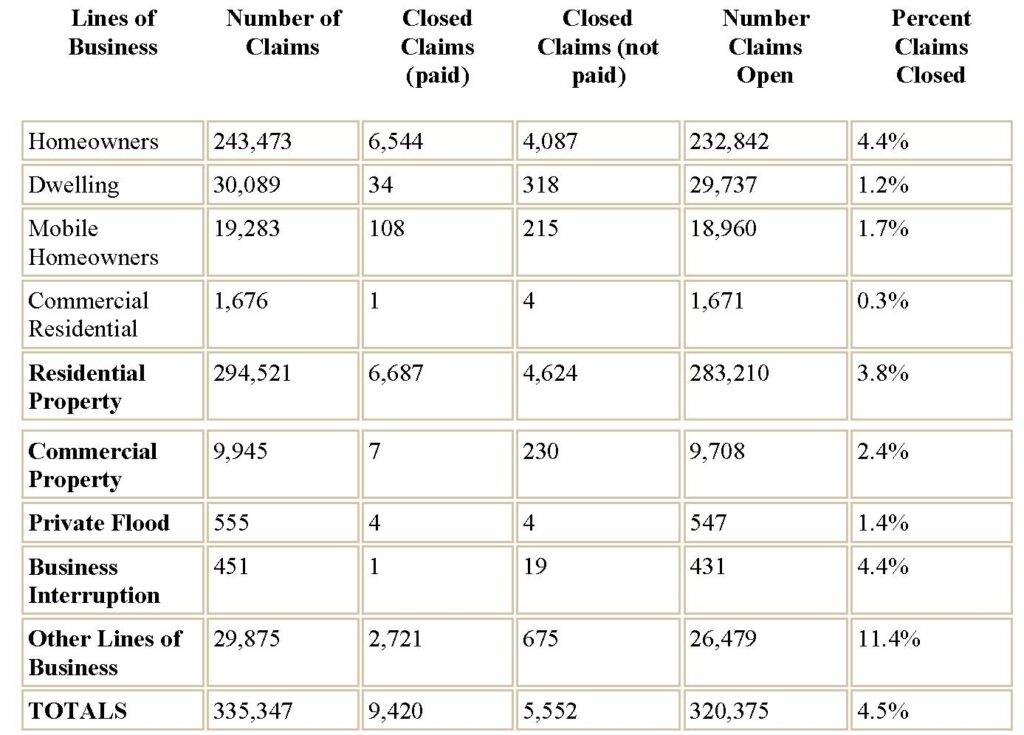

Florida’s Office of Insurance Regulation obtains claims information from insurance carriers and releases them to the public. Here is its first release regarding Hurricane Irma:

These numbers are derived from information provided by insurers. It is notoriously wrong, especially in the early stages. Citizens Property Insurance claimed that over 95% of its 2004 hurricane claims were closed by the time the 2005 Windstorm Conference took place in January 2005. I was on a panel and asked the 1,000 person audience to raise their hands if they believed that statistic. One hand went up—a claims manager for Citizens Property Insurance.

In Misleading Insurance Statistics Regarding Hurricane Sandy, Merlin Law Group attorney Rob Trautmann noted:

I recently had an opportunity to attend a litigation conference where Kenneth E. Kobylowski, Commissioner of the New Jersey Department of Banking and Insurance, gave the keynote address. The Commissioner stated that the insurance industry had reported the 95% closure rate for Sandy claims. However, in response to a question from the audience, he stated that those closure rates included claims where the insurance carrier denied the claim and no lawsuit had yet been filed. An improper denial or underpayment would count as closed. Thus, while the 95% statistic may be accurate, it clearly demonstrates how word play can be used to hide the truth.

Departments of Insurance love to quote high percentage and quick claims closures. Those public servants should be trying to ensure prompt payment and full payment of claims and prevent consumers from being mistreated. They should not be making up or accepting fake statistics just to make themselves look good.

Thought For The Day

Facts are stubborn, but statistics are more pliable.

—Mark Twain