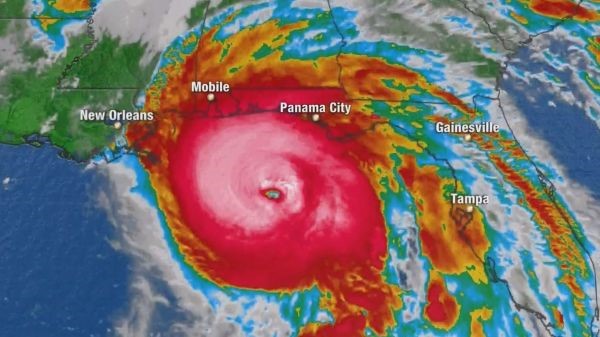

It has been almost eight months since Hurricane Michael devastated the eastern side of the Florida Panhandle. Not surprisingly, many residents and business owners are exhausted. Exhausted in the deepest sense—exhausted from waiting, exhausted from hoping, exhausted from failed promises made by their insurer, which benefited from premiums faithfully paid, only to find out that their insurer has “exhausted” its obligation to them. What is the recourse for the insured who has purchased insurance coverage to protect against a catastrophe such as Hurricane Michael? Will an insured be indemnified under its contract of insurance, including recovery of the costs and expense to pursue the benefits of the policy in court if necessary?

These are the typical topics on the minds of the insureds reeling after Hurricane Michael. A lot of misinformation makes its way around a catastrophe area. One of the more prevalent bits is “if you hire an attorney, you will have to pay all attorneys’ fees and costs unless a judge awards those fees and costs after a successful trial, and most cases are resolved before a trial.”

As a result, many of the insureds we have spoken with regarding their options and next steps are concerned that the expense of hiring an attorney to pursue their contractual rights will preclude them from obtaining any actual recovery or the insurance proceeds necessary to make or complete repairs to their homes or businesses. The good news is that in the context of insurance contracts others have blazed this trail and the courts have addressed statutes and rules embracing public policy to make the prevailing party whole.

Generally, prevailing party fee and cost provisions are to put the prevailing party in the position it would have been in if the matter was resolved without the need to litigate.1 In Florida, a prevailing party is one that prevails on the significant issues in the case or obtains the benefits sought in the litigation.2 In the context of the prevailing insured, the Florida Supreme Court has extended the application of statutory entitlement of attorneys’ fees under FL Stat. § 627.428 (2018) beyond obtaining a judgment against the insurer. In Wollard v. Lloyd’s, the court held that the insurer’s post-suit payment to an insured constitutes a “functional equivalent of a confession of judgment,” which satisfies the requirement of a “judgment or decree.”3

Some of the misinformation regarding the need for a trial judgment may have its roots in the proposition promoted by some defense firms that a finding of wrongful denial or bad faith denial is necessary prior to applying the statutory entitlement of attorneys’ fees under FL Stat. § 627.428. However, in Johnson v. Omega Insurance Company,4 the Florida Supreme Court held that the narrow application of the fee statute as argued by Omega was inconsistent with the court’s prior ruling in Ivey v. Allstate,5 which established that an award of attorneys’ fees under FL Stat. § 627.428 requires merely that an insurer incorrectly denied policy benefits. Justice Lewis wrote: “Here, the facts are undisputed that Johnson submitted a claim, Omega denied that claim, Johnson filed an action seeking recovery, and Omega subsequently conceded that it had incorrectly denied the benefits based on an inaccurate report. These facts alone warrant an award of attorneys’ fees to Johnson under Section 627.428.”

The court explained the public policy behind the fee statute, “Once an insurer has incorrectly denied benefits and the policyholder files an action in dispute of that denial, the insurer cannot then abandon its position without repercussion. To allow the insurer to backtrack after the legal action has been filed without consequence essentially eliminates the insurer’s burden of investigating a claim.” The court then went on to hold, “Section 627.428 provides that an incorrect denial of benefits, followed by a judgment or its equivalent of payment in favor of the insured, is sufficient for an insured to recover attorney’s fees.”

In addition to entitlement of statutory attorneys’ fees, FL Stat. § 57.041 (2018), Title VI – Civil Practice and Procedure, provides for recovery of legal costs: “(1) The party recovering judgment shall recover all his or her legal costs and charges which shall be included in the judgment;…” Consistent with the provisions of the fee statute above, the “confession of judgment rule” and the prevailing party analysis may also provide the insured recovery for costs associated with the litigation.

In Sands on the Ocean Condominium Association v. QBE Insurance,6 Sands on the Ocean and its insurer disagreed on the amount of the loss. Sands on the Ocean filed suit before either party demanded appraisal. Four months after suit was filed, QBE filed a motion to compel appraisal of the loss. The trial court ordered appraisal and stayed the case pending the conclusion of appraisal. As a result of appraisal, QBE paid Sands on the Ocean $931,596.53—a “confession of judgment.” Sands on the Ocean moved to lift the stay and confirm the appraisal award. After concluding it would not disturb the appraisal award confirmation, the trial court ruled it was equally appropriate to enter final judgment for Sands on the Ocean and that Sands on the Ocean was entitled to attorneys’ fees as the prevailing party. Also, the trial court found that Sands on the Ocean, as the prevailing party, was entitled to costs under Federal Rules of Civil Procedure 54(d)(1).

In sum, no white flags based upon misinformation—take the Hill!

__________________________________________

1 Grider-Garcia v. State Farm Mut. Auto., 14 So.3d 1120 (Fla. App., 2009); See also Mikes v. City of Hollywood, 687 So. 2d 1381, 1384 (Fla. 4th DCA 1997)(finding that “Costs, a compensatory monetary award to the winning party, is a judicial attempt to make the winning party as whole as he was prior to the litigation. The theory being that the prevailing party should not lose anything, at least financially, by virtue of having established the righteousness of his claim”).

2 Trytek v. Gale Industries, Inc., 3 So.3d 1194 (Fla. 2009), citing Moritz v. Hoyt Enterprises, Inc., 604 So.2d 807 (Fla. 1992).

3 Wollard v. Lloyd’s & Cos. of Lloyd’s, 439 So. 2d 217, 219 (Fla. 1983).

4 Johnson v. Omega Ins. Co., 200 So.3d 1207 (Fla. Sept. 29, 2016).

5 Ivey v. Allstate Ins. Co., 774 So. 2d 679 (Fla. 2000).

6 Sands on the Ocean Condo. Assoc., Inc. v. QBE Ins. Corp., 2012 U.S. Dist. LEXIS 177380 (S.D. Fla., Dec. 13, 2012).