If you’ve read my recap from Day 1 of the National Flood Conference, you’ll know that there was a lot to discuss from Day 1. Days 2 & 3 were a bit less eventful, and largely more geared towards flood insurance agents and lenders. As with Day 1, there were often several courses running concurrently, so the below is my recap of those that I attended.

As a mentioned in my Day 1 recap, for clarity, I will use a few acronyms throughout this blog including:

- •NFC for National Flood Conference

- •NFIP for National Flood Insurance Program

- •WYO for Write-Your-Own Insurance Companies (companies such as Allstate, Farmers, etc., who issue NFIP flood insurance policies)

I have combined my recaps for Days 2 & 3 because Day 3 was a half-day.

The first session I attended on Day 2 was “NFIP Reform and Reauthorization,” lead by Congresswoman Maxine Waters, who is a Representative out of California and is the Chair of the House Financial Services Committee. Representative Waters is incredibly impressive – she is currently serving her 15th term in the House of Representatives (she’s served since 1991), and has been an elected official in California since 1976.

This session largely focused on the hurdles of proposed reform, and reauthorization of the NFIP. Specifically, some groups want long term reauthorization of 10+ years of the NFIP as it currently stands, whereas others argue that reform is needed to the program and that a flat long-term reauthorization does not resolve many of the issues and areas in need of reform within the program (i.e., risk rating, mapping, pricing).

The concerns addressed in this first session transitioned quite well into the next session, “What is Risk Rating 2.0 and What Does It Mean?” Risk Rating 2.0 was probably one of the most hyped ideas or themes pushed throughout the NFC by FEMA. As a result, the ballroom auditorium was full for this session:

This session included several FEMA/FIMA people as panelists, and let me tell you, FEMA is excited about Risk Rating 2.0. It will be very interesting to see if this program lives up to the hype.

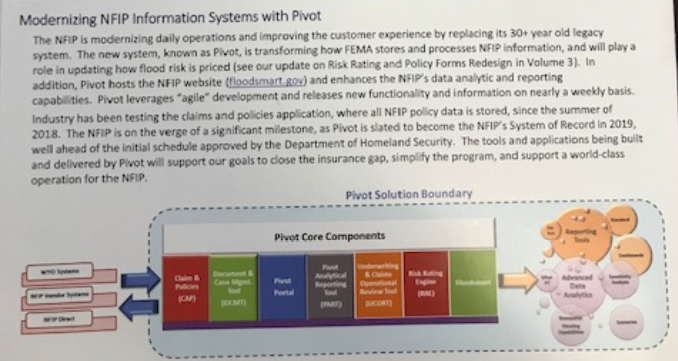

As discussed by FEMA, Risk Rating 2.0 is focused on making people better informed to protect their risk. As many readers may know, FEMA and its National Flood Insurance Program have faced some heat from both the general public, as well as the US Office of the Inspector General over the past few years regarding many issues, including its significant technology gap and problems maintaining oversight of its processes, systems, and third-party contractors. As a result, and to try and correct these problems, FEMA is rolling out Risk Rating 2.0, wherein the NFIP/FEMA has purportedly modernized its technology and redesigned its risk rating system to “improve the policyholder experience.”

Risk Rating 2.0 aims to simplify things for insurance agents by incorporating new technology with modernized flood mapping data to create a new rating plan for each risk. FEMA has significantly updated its catastrophe models and mapping data to provide a more accurate, modern, rating system to allow agents to more readily price and sell policies. The Risk Rating 2.0 technology and program creates an individualized image of each property’s risk and reduces complexity for agents to more readily generate and understand rates and quotes to sell policies.

So again, FEMA is trying to increase education to sell more policies. Here is where I again become a bit cynical because although the idea of providing more people with flood insurance is great, to me, it seems as though the focus and message is more on generating profit than it is on protecting people.

My comments on Risk Rating 2.0 are that FEMA has definitely made significant technological improvements, and serious modernizations to a grossly outdated system. However, I am skeptical, but cautiously optimistic about what/how this will improve the program, other than enabling more policies to be sold.

