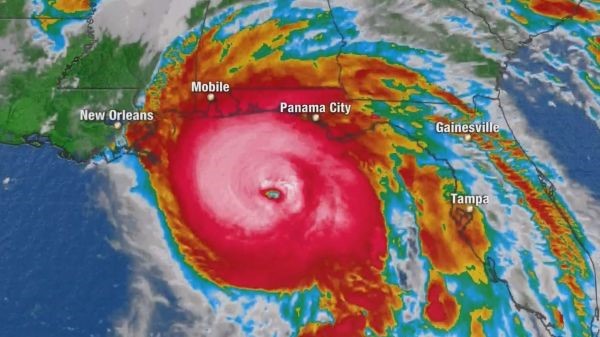

The Florida Office of Insurance Regulation recently released updated data on July 26, 2019, from Hurricane Michael.1 A review of the available data shows the damage for the Florida panhandle. Since my prior blog post, the damage in the Florida panhandle from Michael has continued to grow. Over one hundred and forty-eight thousand claims have been filed (148,347) totaling estimated insured losses at almost seven billion dollars ($6,906,918,311). These numbers come from the insurers directly reporting to the FOIR.

Insurers that compiled data also claim that they have closed 86.2% of claims. The data shows that approximately 20,484 claims remain open with the vast majority (14,891) residential property claims. Of the closed claims reported, 20,233 have been closed and not paid.

The Office of Insurance and Safety Fire Commission in Georgia tracks some of the aggregate disaster losses reported Georgia hurricane Michael claims.2 As of August 1, 2019, reporting insurers in Georgia indicated that approximately 96,000 claims had been filed regarding reported incurred losses of more than one billion dollars ($1,151,426,811). These numbers include claims for damage to homes, vehicles, and businesses.

_________________________________

1 https://www.floir.com/Office/HurricaneSeason/HurricaneMichaelClaimsData.aspx (saved webpage: Here https://www.propertyinsurancecoveragelaw.com/wp-content/uploads/2019/08/HurricaneMichaelClaimsData-1-1.pdf)

2 https://www.oci.ga.gov/AdministrativeProcedures/Openrecords_AllCatastropheDisasterLosses.aspx (saved webpage: Here https://www.propertyinsurancecoveragelaw.com/wp-content/uploads/2019/08/GeorgiaDisasterLosses-1-1.pdf)