At Merlin Law Group, we want policyholders to have the tools necessary to maximize recovery following a loss. Understanding when policyholders are entitled to statutory interest and knowing how to calculate it is a small trick of the trade in the property insurance industry.

Successfully arguing for statutory interest requires knowledge of the applicable law and the proper calculation. Florida Statute § 627.70131(5)(a) requires residential property insurers to pay policyholders statutory interest on payments made beyond ninety days from the date the policyholder reported the loss. I covered this statute in detail in a prior blog post, I Reported My Claim Eight Months Ago! Am I Entitled to Interest Upon Resolution? This blog post will walk policyholders through the actual calculation of statutory interest.

Florida’s Chief Financial Officer sets the interest rates on December 1, March 1, June 1, and September 1, of each year. Judgment interest rates can be found here. Below, are the current interest rates:

The easiest way to explain how the above interest rates are used to calculate statutory interest is through a hypothetical. For example, let’s say Hurricane X swept through the State of Florida on September 10, 2017. Mr. Policyholder has a homeowner’s policy for his residence in Naples, Florida and suffered damage to his tile roof from Hurricane X. Mr. Policyholder reported the damage to his insurance company on September 12, 2017. Mr. Policyholder’s insurance company issued payment on October 30, 2018 in the amount of $60,000 for the roof replacement. Statutory interest is triggered in this case because payment was issued beyond ninety days from the date Mr. Policyholder reported his claim.

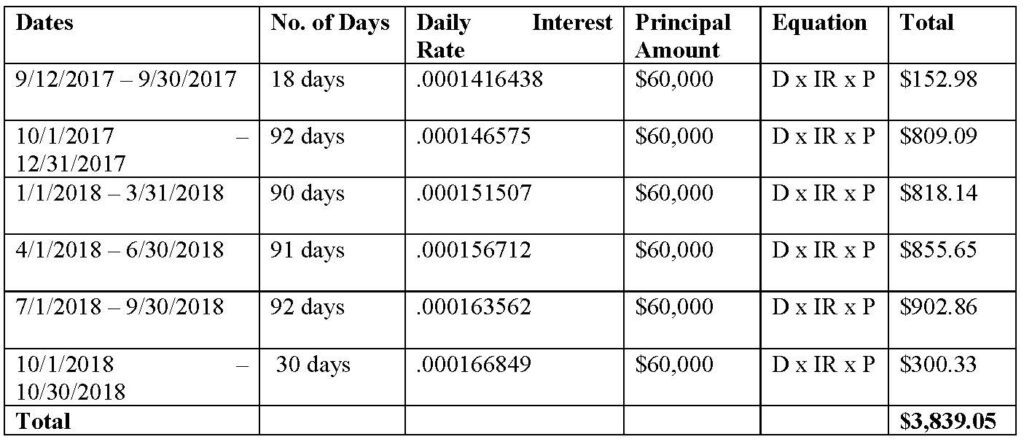

Looking at the above interest rates, statutory interest is calculated from the date of notice as follows:

In the above example, Mr. Policyholder is entitled to the $60,000 plus an additional $3,839.05 in statutory interest. This calculation can be tedious but will provide policyholders with the necessary ammunition to maximize their recovery following a loss.

If you have questions regarding statutory interest, when it applies, or the proper calculation, please contact either myself or another qualified property insurance professional licensed in the Sunshine State.