The next course that I attended was “The Foundation of NFIP Claim Handling,” and this was in my opinion one of the best courses that I attended. The panel included several experienced FEMA Claims Examiners and Appeals Examiners, and Senior Lead Adjusters for adjusting companies. Overall, it was my impression that these individuals are some of the best at what they do and set the gold standard for claims adjustment and claims handling.

My problem is that there seems to be a disconnect between the message, standards, and practices preached by the panelists versus what’s actually implemented in the field on each claim by the boots-on-the-ground adjusters. This leads me to the conclusion that the issue is either with oversight, or that somewhere in between those at the top and those in the field, the message is getting blurred. Additionally, I think this would have been another good opportunity to allow a policyholder’s attorney/advocate to participate on this panel to facilitate an open discussion about bridging the gap.

This panel emphasized the importance of “Communication, Consistency, and Connection” on every single flood claim. This was both well stated and emphasized with tangible examples as to how adjusters can accomplish each of these ideals. For example, one of the panelists discussed the importance of sitting down with the property owner at the outset to lay out the policy, their coverage, and properly set expectations as to the claim handling process, timing, etc. They explained how “trust settles claims” because you are building a relationship with the policyholder in order to get their claim resolved.

The panel discussed the importance of handling the claim the right way from the outset, and how doing so makes the adjusters, claims examiners, and others lives easier in the long-run. To that extent, they emphasized the importance of taking detailed notes, extensive photos of all areas with notes as to the captions, and preparing a detailed, accurate estimate of the flood damages on the property. To take it a step further, they explained the importance of discussing coverage limitations with the property owner/policyholder at the outset in order to properly set expectations (for example, if they had flood damage in the basement, as soon as the issue is seen/presented the adjuster should discuss with the policyholder that the basement coverage is limited, and show them the portion of their policy that describes the same; that way, they are properly informed and have correct understanding and expectations at the outset).

Another key element discussed by this panel was the importance of getting what is needed as early as possible – meaning that if the adjuster sees during the first inspection that there may be an engineering issue, get an engineer involved right away; or if the policyholders have a special/rare material used as tile for their flooring, ask the policyholder for documentation regarding the pricing of that material.

The last message emphasized was that claims handling professionals must protect the policy while providing the policyholder as much as they can to repair their flood damage under the policy.

Next up was “Using Educational Techniques with Successful Outcomes” which was a more interactive session with significant audience participation. The panel included high up insurance and adjusting company executives. The primary message here was that there is an overall issue with lack of education and communication regarding flood insurance generally, but during claims specifically, which seems to be an ongoing issue. These executives truly seemed interested in resolving these issues.

There was a discussion on the importance of knowing your audience in order to shape the style and message of the communication to better educate, which is an extremely important technique and communication tool. Audience participation was strongly encouraged, and many folks shared their success stories, but also questions and difficulties. To me, it seemed as though many of the questions/difficulties were expressed by agents who lacked the education to properly inform their clients of policy and flood insurance information. That was quite unsettlingly to me because its concerning that anyone would issue or apply for a policy without knowing the details of the policy and coverages being afforded.

Then came an interesting discussion on “Mitigation + Insurance—Reducing the Risk/Reducing the Rate” lead by a diverse panel, including the Lead Physical Scientist in the Building Sciences Branch of the Risk Management Directorate of FEMA/FIMA. I found that particularly interesting because I was unaware FEMA employed scientists, much less has an entire department on Building Sciences – FEMA is a lot bigger and more involved than I previously realized.

The session involved how mitigation measures (home elevation and flood proofing) can reduce both risk and premiums. I learned that throughout the country each area/locale has a designated Certified Floodplain Manager whose primary role is to focus on mitigation steps needed to reduce flooding in a large community area/locale, both on a general basis, as well as property specific basis. These Floodplain Managers work with local communities and local government on building codes, standards, and regulations to protect the area from future flood damage. This made me wonder, where is our Floodplain Manager in Houston? It seems like there is no one stepping in to do this job (at least not properly) in my city.

