TWIA (short for Texas Windstorm Insurance Association), frequently referred to as the Texas windstorm insurance carrier of last resort, just can’t seem to get this insurance claims handling thing right. A conclusion quite alarming considering that insurance claims handling is one of the primary functions of its business. At this point many are left wondering if TWIA will ever get it right.

In 1971 the Texas Legislature developed the Texas Windstorm Insurance Association to provide insurance coverage for Texas families, businesses, schools, and properties in ‘high risk’ areas along the fourteen coastal counties. Over the past decades TWIA has attempted on several occasions to receive immunity from both the courts and Texas Legislature to shield it from being responsible for damages (and causes of action) directly related to its own bad acts.

In the aftermath of Hurricanes Ike and Dolly in 2008, TWIA reached new lows. TWIA sent ill-equipped, untrained, unsupervised adjusters to assess Texans damages, and ultimately deny the same. As years went on more and more Texans began to sue TWIA, its adjusting companies, and adjusters, and more evidence of TWIA’s bad acts came to light.

Texans discovered alarming incidences of unlawful claims handling at the hands of TWIA and its adjusters. There, TWIA and its go-to primary adjusting companies – including ABJ, Brush County Claims, Crawford & Company Inc., GAB Robins, Eberl Claim Service, Pacesetter Claims Service, Schafer Wood & Associates, and Wardlaw – purposefully and systematically denied, delayed, and underpaid hurricane claims for families, businesses, and schools throughout Texas. TWIA and its primary adjusting firms were exposed for blatant racism, sexism, and overall improper claims handling procedures.

In 2011, rather than punish TWIA and its adjusters for their undeniable bad acts, the Texas lawmakers (elected officials) wrote new laws that protect TWIA (even when it commits bad acts) by granting immunity in part, and punished the policyholders (Texas homeowners & business owners) by writing laws that restrict legal remedies for policyholders mistreated by TWIA.1

TWIA claimed to be ‘reformed’, but TWIA’s claims handling practices for Hurricane Harvey continue to show that a zebra can’t change its stripes, and you can’t teach an old dog new tricks. Most would think that TWIA would cut ties with those adjusting firms under fire for extensive bad claims handling with TWIA after Hurricanes Ike and Dolly. Not the case.

In fact, in 2017 alone TWIA paid these adjusting firms millions while at the same time making an average claim payment of $6,587.14 for Harvey victims’ TWIA damage claims.2

For example, in 2017 alone TWIA paid Crawford & Company $1,574,965.27; TWIA paid Schafer Wood & Associates $4,396,287.22; TWIA paid Pacesetter Claims Services, Inc. $5,899,015.62; TWIA paid Eberl Claims Services $7,568,334.73; and most alarming, in 2017 alone TWIA paid Wardlaw Claims Service $11,409,092.34.3

As concerning is that the Texas Department of Insurance (“TDI”) has approved various TWIA Appraisal Umpires currently employed with these firms or other firms previously paid copious amounts of money by TWIA for work on various claims.

The Texas Department of Insurance developed criteria and requirements for appraisal umpires to resolve property damage claims on TWIA policies.4 However, it appears as though TDI is either not enforcing its rules as strictly as anticipated, or some applicants have slipped through the cracks and been approved as appraisal umpires.

TDI states that an applicant has a “disqualifying conflict of interest” if they (among various factors):

- Are a current TWIA contractor or contractor’s employee;

- Are an employee of the adjusting company or public insurance adjusting company that adjusted the loss;

- Have any other direct or indirect interest, financial or otherwise, of any nature that substantially conflicts with the umpire’s duties.5

TDI also notes there is a potential conflict of interest if the applicant is a former TWIA employees or contractor or contractor’s employee.

