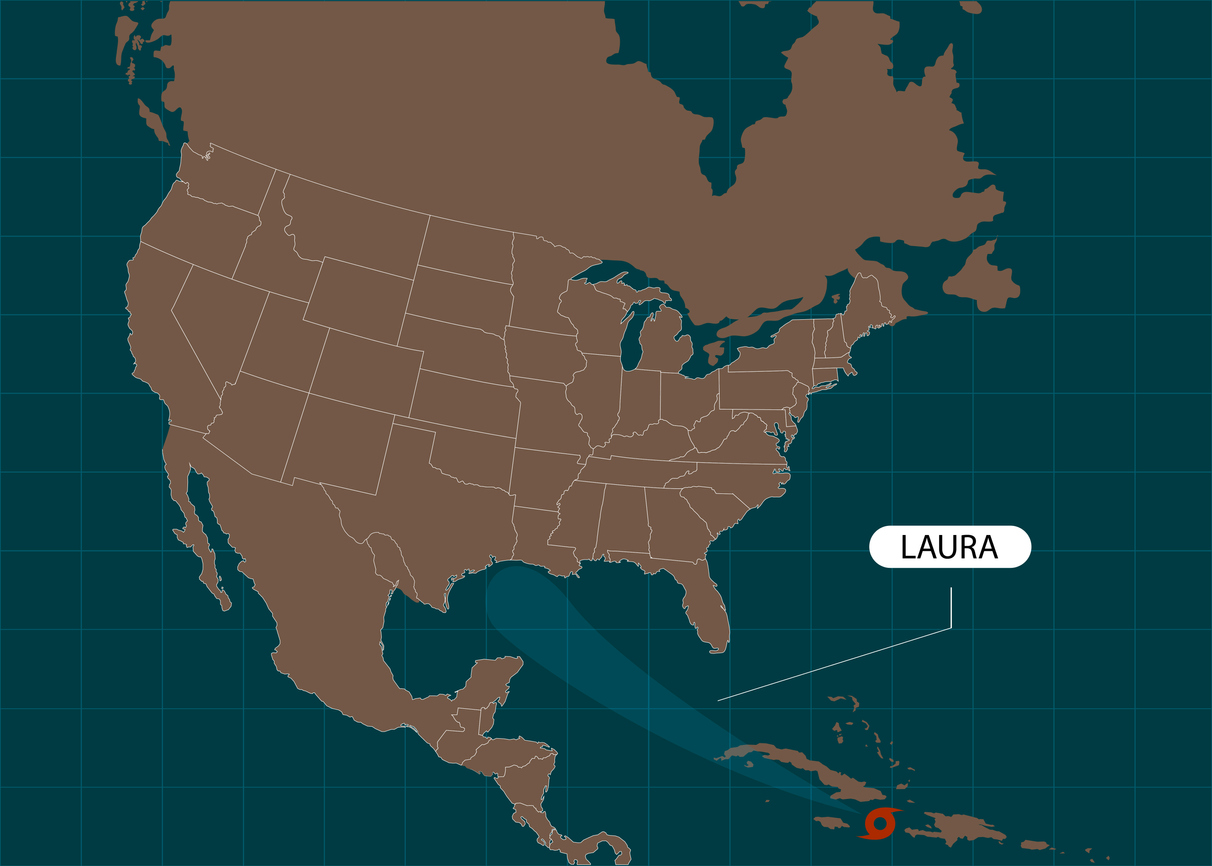

Similar to prior insurance catastrophes and claims, our firm with a specialty practice in property insurance law has teamed up with the very reputable local law firm and with attorneys, Dwight & Gary. Deborah Trotter and I were selected over a bunch of New Orleans lawyers because we were the best when it came to the Port of New Orleans nine figure claim. Local and specialty counsel can help a community. This local law firm will be here long after Hurricane Laura has left, and all of their generational attorneys will be proud to have worked with us long after the recovery is completed.

What should you do after Hurricane Laura? Read your insurance policy and the part about Duties After Loss. We wrote about this is in Hurricane Laura Recovery: Policyholder’s Duties After a Loss:

After a catastrophe such as Hurricane Laura, it is common that policyholders may not have a full copy of their insurance policy. Often the only policy document they may have in their possession is the Declaration Page showing a summary of the insurance benefits available to them. Though helpful, a full policy is necessary to inform the policyholders of their rights and duties under the insurance policy.

In a standard from policy, under the Conditions Section you will find the ‘Duties After Loss’ provision. The following is a typical Duties after Loss provision:

SECTION I – CONDITIONS

B. Duties After Loss

In case of a loss to covered property, we have no duty to provide coverage under this policy if the failure to comply with the following duties is prejudicial to us. These duties must be performed either by you, an ‘insured” seeking coverage, or a representative of either:

1. Give prompt notice to us or our agent;

2. Notify the police in case of loss by theft;

3. Notify the credit card or electronic fund transfer card or access device company in case of loss as provided for in E.6. Credit Card, Electronic Fund Transfer Card Or Access Device, Forgery And Counterfeit Money under Section I – Property Coverages;

4. Protect the property from further damage. If repairs to the property are required, you must:

a. Make reasonable and necessary repairs to protect the property; and

b. Keep an accurate record of repair expenses;

5. Cooperate with us in the investigation of a claim;

6. Prepare an inventory of damaged personal property showing the quantity, description, actual cash value and amount of loss. Attach all bills, receipts and related documents that justify the figures in the inventory;

