Insurance companies have never embraced people or professionals helping their own customers obtain what they are owed or laws that may expose insurance claim abuses by insurers. The obligation to treat the insurance customer with utmost good faith is one that is taught, but not one the insurance claim industry wants to be held accountable to follow. They especially do not want their own customers to have free-market accountability through private lawsuits enforcing this agreed to obligation. Instead, it appears to many that insurance executives want customers that are “sheep” and take what the insurance claims department determines is owed without question.

This is understandable from their viewpoint. An example of a wrong claims philosophy is from one of the largest insurance companies which developed a Jewish Lawyers List in the 1990s which I discussed in Hindin v. State Farm – The Landmark Claims Practice Case That Few Know About Finally Ends.

In the Hindin case, State Farm automatically sent claims to the fraud (SIU) claims department if the claimants were represented by Jewish, Hispanic, or Black attorneys or attorneys with a foreign-sounding name. Pretty shocking, but this was discovered only because of a private bad faith lawsuit brought by a Jewish lawyer, Todd Hindin. In California, where the lawsuit was brought, the Department of Insurance never knew this claims practice discrimination was going on.

So, the property insurance industry naturally tries to prevent policyholders from hiring those which may challenge their views and expose various unfair claims practices. Contractors, public adjusters, and policyholder attorneys are the natural scapegoats for the property insurance claims industry.

The Zelle law firm is a fine law firm with many good lawyers who have traditionally represented the insurance industry. Steve Badger is an opposing colleague who I have written about in this blog as recently a few weeks ago in Steve Badger and Chip Merlin Clash Again Over Appraisals, Umpires, and Appraisers! Come to the Show in San Antonio on October 1 and 2!

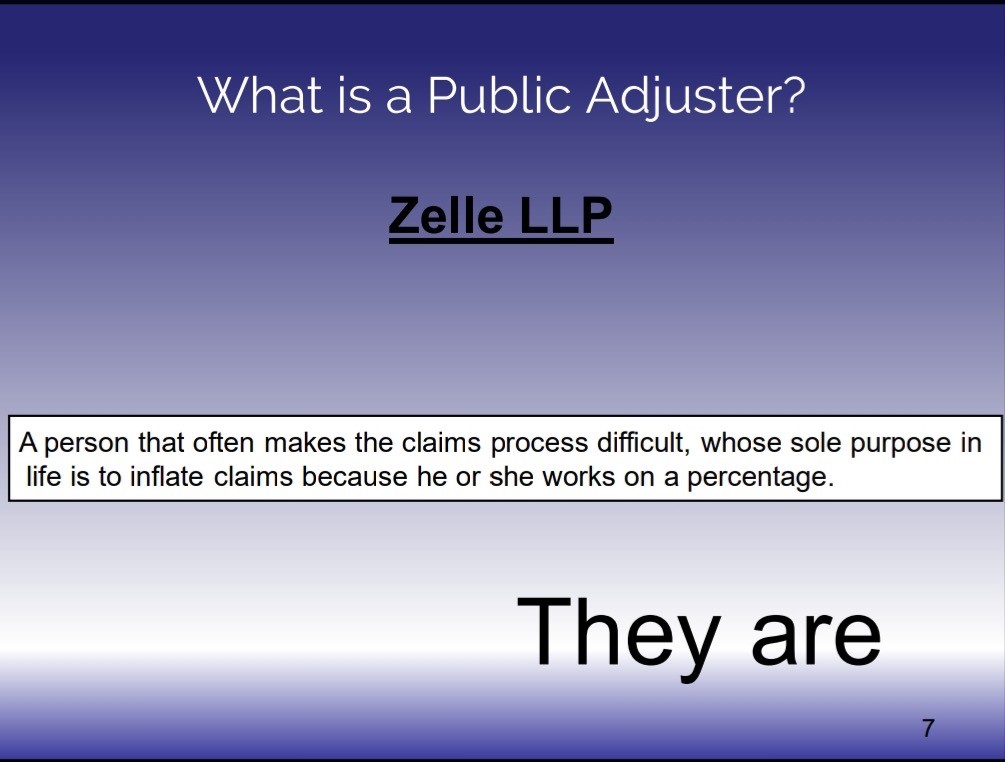

I am not certain if Steve Badger is going to be invited to debate me at future public adjuster events because his firm made the following statement in a teaching webinar of the Property Loss Research Bureau (PLRB):

What is a Public Adjuster?

A person that often makes the claims process difficult, whose sole purpose is to inflate claims because he or she works on a percentage.

“Often makes the claims process difficult” may be a fair statement from the insurance company view. Public adjusters usually challenge coverage interpretations which the insurer finds no coverage. Public adjusters often make claims for benefits that the insurance company adjuster never explained to the customer were available. They make claims for values that are often overlooked and reflect pricing higher than insurance company adjusters. I have personally seen the results over and over again. If “difficult” means paying more to the insurance company customer, the best public adjusters get an A+ for that.

“Their sole purpose is to inflate claims” is going to enrage the best public adjusters. Many public adjusters are going to be thinking that I should write something like the following:

The sole purpose of the insurance company claims department is to underpay their own customer and get away with it without regulatory penalty or lawsuit exposure.

But that would not be a true statement and one that I do not believe. The entire purpose of insurance, the transfer of financial risk in the event of a loss, would be undermined. I have also seen many examples of caring and good insurance company adjusters fully paying their customers and even doing it despite claims office red tape which would seem to prevent this from occurring. I am certain that some claims departments have a philosophy of looking for ways to pay claims and provide greater benefits because I have reviewed their training and spoken to those who have left those organizations.

I have said in many speeches to public adjusters and contractors that many in the insurance claims industry literally hate them because public adjusters and contractors make adjusters look bad. Both trades call out insurance company mistakes. Often, the positions and initial findings of insurance company adjusters are made to look silly.

We see claim philosophy memos and directives in bad faith lawsuits. As in this case, we see how insurance companies are taught to view all public adjusters and contractors. In most instances, licensed public adjusters are viewed as the enemy of the insurance claims department. This training webinar is just further proof.

Still, those watching out for policyholders suggest hiring public adjusters. Consumers Reports, in an article about problems that people face when making claims, noted the following:

If you reach an impasse, consider getting help from a public adjuster. You’ll pay a hefty fee, typically 10 percent of the policy payout. But a Florida study of more than 76,000 claims found that policyholders who used one got payments that were 19 to 747 percent larger than those who didn’t, though the cases took longer to settle.

Public adjusters can only respond to criticism, wrong or right, by raising the bar of professionalism, endeavor to uphold high ethical behavior and push for the competence of all of those in the business. It has been my pleasure to help contribute whatever little I may to the education of those dedicated to being the best they can when helping policyholders who need all the help they can get.

Thought For The Day

Being the best at whatever talent you have, that’s what stimulates life.

—Tom Landry