Many of TDI’s Approved Umpires for TWIA Appraisal should likely be disqualified. Unfortunately, TDI has approved (as TWIA appraisal umpires) many current or former TWIA employees and/or contractors and/or contractor’s employees. For example, TDI has approved appraisal umpires affiliated with Crawford & Company (who as stated above TWIA paid over $1 MM in 2017 as a contractor); and those affiliated with Engle Martin a/k/a Eberl Claims Services (who TWIA paid over $7.5 MM last year), Nelson Forensics (who TWIA paid over $1 MM in 2017).6

This further begs the question: Is the appraisal process ever fair? Does anyone win in appraisal? Both sides have to incur unnecessary expenses – to pay for both appraiser and umpire – and in these TWIA matters it is largely uncertain when appraisal is appropriate. The law in Texas states if TWIA accepts coverage for a claim in full or part, and the policyholder only disputes the amount of the loss then the policyholder may demand appraisal.7

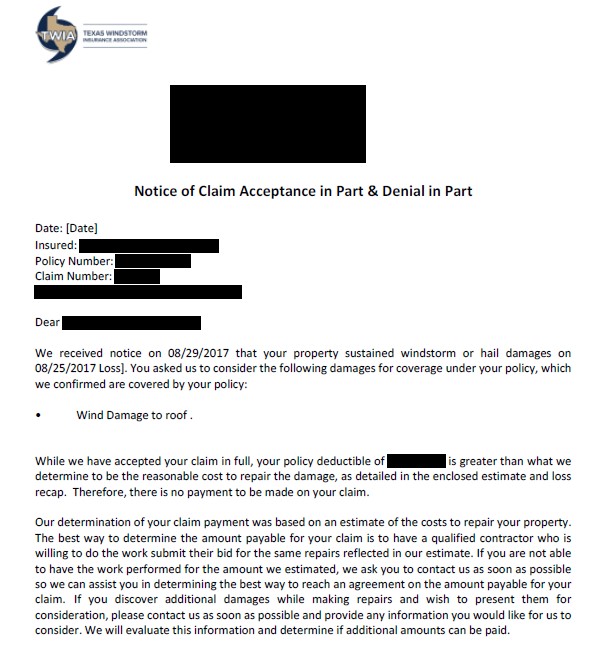

The problem here is TWIA’s actions frequently don’t match up with its written words. For example, a homeowner in Victoria may file a claim for Harvey wind damage to her home (the roof was blown off the home and Harvey rains poured in through the opening for days). That policyholder may have a contractor’s or public adjuster’s estimate showing $75,000.00 to repair Harvey damages. TWIA sends an untrained ‘consultant’ to inspect the property, and then issues a letter that says “TWIA accepts your Hurricane Harvey Claim in Full. As a result of our investigation we have determined that wind damaged the roof of your home and we will pay $2,000 to replace the roof. The water damages to the interior are excluded as wear and tear…” An example of something similar is shown below:

This has become common for TWIA claims, and it is unclear what exactly TWIA is accepting – TWIA didn’t pay the amount necessary to replace the roof, as stated in the contractor or public adjuster estimate, and TWIA said that the interior damages were excluded. So, did TWIA accept the claim in full? Or did they actually deny it in full? Or did they deny it in part and accept it in part, and if so, what exactly is accepted?

And more important, what is the next step – does the policyholder need to invoke appraisal? Can they file a lawsuit? Is TWIA responsible for its misrepresentations? Why did our Texas Government pass laws that protect TWIA’s bad acts?

These important questions must be answered by TWIA and by our Texas Government officials.

Texans, don’t sit by and let TWIA and its adjusters (or any insurance company or adjuster for that matter) treat you unfairly. Texas policyholders are owed a duty of good faith and fair dealing. TWIA and its adjusters must be held accountable – the Texas Department of Insurance allows consumers/policyholders to file a complaint if they’ve been treated unfairly by an insurance company, adjuster, or agent. Do not hesitate to go to https://www.tdi.texas.gov/consumer/complfrm.html to file a complaint today – help bring awareness to the Texas Department of Insurance and our Texas Government about these issues.

As always, an experienced insurance attorney may help offer guidance or representation on these complex legal questions.

_______________________

1 See House Bill No. 3 “HB 3”

2 See https://www.twia.org/news-and-announcements/twia-ultimate-losses-harvey/; see also https://www.twia.org/wp-content/uploads/2018/01/HB3-List-Final-2017-V2.pdf.

3 https://www.twia.org/wp-content/uploads/2018/01/HB3-List-Final-2017-V2.pdf.

4 See https://www.tdi.texas.gov/forms/pcgeneral/pc406umpireapp.pdf.

5 https://www.tdi.texas.gov/forms/pcgeneral/pc406umpireapp.pdf.

6 See https://www.tdi.texas.gov/commercial/documents/umpires.pdf.

7 Tex. Ins. Code §2210.574.