7. As often as we reasonably require:

a. Show the damaged property;

b. Provide us with records and documents we request and permit us to make copies; and

c. Submit to examination under oath, while not in the presence of another “insured”, and sign the same;

8. Send to us, within 60 days after our request, your signed, sworn proof of loss which sets forth, to the best of your knowledge and belief:

a. The time and cause of loss;

b. The interests of all “insureds” and all others in the property involved and all liens on the property;

c. Other insurance which may cover the loss;

d. Changes in title or occupancy of the property during the term of the policy;

e. Specifications of damaged buildings and detailed repair estimates;

f. The inventory of damaged personal property described in 6. above;

g. Receipts for additional living expenses incurred and records that support the fair rental value loss; and

h. Evidence or affidavit that supports a claim under E.6. Credit Card, Electronic Fund Transfer Card Or Access Device, Forgery And Counterfeit Money under Section I – Property Coverages, stating the amount and cause of loss.

Louisiana policyholders have the right to request a full copy of their insurance policy, including all forms and endorsements:

(16) Policyholders shall have the right to a readable policy, to receive a complete property insurance policy, and to request a duplicate or replacement policy as needed.

Policyholders recovering from Hurricane Laura should immediately request a copy of their full insurance policy from their agent or insurance carrier. The policy provides important information needed to ensure compliance with the duties after a loss and will also provide guidance in the manner in which to present the various aspects of their insurance claims to their carriers. Insurance policies are some of the most difficult contracts to understand and these trying times will not make it any easier. We will be happy to assist you in understanding your coverages, rights and duties under your policy. God Bless you in your recovery.

So, what can you expect from your independent adjuster? We have legions of whistleblowers on this topic. Here is an honest response I noted in 2014:

Your blog is required reading in my world. Before I became a public adjuster, I was very proud of being a General Adjuster. I worked for 30 years for the insurance companies, and I was proud of our profession.

After Katrina, things changed. I represented Citizens of Florida in several hundred commercial appraisals, and I was broken hearted to see the abuses. The guys I ran with paid their claims. It was a cold slap in the face to see how badly Citizens treated their policyholders, and I switched sides at 55 years old, burning all my bridges behind me.

Before that, as a hobby, and to scratch my writers itch, I was a columnist for a baseball website. They knew I was a disaster relief guy, and they asked me to blog about my experience as I headed in to ground zero on Katrina.

…

Not all company adjusters and IA’s are evil. Many are good people who do the best they can to help everyone they meet. All of my friends in the business were in that category. Sadly, it’s very rare today.

Ask when the adjuster will come back, how much time the adjuster will spend at your structure to get the full damage, and do not trust that this storm trooping adjuster is there for anything other than to satisfy Louisiana codes requiring adjusters to be on site within certain time frames. This is what we have found, as stated by an independent adjuster in David Charles, Good Guys, and Memories from Katrina:

If you are being slammed for 20 plus claims a day, that is not good faith claims management. There is no way you can handle 20 plus claims per day properly. If that is the normal course of operations, no wonder there are so many poorly adjusted and delayed claims.

The policyholder signed up to have full service right away with people dedicated to provide the full amount of money right away. Not excuses for delay and excuses from adjusters showing that they are more concerned about finding ways not to pay and not having time to do a timely investigation—which means right away!

If the insurance company does not provide this type of service after a loss, it should not be in the business of selling insurance policies in the first place. It is simply ripping off the public and causing the types of problems we find in the Panhandle of Florida and elsewhere.

My roof is leaking and who should I hire to get it fixed? Read, Do Not Make These 7 Mistakes When Choosing a Roofing Contractor After a Hurricane:

1. Pick only a Licensed Contractor. (While in North Carolina only requires $30k roof jobs for a license, still require the roofer to show a license because the best roofers have that license.)

2. Accept only a contract based on a written proposal with a full detailed written explanations of the materials, costs of permits, and detailed description of the work to be done with a price.

3. Only accept a roofer with evidence that they show you, not just say, of industry professionalism, manufacturer certifications, association memberships and training of workers.

4. Only accept work from those with a permanent business address and being in the business long enough to show financial stability.

5. Only accept a contract with warranties backed up by a manufacturer.

6. Only accept a contract from a roofer that can show you in-state references, call the references and do a google search about the company. Never get pressed to sign a contract right away.

7. Do not sign with those that demand money up front before the materials are on site, say permits are not needed, cannot show proof of insurance and who fail to pass all 7 of these points when you show it to them.

So, what else should you do?

This is what a Forbes article quoted me as saying:

After the loss, ‘your ego is not your hero.’ Do not think that you can figure out what all the small print means in an insurance policy and that you are now an expert in valuation. My rule is that the larger the claim, the more important it is to seek outside professional help. Small claims may be handled individually and that passionate insurance agent will often be able to help get the matter resolved. But once the claim becomes larger and especially if it is a commercial loss where your business survival depends on a prompt and full recovery, getting additional help from claims experts is important.

The insurance company will have their own experts. Sometimes, those experts who should have your best interest in mind do not and you will never find out until it is too late.

My best advice to people looking to avoid a second insurance disaster after a catastrophe is to seek the best help you can before and after the loss.

We will have more tips. But the problem is clear—most insurance companies have emergency adjusters rather than super-skilled adjusters to determine your full damage. You need to show the damage and cooperate. But you have to understand that most insurance companies will depend upon you to determine what is owed. They will neither pay the costs for the time it should take nor for the expertise to make that determination for you.

Thought For The Day

When you combine ignorance and leverage, you get some pretty interesting results.

—Warren Buffett