The panelists were incredibly knowledgeable and opened my eyes to the various behind the scenes people working to prevent and/or reduce future flood risks and protect property owners. They, like panelists in other sessions, emphasized the ongoing issue of lack of education and communication about flood mitigation and flood insurance that needs to be resolved.

The last session of Day 2 that I attended was “Flood Zone Determinations – When Disagreements Arise, What to Do?” It was quite scientific in nature, and largely related to the science behind the flood mapping. It started out by discussing how Coastal Barrier Resources System (“CBRS”) was modernized and fully digitally converted by October 2018 with up-to-date data. I learned that the Coastal Barrier Resources Act (“CBRA”) was enacted in 1982 to protect and address the problems with coastal barrier development. There are certain areas along the coast in our country designated as protected “COBRA zones,” generally, properties built in COBRA zones after a certain date may be banned from being covered by NFIP flood insurance and/or are considered the highest risk for NFIP coverage, which can mean high rates/premiums for coverage.

Apparently, there has been a significant issue in the past with properties being designated in a COBRA zone that may not have actually been fully in the zone, which affected coverage options. Recently, there has been a remapping of 43 COBRA areas to update the data. The FIRM panels used by FEMA/NFIP for rating and policy issuance will largely be outdated in the near future as well. The CBRS has created a highly advanced new technology tool that can be utilized here: https://www.fws.gov/cbra/Maps/Mapper.html. However, it was relayed that the program is still being tested and updated.

This new program is supposed to resolve the issue of determining whether a property is in or out of a COBRA zone. A lot of people seemed to be very happy and interested to hear this.

The next part of the discussion focused on the significant confusion and lack of clarity as to who is responsible for verifying the accuracy of flood zone per property on a policy by policy basis – is it the agent that’s responsible? The WYO? FEMA? This is a question and issue that seems to be causing a lot of uncertainty.

If a policyholder or an agent want an official determination as to their zone, they can request a “CBRS Property Determination,” which is a quality-controlled process that uses humans (rather than only technology) to individually review and assess a zone. Once the process is completed, the U.S. Fish & Wildlife Service issues an official letter to the property owner (or requestor) regarding the zone determination.

The big problem discussed here is that most people do not know about this option, and also, frequently the step is taken and brought to light retroactively, after someone’s property has been flooded and they have been denied coverage because they were not covered for the proper flood zone.

One panelist, who is a lender/mortgage company representative, stated that lenders have been seeing an increase in private flood insurance policies because they are more uniquely tailored and cautiously written with the specific property in mind. An audience member stood up and stated that “accurate flood zone determinations are very valuable, and it’s good to know that the Fish & Wildlife Services have prioritized the importance and can be the final determination as to this issue.”

Ultimately, while this was interesting, my biggest concern is the same as what was expressed by one of the panelists because the question was not answered – on the front end, who is responsible for verifying the accuracy of a flood zone determination. This issue cannot be put on the backburner until someone suffers a loss and is denied for being in the wrong flood zone.

That was the end of Day 2.

Day 3 was a lot of the same thing from previous days. It was quite apparent that many people had left the conference, and the sessions were significantly less full. There were two sessions on NFIP Reauthorization and Reform, which largely emphasized what was discussed on Days 1 & 2 on those topics, as well as Risk Rating 2.0, which was a bit less in-depth, but more interactive than the previous days session on the same.

Overall the National Flood Conference was quite informative, but I think some improvements can be made moving forward. The primary points that I think I realized and now better understand is that at the end of the day, Flood Insurance (even if through FEMA on an NFIP policy) is a business. This Conference was treated like a business conference with Advertisements, Sponsorships, and aimed at building business and generating profits. As with every industry, there are good guys and bad guys – people who want to do the right thing, and those that either don’t care and/or those that disregard the lives affected by their actions. Largely, I think the human element is lost to many of these, as shown in the disturbing image below of an ad brochure that I received at the NFC that shows money with the caption “More is Better for WYOs, Reinsurers & Insurers.”

The policyholders are never mentioned in this brochure, educating the public or their clients is never mentioned – the message is clear “expand revenue” and “create a money making” flood insurance strategy. Let’s hope these agents know what they’re doing.